Why Didn’t Gold Soar as U.S. Dollar Fell?

2023.07.17 09:30

It’s always darkest before dawn, and the feeling is most bullish before the top. Is the sentiment (unnecessarily) positive right now?

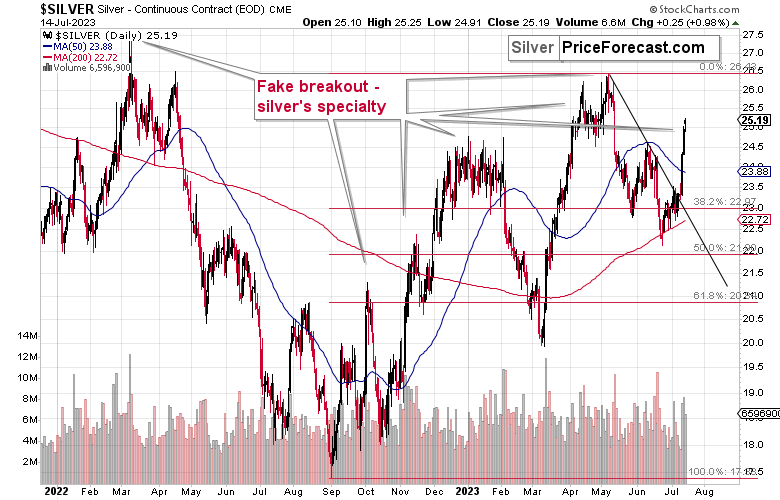

Just look at .

The white metal soared, which is bullish… Only if one is new to the precious metals market. There were multiple occasions on which silver soared and broke above previous highs only to invalidate them and decline shortly thereafter. That’s how this year’s and last year’s tops formed, for example.

And that’s exactly what silver did right last week – it soared, outperformed, and broke above the previous highs.

Silver was even strong on Friday.

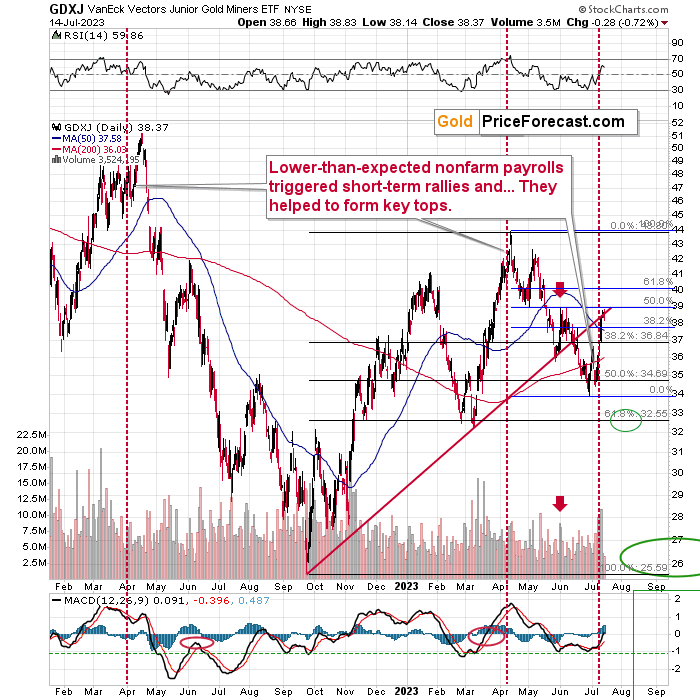

Now, let’s contrast this brief silver price analysis with what miners did.

No invalidation of the previous key breakdowns.

The June high held, and so did the rising red resistance line. In fact, it was just verified as resistance.

And what happened on Friday? Did miners rally just like silver? Nope – the VanEck Junior Gold Miners ETF (NYSE:) was down by almost 1%.

One of the trading strategies is monitoring the market for the times when miners underperform gold and silver outperforms. That tends to happen close to and right at the tops. That’s what just happened.

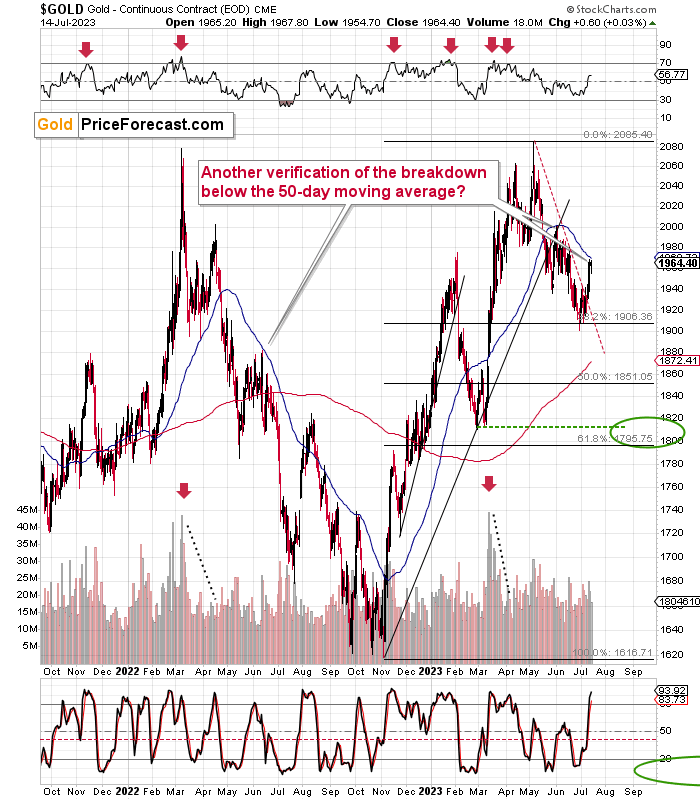

Gold itself moved back to its 50-day moving average, which is in perfect tune with what we saw during the big 2022 decline. And in tune with what we saw in early June.

