Will the NFP Take a September Double Fed Cut Off the Table?

2024.09.04 11:10

- Fed fund futures suggest a 40% chance of a 50bps September cut

- Powell’s Jackson Hole speech adds importance to jobs data

- US employment report scheduled for Friday at 13:30 GMT

Investors See Increasing Chance of 50bps Cut

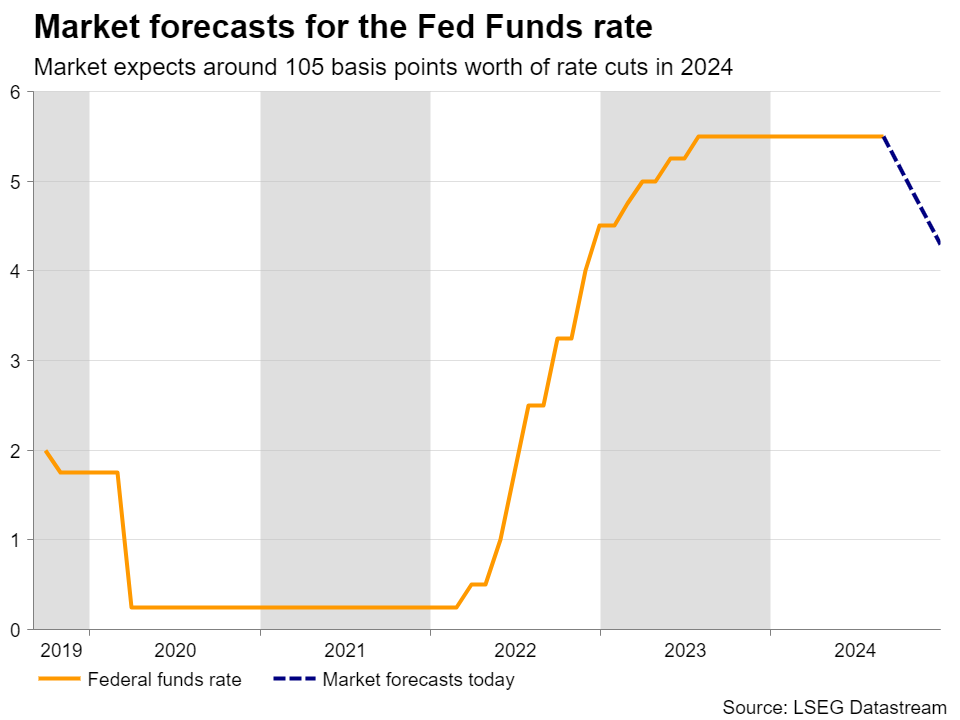

The had a rough time in August, underperforming against all its major counterparts as market participants remained convinced that the Fed will cut interest rates by around 105 basis points by the end of the year. This translates to a rate reduction at each of the remaining decisions for 2024, with one of them being a double 50bps cut.

Given that Fed Chair Powell appeared more dovish than expected at Jackson Hole, investors are currently assigning a 40% probability for that 50bps cut to be delivered at the upcoming meeting, on September 18. During his speech, Powell highlighted the importance of the labor market, noting that they will not tolerate further weakness, and thus, investors may be sitting on the edge of their seats in anticipation of Friday’s employment report for August.

