Yen Defies Intervention Warnings, Gold Loses Its Shine

2022.09.15 06:00

[ad_1]

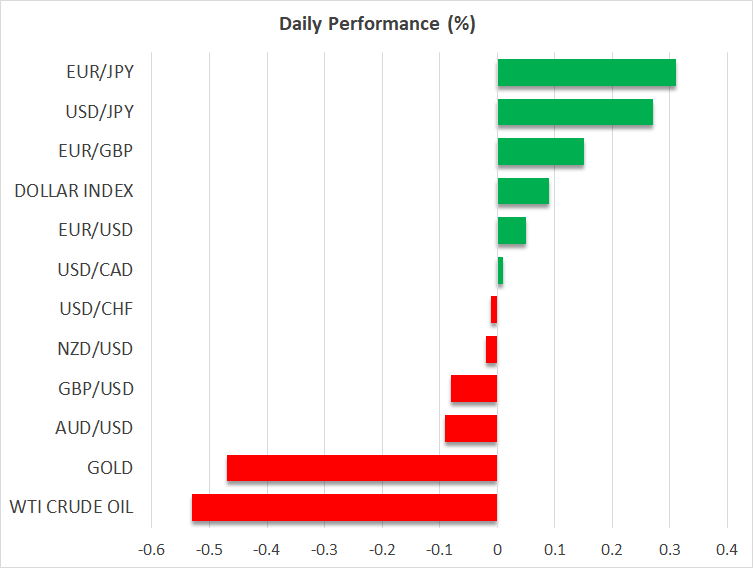

- Threats of FX intervention don’t do much to boost the yen

- Currency pairs trapped in narrow ranges, stocks lick wounds

- Gold under heavy pressure, US retail sales coming up next

Yen dismisses intervention

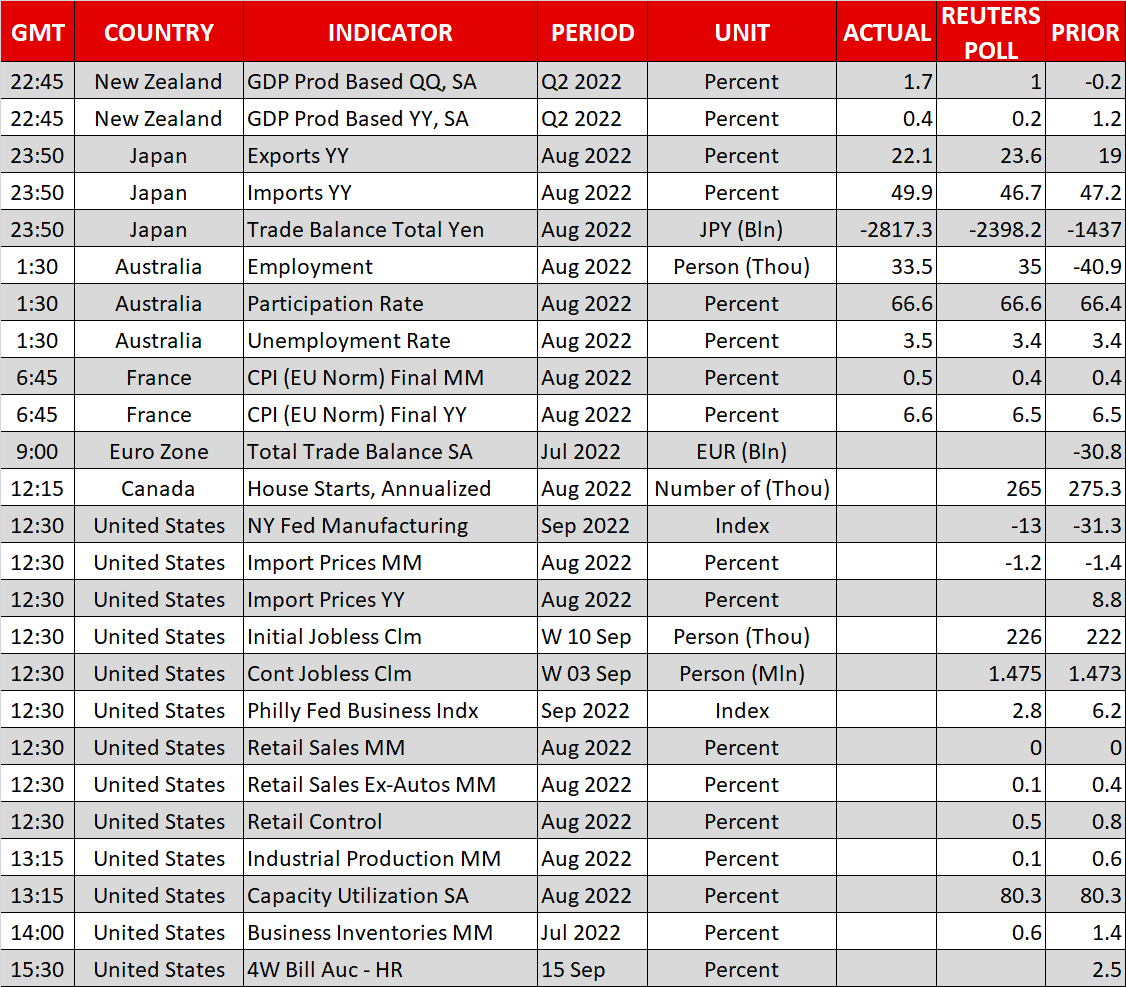

The battle for the yen continues to rage in the FX arena, with Japanese officials using every trick at their disposal to stabilize the devastated currency. A double salvo from the government and the Bank of Japan yesterday saw intervention threats being dialed up, which stopped the bleeding for a few hours, until the yen’s wounds opened up again on Thursday following a record-breaking trade deficit.

Shifting trade flows have been a thorn in the yen’s side this entire year, compounding the pressure from widening interest rate differentials. Japan used to run a chronic trade surplus but with energy prices going through the roof and the nation importing most of its power, this has flipped into a gaping deficit, depriving the yen of its main historical advantage.

Market participants have concluded that Japanese authorities can threaten FX intervention all they want, they are still unlikely to pull the trigger, and even if they do, it won’t have a lasting impact. Solo intervention would be costly in terms of FX reserves, it carries a low probability of success, and it could backfire by inviting more speculators if it does fail.

The only player that can turn the tide is the Bank of Japan, which meets next week, although the appetite for any strategy shift is low because the outlook for inflation and wages remains muted. This makes it hard to trade the yen in either direction. A BoJ-induced trend reversal remains unlikely, but shorting the yen into the ground on rate divergence also seems like a crowded trade at this stage.

Markets calm down

