WTI futures remain flat within bearish channel

2023.06.29 06:13

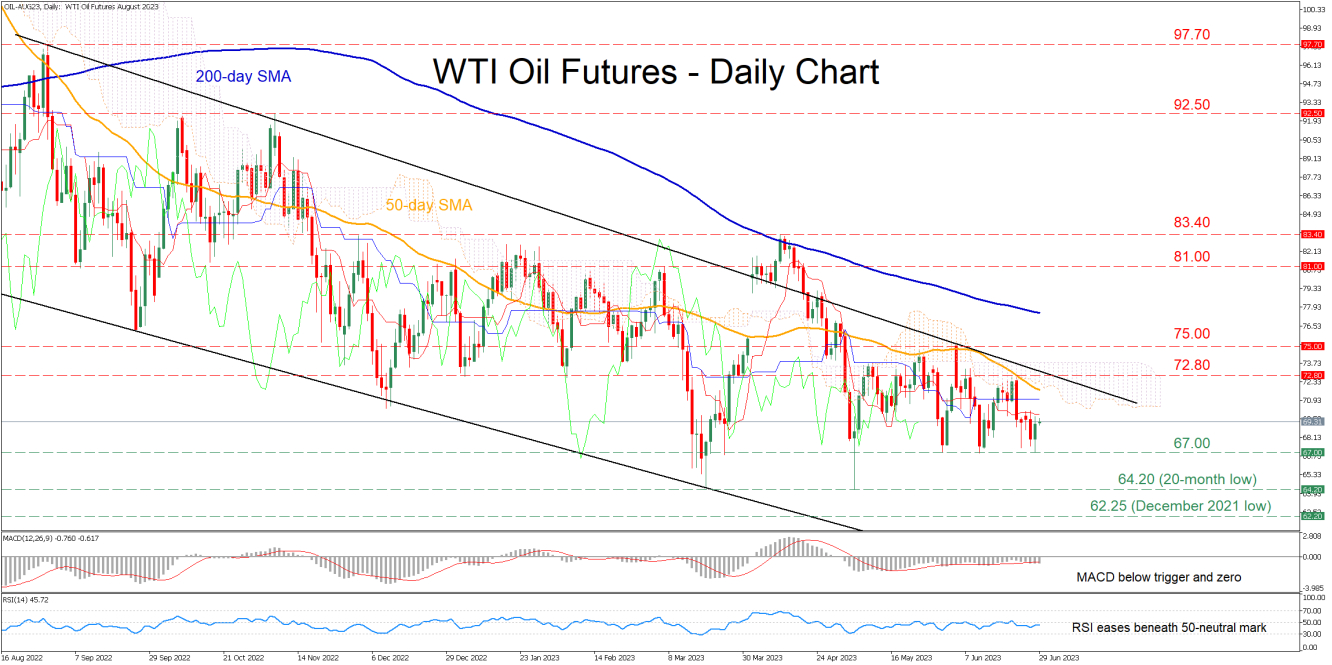

WTI oil futures (August delivery) have been moving within their downward sloping channel for the last 10 months, creating a structure of lower highs. In the near term, the price has been directionless, slightly below the 70.00 region following a moderate pullback from the 50-day simple moving average (SMA).

The momentum indicators currently suggest that bearish forces are holding the upper hand. Specifically, the RSI has flatlined below its 50-neutral mark, while the MACD is softening below both zero and its red signal line.

Should the bears try to push the price lower, immediate support could be found at 67.00, which has held strong three times during the past two months. A dive below that floor could open the door for the double-bottom region of 64.20, which is also a 20-month low. Failing to halt there, the price could retreat towards a fresh multi-month low, where the December 2021 bottom of 62.25 could curb further downside attempts.

On the flipside, if the positive momentum intensifies and the price reverses higher, the recent resistance of 72.80 might be the first barrier for buyers to conquer. Crossing above that zone, WTI futures might face the June high of 75.00 before the March peak of 81.00 comes under scrutiny. Even higher, the price could revisit 83.40, its highest level in 2023.

In brief, WTI oil futures have been trading sideways in the past few daily sessions, waiting for developments that could provide fresh directional impetus. However, for the broader outlook to change, the price needs to escape its downward sloping channel.