Yes, This Time Is Different: Front-Loading the Fed Pivot Is a Bad Idea

2023.01.18 09:52

[ad_1]

- Have a look at the last US inflation report;

- Answer the big question: Powell pivoted in 2019, is he going for it again in 2023?

- Analyze what’s priced in for bonds and equity markets: a recession, Goldilocks, or what regime exactly?

Yes, this time is different: front-loading the Fed pivot is a bad idea.

Last week’s US report delivered the good news: inflation is coming down and fast.

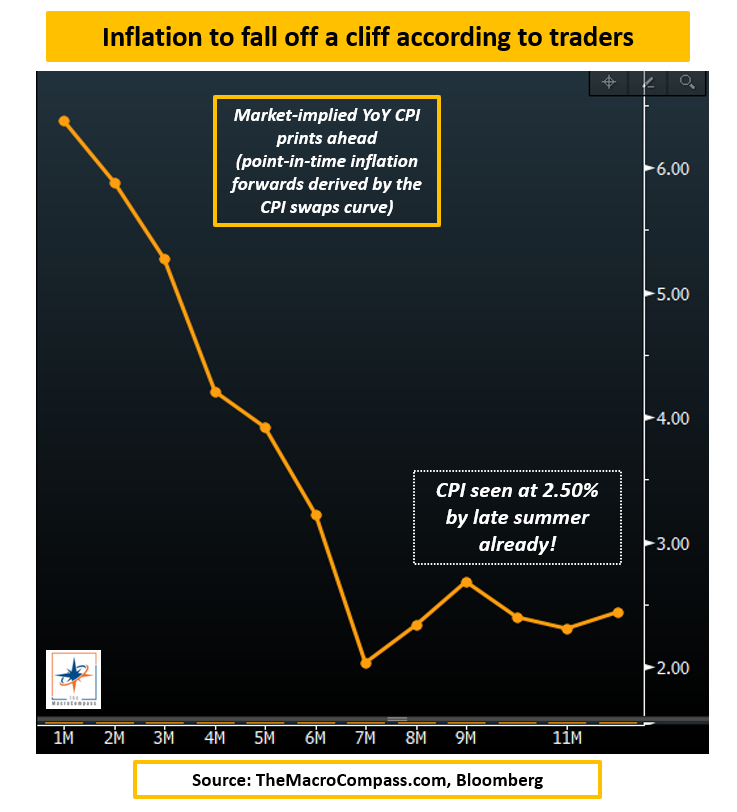

Fixed-income traders are nodding to this trend and expect YoY CPI to print at 2.50% by late summer already.

Inflation Expectations Chart

Inflation Expectations Chart

Not only that, but Powell got exactly what he was looking for:

- Inflationary pressures are less broad: the share of CPI items whose MoM annualized price increases exceed 4% is now quickly heading back down to 50% from its 75% peak a few months ago;

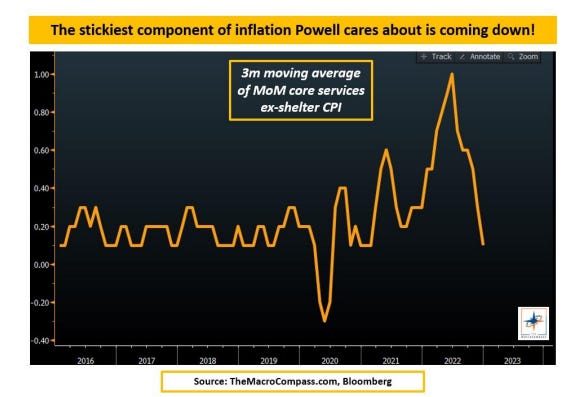

- The momentum of sticky inflation is fading: the 3m moving average of MoM core services ex-shelter CPI has dramatically slowed down, and it’s now in line with a 2.5-3.0% annualized core inflation.

3-Month MA of MoM Core Services

Markets have a huge recency bias. For the last ten years, every time inflation and growth slowed down, you had to do one simple thing.

Buy every asset you can, and front-load the upcoming Fed pivot. So that’s exactly what markets did.

Junk bonds, , Bed Bath & Beyond Inc (NASDAQ:) and Co. to the moon. Implied volatilities crushed across the board.

My mentor used to tell me the most expensive four words in finance are ‘’This Time Is Different’’. Yet, I think the old adage is wrong here.

[ad_2]