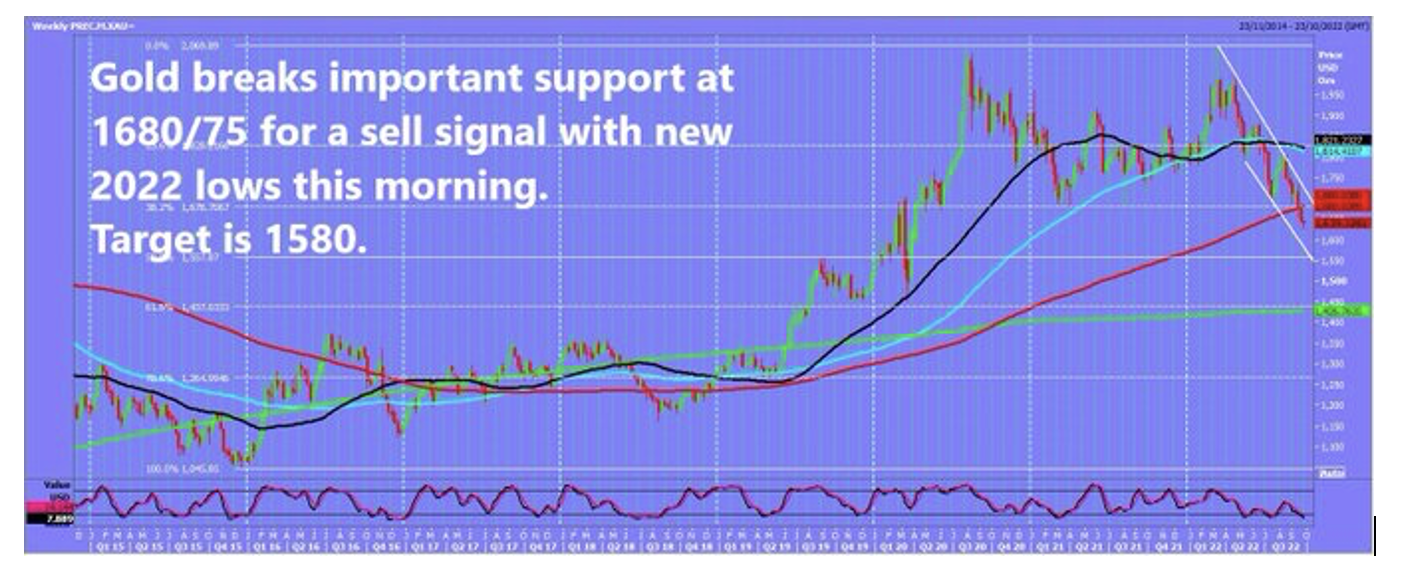

Gold Breaks Important Support

2022.09.26 12:04

[ad_1]

we predicted: Likely to be forming yet another bear flag, meaning eventually we will break lower, but it is impossible to know the timing.

Well, it happened on Friday!. Selling at resistance at 1675/80 worked last week and finally it broke below 1650. For the next sell signal, we are initially targeting 1640/35 – a low for the day. The outlook remains negative.

we predicted: Key support at 1950/30. A break below 1920 is a sell signal.

Silver also broke lower to the next target of 1880/70, with a low for the day exactly here. The outlook remains negative.

WTI Crude November made a breakout of the September low at 8125/8090 to the downside as predicted for an obvious sell signal targeting 7950/20 and 7800, a low for the day, in fact

Remember when support is broken it usually acts as resistance and vice-versa.

Today’s Analysis

Gold broke lower and kindly retested the break point at 1650/55 to allow us to get in to short after the sell signal was triggered. We hit the next target of 1640/35, as we look for 1610/00. I am looking for a break below 1590 to targets 1560/55.

Gains are likely to be limited, with key resistance now at 1650/55. A break higher, however, can target 1680/90. Shorts need stops above 1700.

Silver broke key support at 1950/30 for a sell signal targeting 1880/70, perhaps as far as 1850/40 on Monday. If we continue lower look for 1810/00.

First resistance at 1930/50. Shorts need stops above 1960.

November shorts on the break below 8090 worked perfectly, targeting 7950/20 and 7800. From a 1 month trend line at 7800 down to the 100 week moving average at 7750 is first support today. A break lower is another sell signal targeting the 500 day-moving average at 7630/00. Failure to hold above here is an important longer term sell signal.

[ad_2]

Source link