Will Eurozone Inflation Data Push the Euro Higher?

2023.05.01 13:25

Lately, the Euro has been trading in a tight range especially against the United States dollar despite some tryouts of a break to the upside. The 14-Day average true range, which measures the average of the distance between the high and the low posted during this 14-day period, dropped close to its lowest level since February 2022.

The fact that Central banks could be close to ending their monetary policy tightening cycle is not leaving much room for directional moves, but rather a more choppy trading. Since the beginning of the year, the pair had a trading range of around 600 pips compared to +1000 pips, at the same time last year.

Range Jan-April 2022 / 2023

What could lead the Euro through the next directional move?

The Preliminary reading of the Eurozone April Consumer Price Index is due tomorrow, and since it is only two days ahead of the European Central Bank’s decision on monetary policy, it is widely followed by traders and investors. The headline inflation reading has eased significantly on a year-on-year basis, supported by a significant drop in energy prices. However, the core inflation reading which excludes food and energy remained significantly high and is expected to come out at 5.7% tomorrow.

Currently, the market is pricing in a probability of 80% chance that the ECB will raise interest rates by 25 basis points, while the remaining 20% is for a 50 basis points rate hike. Any surprise to the upside in inflation readings could push the market to price in a larger interest rate hike, which will come in favor of the Euro over its counterparts.

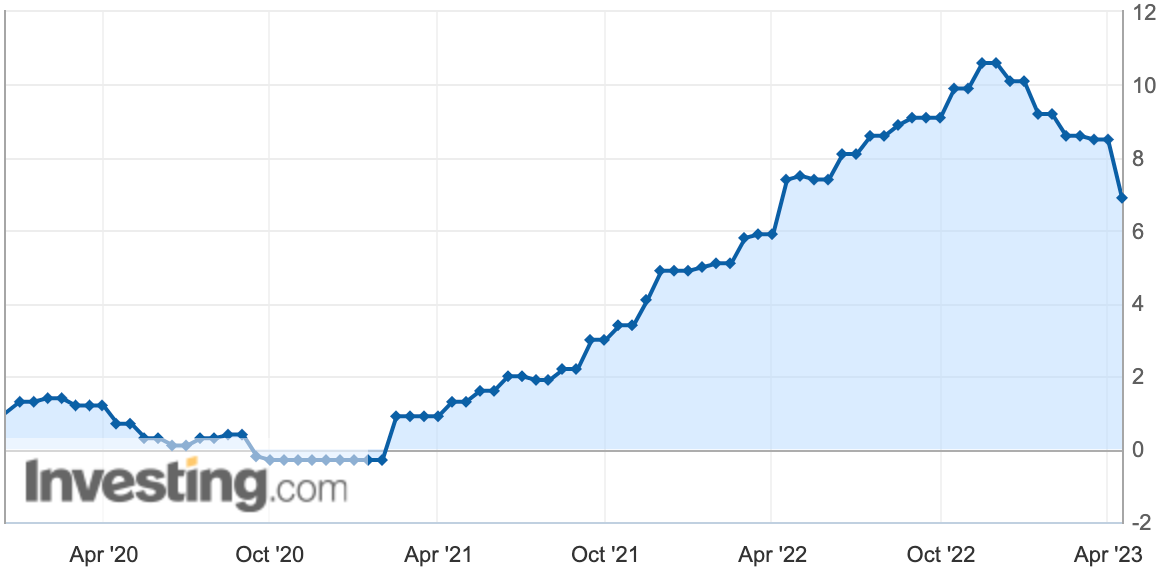

Eurozone Consumer Price Index YoY

Eurozone Core Consumer Price Inde YoY

Eurozone Core Consumer Price Inde YoY

Technical Analysis

As you can see in the chart below, the EUR/USD pair has been somehow consolidating in a tight range close to its highest level since April 2022, despite a trial of a break to the upside last week. In a bullish scenario, the pair could rally to $1.1185, the high recorded on March 31st, 2022, while in a bearish scenario, the pair could drop to the 200-H4 exponential moving average close to $1.09.

EUR/USD H4 time. Exponential moving average 55, 100, 200.

Trading during the news involves high risk, and you better be well-informed on different aspects of the market before initiating any trade. The above should not be considered as trading advice but rather an unbiased market commentary.