Will the U.S. Default?

2023.05.23 07:39

The US is dangerously close to triggering its debt ceiling limit, yet markets seem very relaxed.

The 2011 episode shows us how political incentive schemes can instead drag negotiations until the very last minute and force investors to price in a more meaningful probability of an actual bad outcome.

In our monetary system, the government doesn’t need money to spend money.

As the very issuer of the currency we use, with deficit spending, the government actually increases our net wealth – for instance, tax cuts imply we have more spendable money without incurring any direct liability.

The real limitation to uncontrolled deficit spending is not ‘’where is the government going to find money’’, but inflation: excessive deficits may lead to (unproductive) excess demand, which often can’t be met by a rapid increase in supply or resources – and the release valve is then an ugly inflationary spiral.

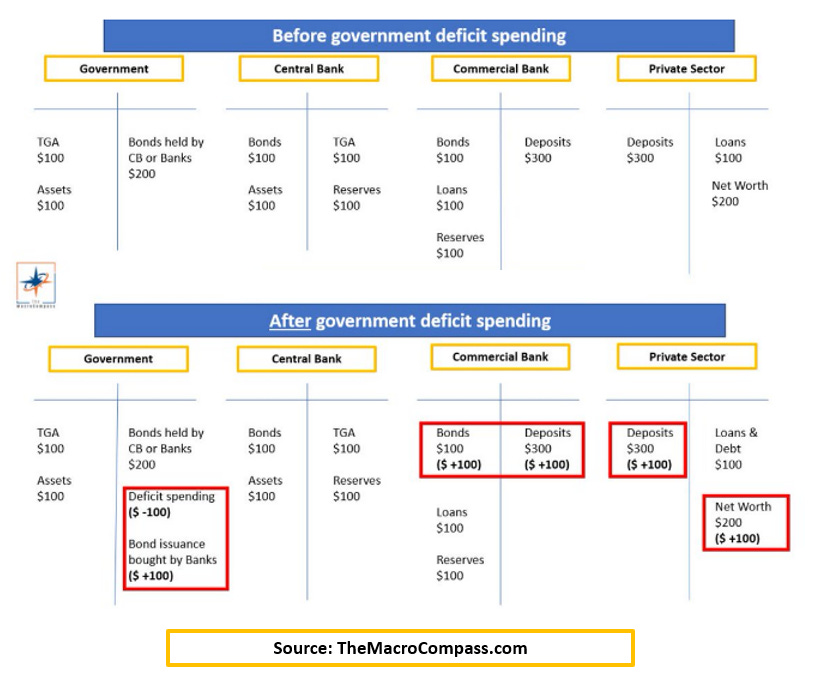

In any case, we also have another self-imposed accounting rule which dictates the government can’t run with negative equity. We hence must issue bonds to ‘’fund’’ its deficit spending – see the table below.

Before/After Government Deficit Spending

Before/After Government Deficit Spending

This is when the US debt ceiling becomes a problem: another self-imposed limitation that prevents the US from incurring debt above a certain threshold to ‘’fund’’ its deficit spending.

If the government can’t issue bonds anymore, to maintain its current level of (deficit) spending, it will spend down its Treasury General Account at the Fed – but we are running out of fuel there too.

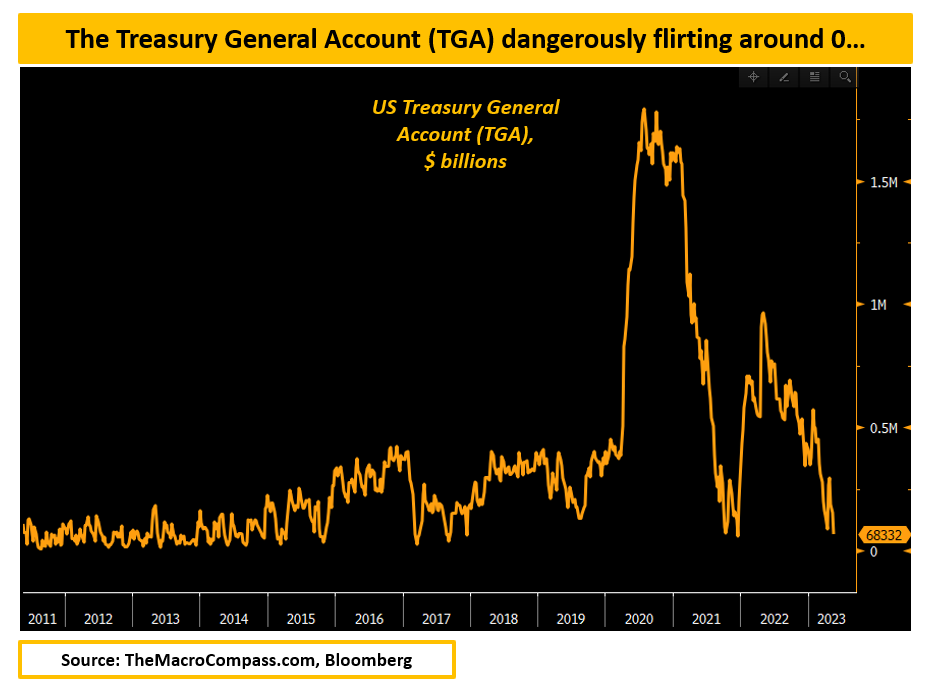

The Treasury General Account (TGA) Chart

The Treasury General Account (TGA) Chart

The TGA has been rapidly drawn down from $600 billion in January to less than $70 billion as of last week.

A key question is – when do we actually hit the zero lower bound?

John Comiskey (here) has been doing a great job in tracking and estimating government cash flows to project the famous ‘’x-date’’ when the US government is going to empty its TGA completely.

His latest analysis shows that between June 2 and June 9, we are going to be dangerously close to the zero lower bound – and as Yellen already warned us, we might actually hit it around these dates.

It’s worth remembering that past these dangerous dates, by June 12, new tax receipts would be coming in hence providing a much-needed TGA boost to the government. But let’s assume the TGA hits zero, and the debt ceiling prevents the US government from issuing bonds to fund (deficit) spending.

Would the US government default then?

What would be the impact on bonds, stocks, the , and , and are markets preparing for such an outcome, or would they be surprised?

***

This article was originally published on The Macro Compass. Come join this vibrant community of macro investors, asset allocators and hedge funds – check out which subscription tier suits you the most using this link.