Will Selling of US Bonds by Foreign Holders Drive Yields Higher?

2023.11.03 20:33

Several factors have conspired in recent weeks to send US Treasury rates sharply higher. These include the Fed’s program to reduce Treasury holdings by allowing them to mature; soaring fiscal deficits in Washington and a missing-in-action Congress; the downgrade of US Treasury debt by Fitch Investor Services; and high-profile buys and sells by foreign owners of Treasury debt, writes John Eade, president of Argus Research.

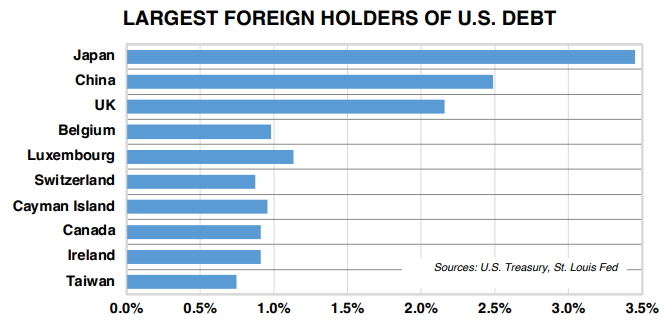

Total Public Debt owed by the US federal government was $32.3 trillion at the end of 2Q23. Outside the US, the two largest holders of US Public Debt are Japan, which owns 3.5%, and China, which owns 2.5%.

Other nations among the top 10 holders own 9% of the debt, so the top 10 holders collectively own about 15%. The grand total of US debt owned by foreign holders is $7.7 trillion, or about 24% of the total.

Foreign Holders of US Debt

Foreign Holders of US Debt

While the absolute holdings level is up about 3% over the past year, we have seen pronounced shifts among the major holders. Japan’s bondholders historically have been long-term in nature, attracted to Treasuries while their local sovereign bond yields have been near zero for years.

A recent rate hike in Japan, though, has led to the repatriation of approximately $80 billion out of Treasuries and into local sovereign securities in the past year. China has also been selling, in part for political reasons. China’s current Treasury holdings are lower by about $135 billion over the past year.

But while some nations have reduced exposure, others have increased it. Canada has increased its holdings by 17% and the UK’s holdings are up 8% in the past year. We think this type of global demand for US Treasuries should help keep a lid on long-term rates in 2024.

This content was originally published on MoneyShow