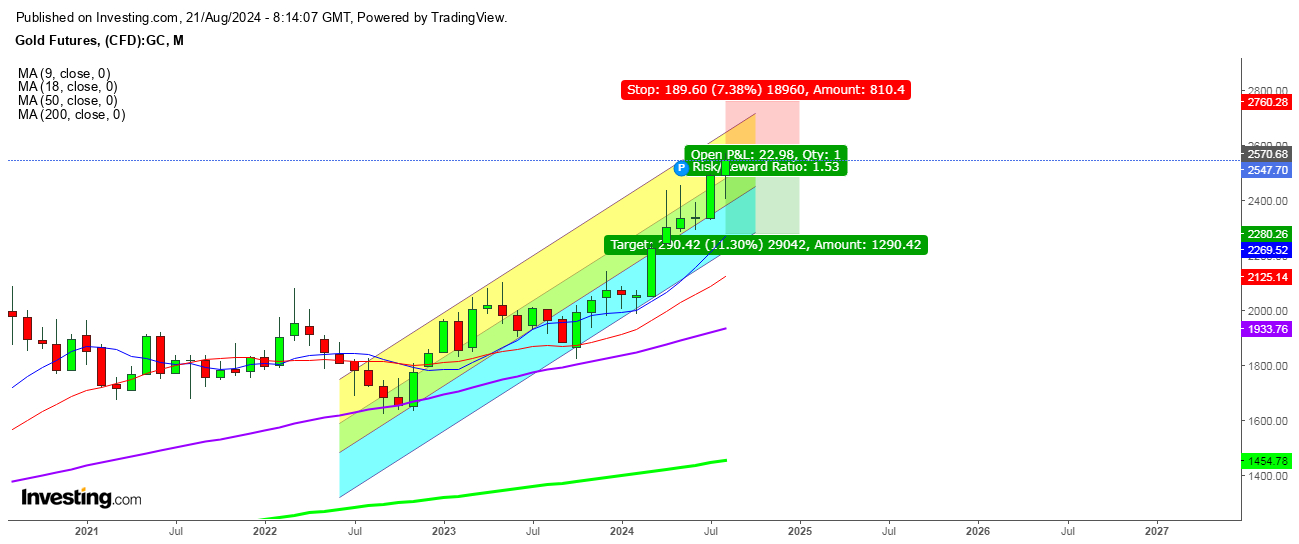

Why Gold Rally Could Halt at Current Levels

2024.08.21 07:47

On analysis of the movements of the futures in different time frames, I find that the current rally could see a halt at this point, despite supportive fundamentals.

Supportive fundaments favor the bulls despite their resistive ignorance to map their presence inside the overbought territory.

Undoubtedly, this rally has pushed the gold prices to hit a new lifetime high, making the situation more problematic for the gold bulls despite favorable geopolitical tension as the budget deficits in major economies like the US, UK, and France look to be quite supportive to keep the bullish momentum intact.

But, merely keeping the eyes shut to ignore the overbought territory could be extremely fatal for the traders as the current situation could take a U-turn at any time.

On analysis of the movements of the gold futures in a monthly chart, I find that the gold futures are feeling selling pressure after testing a lifetime high at $2570. Undoubtedly, this has defined the limit inside the overbought territory.

In the weekly chart, gold futures, showing indecisiveness among the traders could tilt the move downward before this weekly closing as the outgoing election cycle is building anxiety among the investors.

In the daily chart, the beginning of the price exhaustion is visible in today’s session. Undoubtedly, a downward move by the gold futures below $2509 will confirm a slide during the rest of the week.

In the hourly chart, gold futures are about to find a breakdown below the significant support at 50 DMA which is currently at $2547.