Rates Spark: Setting the Stage for the Fed

2022.12.13 16:51

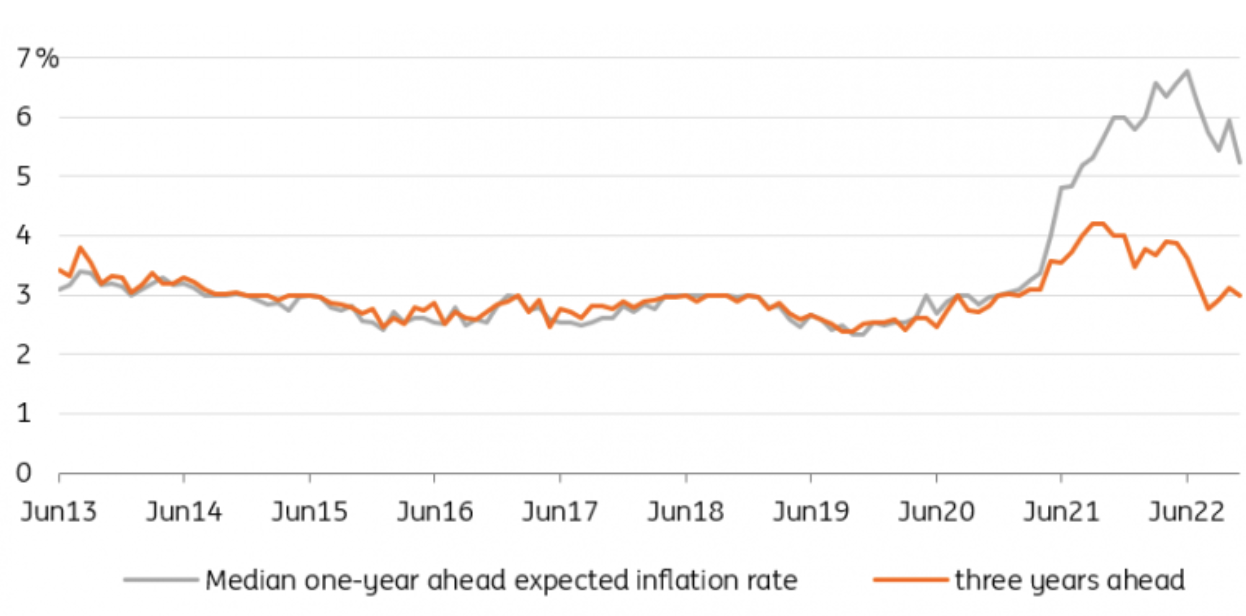

The predominant view, judging by today’s release and market moves in recent weeks, remains that inflation is on its way down and should allow the Fed to slow, and eventually stop, its hiking cycle at the coming meetings. Data on that front is encouraging. Consumer inflation expectations in the and New York Fed surveys is, globally, on its way down, and the price components of surveys such as the ISM are also suggesting the direction of travel is lower.

The problem of course is that there is no guarantee that inflation continues to converge on a linear path towards the Fed’s target. One key worry, for instance, is that after an initial drop, inflation upside resumes. In that context most, including us, expect the Fed to continue striking a cautious tone at this and subsequent meetings. Since the summer, this has resulted in the Fed pushing back against instances of easing of financial conditions. Lately, that pushback has been less effective, due to more encouraging data.

It is still too early to talk about a change in the market’s economic outlook. Most telling market moves, the richening of 5Y on the curve and the flattening of the slope, have merely stopped, rather than reversed. The speed of the moves since October make a retracement most likely, before rates converge lower and before the curve re-steepens in the course of 2023.

Consumer Inflation Expectations Support the Current Dovish Narrative

Median 1-Year Ahead Inflation Expectations Vs. 3 Years Ahead

Median 1-Year Ahead Inflation Expectations Vs. 3 Years Ahead

Source: New York Fed, ING