After an explosive start to the week in most asset classes, markets calmed down on Wednesday. Most major currency pairs remained trapped in narrow trading ranges, taking a breather from all the volatility following the US inflation report.

European officials unveiled plans to negate the fallout of the energy crisis, which include easing collateral rules for power producers to prevent liquidity issues, windfall taxes on fossil fuel companies, and caps on excess revenue of renewable energy producers. This is certainly a step in the right direction to avert an economic meltdown, but not the magic bullet some investors hoped for, hence the lack of enthusiasm in the euro.

Meanwhile, Wall Street closed in the green, stabilizing after the heavy losses as bargain hunters dipped their toes back into the market. The elephant in the room is next week’s Fed meeting, where traders are pricing in a one-in-three chance of a shock-and-awe full percentage point rate increase.

Overall, the risk-reward profile for equities remains unattractive. The Fed’s terminal rate has shot higher to reach 4.4%, quantitative tightening has ramped up, valuations are still not cheap, and the economic data pulse is slowing at a dramatic pace led by Europe and China, threatening to chip away at earnings estimates.

Gold crumbles, US data coming up

Gold could not escape the Fed inferno without burns either. With the dollar powering up and real US yields going ballistic to reach multi-year highs, the precious metal has taken heavy damage as the opportunity cost of holding onto it increased sharply. Bullion is approaching the danger zone around $1680, which served as a springboard for the price action several times after the pandemic and now includes the 200-week moving average as an extra layer of protection.

As for today, the spotlight will fall on the latest batch of US retail sales, alongside a meeting between the leaders of Russia and China.

[ad_2]

Source link