Will the Economy Stabilize in Q2 After Consecutive Quarterly Downshifts?

2024.05.03 08:50

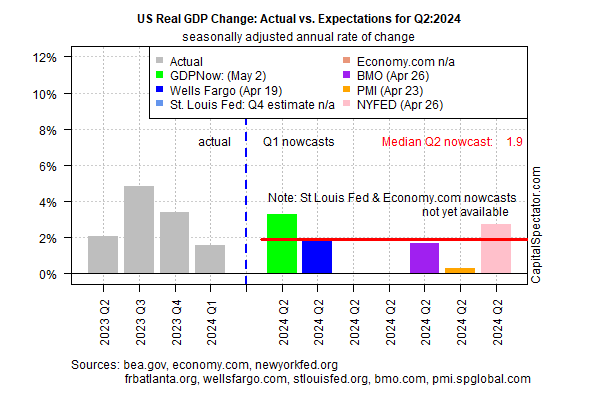

Preliminary estimates of second-quarter US activity suggest output may stabilize after two straight quarters of slower growth, based on the median for a set of nowcasts compiled by CapitalSpectator.com. This estimate should be viewed cautiously this early in the current quarter, but for now the current data suggest that economic activity may be set to normalize after post-pandemic volatility.

Output for the April-through-June period is currently projected to increase 1.9% (seasonally adjusted real annual rate), a modest improvement over Q1’s 1.6 advance. If today’s median Q2 nowcast is correct, the economy will post its first improvement over the previous quarter since the surge in output in 2023’s Q3.

The caveat is that there’s still a high degree of uncertainty about second-quarter economic activity due to the calendar. Indeed, hard data about April’s economic profile remains in short supply; meanwhile, May and June are still the realm of guesswork.

Some analysts warn that stagflation is a rising risk for the US. That is, sticky and perhaps rebounding inflation will be paired with sluggish growth in the months ahead. But Federal Reserve Chairman Jerome Powell earlier this week pushed back on the risk, quipping: “I don’t see the stag, or the ’flation.”

That aligns with the view of Carson Group’s global macro strategist Sonu Varghese, who says US economic activity remains robust.

“The workhorse of the US economy remains the consumer, and there’s really not much sign of a slowdown as far as household spending is concerned,” he observed in a research note last week. “In fact, services spending, which makes up 45% of the economy rose at an annualized pace of 4%.”

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

But some economists see the risk of another round of slowing growth in early Q2 numbers.

“The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April,” says Chris Williamson, chief business economist at S&P Global Market Intelligence.

Nonetheless, today’s 1.9% median estimate for Q2 GDP is encouraging. It’s too early to take this number seriously, but we have a baseline for gauging how economic activity evolves in the weeks ahead. For the moment, cautious optimism prevails.