Will Rate Hikes Really Tame Inflation or Is It Different This Time?

2022.11.10 11:19

[ad_1]

A widely discussed criticism of the Federal Reserve is that the central bank was asleep at the switch last year, when it waited too long to begin tightening monetary policy to nip emerging inflation in the bud. The critique implies that adopting a more hawkish policy earlier would have spared the US from the high inflation that now stalks the economy. But a review of other central banks that followed that script suggests otherwise.

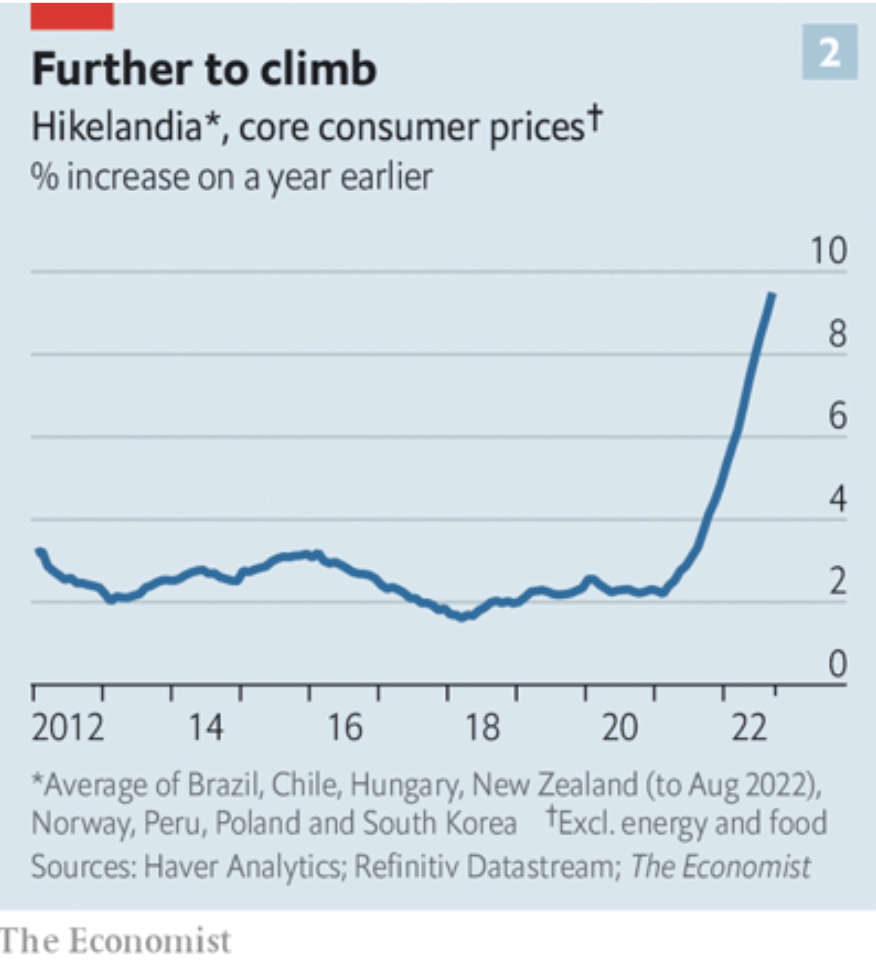

The Economist analyzed numbers on eight countries (including Brazil, South Korea and New Zealand) where policy tightening started a year or more ago. The median hike: six percentage points, substantially more than the Fed’s hikes to date. The accumulated rate increases, in theory, should have tamed inflation, but that’s not what happened.

Comparing monetary policy across economies is tricky since every country is distinct in terms of macro conditions. Nonetheless, the analysis raise intriguing and troubling questions about what’s possible, or not, with the standard playbook for fighting inflation this time.

The smoking gun in the analysis: core consumer prices in the eight countries overall – Hikelandia – have shot up quickly and dramatically this year despite aggressive and early rate hikes.

Core Consumer Prices In Countries That Start Rate Hike Cycle Early

Core Consumer Prices In Countries That Start Rate Hike Cycle Early

The Economist outlines three possible explanations for why inflation increased so sharply despite early policy tightening. One is that the lags between policy changes and changes in inflation take longer than a year, especially in the current environment. Second, maybe Hikelandia’s tightening wasn’t enough and even bigger, faster hikes were needed. Third, inflation may be more entrenched and persistent this time and so monetary policy is less effective.