Forecasts Point to Some Improvement

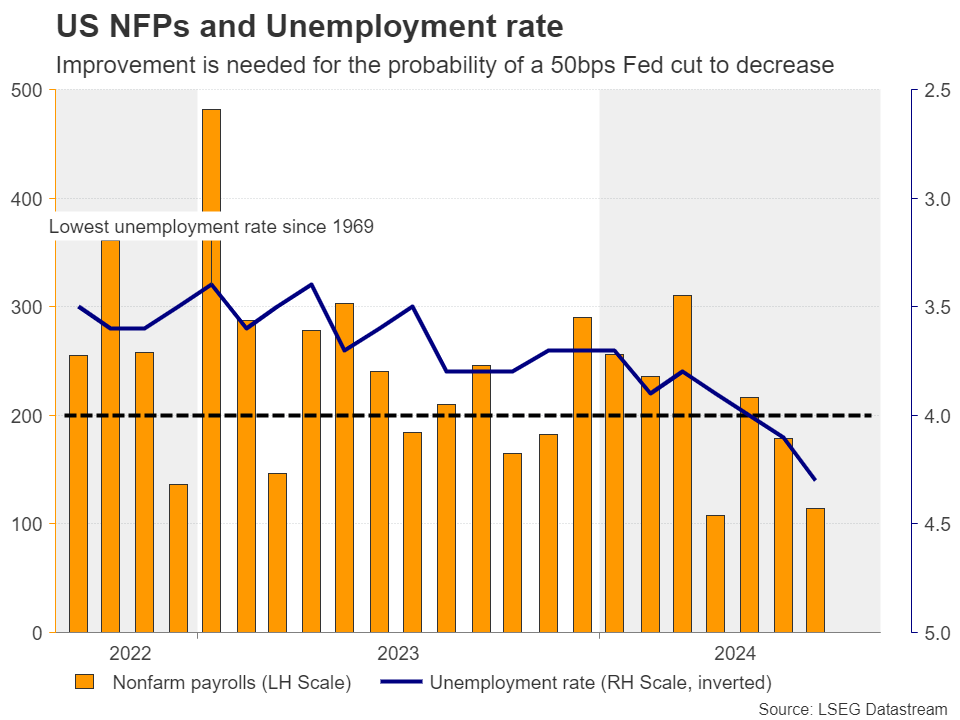

Expectations are for nonfarm payrolls to have accelerated to 164k from 114k in July and for the unemployment rate to have ticked down to 4.2% from 4.3%.

Average hourly earnings are also expected to have accelerated in monthly terms, to 0.3% from 0.2%.

Following the upward revision of Q2 GDP and taking into account that the Atlanta Fed GDPNow model points to a 2.0% growth rate for Q3, some improvement in the jobs data may prompt traders to lean more towards a 25bps reduction at the upcoming Fed decision. This may allow the dollar to further strengthen as Treasury yields extend their recovery.

But PMI Surveys Pose Downside Risks

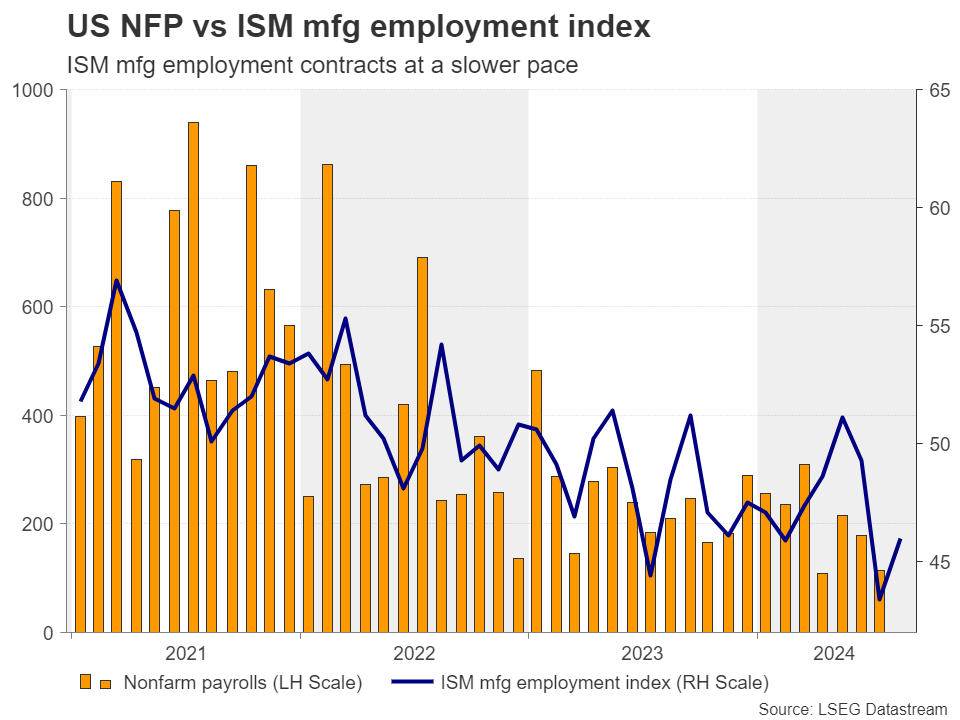

Having said all that though, the preliminary S&P Global PMIs revealed that employment fell in August, while the employment subindex of the ISM manufacturing PMI for the month, although it rose somewhat, remained below the boom-or-bust zone of 50 that separates expansion from contraction.

This imposes some downside risks to Friday’s report, which if materialized, could rekindle market panic, with the US dollar coming under pressure again. Equities could also slip as renewed recession fears may not allow investors to celebrate the prospect of lower borrowing costs.

Euro/Dollar Pulls Back, but Rebound Still Likely

From a technical standpoint, has been correcting lower lately, after hitting resistance at 1.1200 on August 23 and 26. Currently, the bears seem to be pushing for a break below the 1.1040 barrier, a move that may see scope for declines towards the 1.0950 barrier, marked by the low of August 15. A decent jobs report could add fuel to the slide.

That said, even if this is the case, euro/dollar would still be trading above the crossroads of the key 1.0900 area and the upward sloping line drawn from the low of June 26. This may allow the bulls to take the reins again at some point in the foreseeable future.

Now, if the report comes in softer than expected, the pair may shoot up without correcting lower, which could encourage the bulls to revisit and even breach the 1.1200 zone. Their next stop may be the high of July 18, 2023, at 1.1275.