That’s a corrective upswing, not a bullish game-changer.

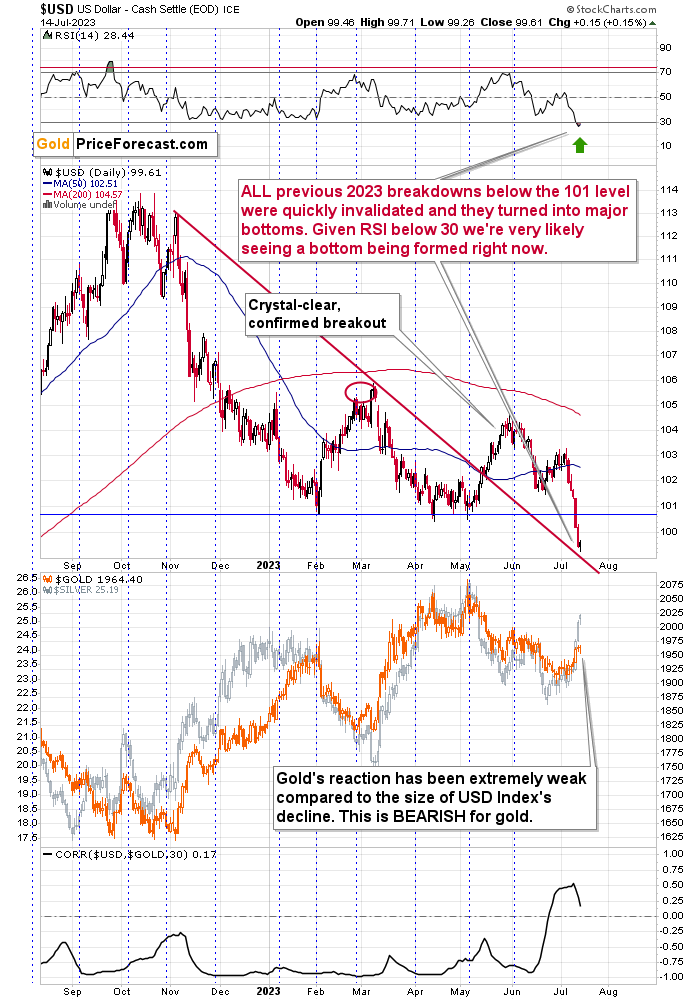

The most bearish thing about gold right now is not visible on the above chart. It’s visible only once we compare what happened above to what happened below – in the .

The USD Index plunged last week, moving well below the previous 2023 lows. Gold would normally be expected to soar to new 2023 highs in this kind of environment. But that’s not what happened. In fact, gold is nowhere close to its 2023 highs.

This is an extremely bearish piece of news for gold prices. Why? Because, given this kind of relative performance, when the USD Index turns up and rallies with a vengeance, gold is likely to truly plunge.

Why is all this happening?

Because the real rates are increasing globally. Remember how lowering of interest rates and keeping them very low for a long time, along with rising inflation, was super-bullish for gold? We now have the opposite. So, yes, it’s super bearish.

Is there any sign pointing to higher values in the USD index?

Yes! We just saw an intraday reversal, while the RSI indicator was pointing to the extremely oversold situation. This is practically screaming, “buy!!!”.

Combining USD’s reversal, gold’s relative weakness, along with the bearish relative signs from both: miners and silver, we get a very powerful bearish combination for the precious metals market for the following weeks and – quite possibly – days.

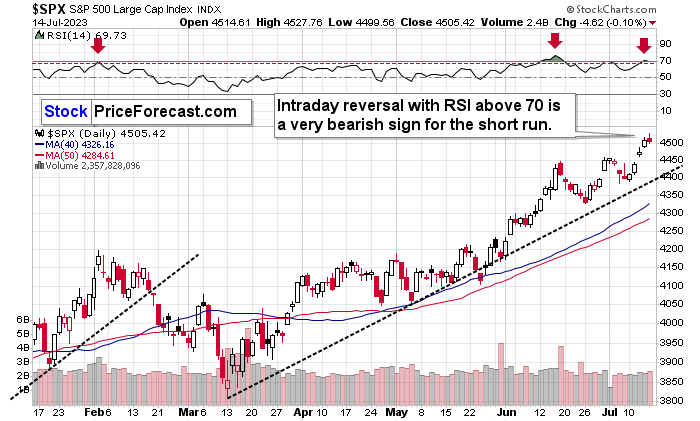

On top of that, we saw a reversal in stocks.

Just as the USD Index is extremely oversold, the was just above 70, indicating extremely overbought conditions.

If stocks reverse and finally decline, too, it will put enormous selling pressure on the prices of mining stocks. The same goes for the rest of the precious metals sector, but the biggest impact is likely to be on the junior miners. And this creates a tremendous trading opportunity right now.