The third explanation is the more threatening one because it implies that the Fed’s ability to reduce inflation is less effective than assumed. Meanwhile, the risk of a policy error – tightening too much for too long – continues to lurk.

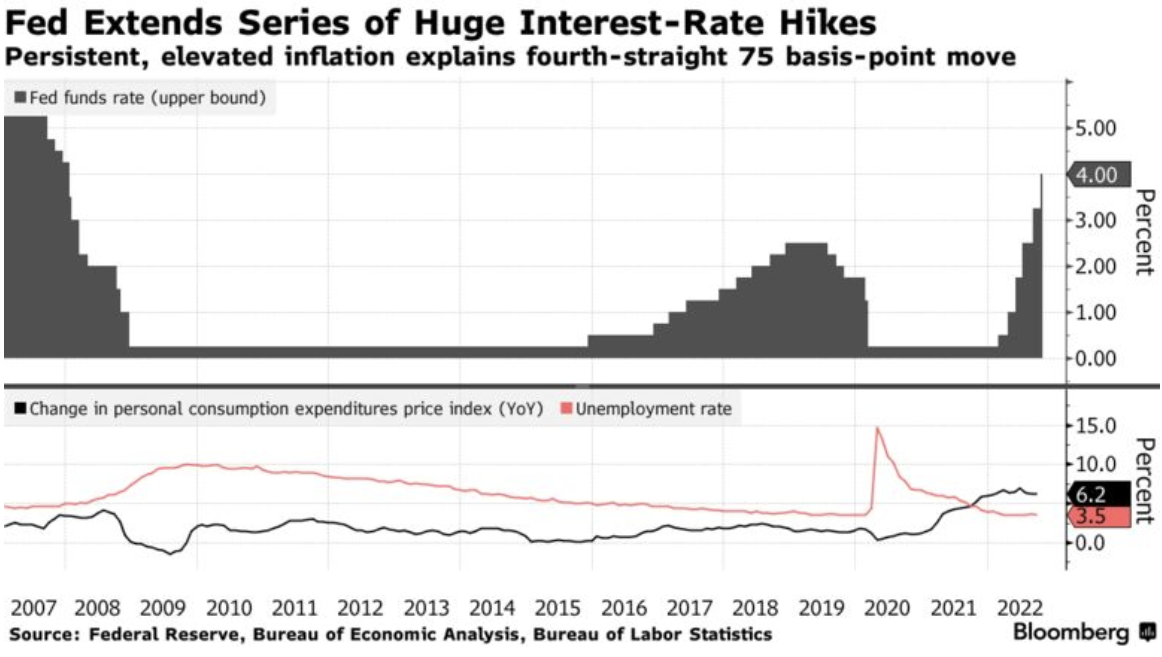

Charles Evans, the outgoing president of the Federal Reserve Bank of Chicago, says:

“I do think there’s benefits to adjusting the pace as soon as we can. I’m hopeful that we’re getting to a point where the dynamics for inflation turning over and returning towards our 2% objective will be put in place, if not very soon, soon, and we’ll actually see it in inflation. If you don’t begin to think about adjusting the pace, taking account of lags, and you just keep increasing rates by a large amount every time you get a disappointing report, [and the] next thing you know, you’re at a very high federal funds rate.”

Fed Funds Rate, PCE, Unemployment Rate

Fed Funds Rate, PCE, Unemployment Rate

Effective or not, market sentiment expects the rate hikes will continue, although there’s more uncertainty about the size of the increases. Fed funds futures are pricing in a near certainty of either a 50- or 75-basis-points rate hike at the next FOMC meeting on Dec. 14.

It’s likely that higher rates will slow the economy and perhaps trigger a recession. Less clear is the efficacy of additional rate hikes on reducing inflation.

Some Fed officials recommend staying hawkish for longer. “The Fed can’t let inflation fester and expectations rise,” advises Richmond Fed President Thomas Barkin, who’s not voting on policy decisions in 2022. “If we back off for fear of a downturn, inflation comes back even stronger and requires even more restraint.”

The bigger question is whether inflation will stay hot even if rate hikes continue? The experience in Hikelandia suggests the answer isn’t obvious, at least for the near-term outlook.

[ad_2]

Source link