Where Are The Trades?

2022.11.07 17:29

[ad_1]

Don’t fight the Fed was the mantra all throughout the go-go bull market of the 2010s and it remains excellent advice now that we find ourselves in the post pandemic bear market hangover.

If there is anything that last week’s FOMC meeting proved it’s that the FOMC is hellbent on wrecking the US economy in order to bring lower. The fact that inflationary pressures are coming down all by themselves seems obvious to everyone but the Fed chair himself.

The FOMC presser was truly painful to watch as Powell, faced with a series of questions on falling commodity prices, cratering housing markets and the slowdown in wage growth, blithely fully shrugged off the concerns to make it very clear that was perfectly willing to cure the patient by killing him.

While it’s true that the nominal level of inflation remains high, the month over month increases have essentially stopped three months ago and as for the single most important aspect of inflation – the wage price spiral – that dynamic has now reversed and will begin to exert downward pressure on prices assuming we have no further supply shocks in store.

As David Rosenberg wrote, the latest data was actually much weaker than the headline number would suggest, noting:

“My take on the jobs data: take the “L” out of “BLS.” Strip out the birth-death model & the headline was +78,000. The HH survey was -328,000 and all full-time. The U-rate spiked 0.2 ppts. The quit rate dipped to a 4-month low. Real wages fell 0.1% And guess what? All the Fed sees is +261,000”

All of this suggests that the peak choking of the economy may be over and that last week’s 75 basis point (bp) rate hike may be the final one of this rate cycle as the Fed shifts to smaller bite sized increases on its way to reaching the terminal rate.

That’s a small ray of sunshine for equity bulls but may not be enough especially if economic conditions begin to deteriorate. On the other hand the downside appears limited as well not only because we have already corrected so much, but because as many derivative commentators have noted that the market is heavily over hedged with generally steady or dropping even as equities sell off.

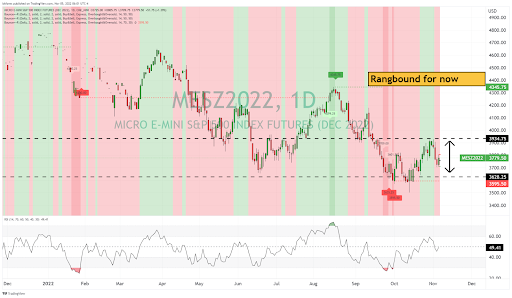

In such an environment it’s difficult to imagine equity prices dropping much further without option dealers stepping in as natural buyers to offset all the protection that they sold. The equity market therefore remains a trader’s market with intraday volatility remaining high but with price action showing little movement either way, or as they say in the American South – “lot’s of heat, little light.”

S&P 500 Futures Chart

Commodities

remains the single greatest existential shock to global growth. After spending most of the summer in a clearly defined selloff bottoming out near $75/bbl, crude has started to rally again putting in a clearly defined bottom with higher lows, suggesting that it may be ready to start a run at $100/bbl mark fueled by the double whammy forces of an OPEC+ production cut and the possible easing of COVID restrictions in China.

The situation is exacerbated further by the fact that the US – having released a significant portion of its SPR on the market already – may be a limited seller from this point forward.

All of these factors are setting up for a possible oil rally into the year end which could quickly verticalize as the late shorts are forced to cover.

Spot Crude Oil Chart

The pop in oil has finally translated into a rally in which enjoyed its best rally in months after drifting lower for most of the year. We have been noting that gold has found a bottom at the $1600 level for the past month and that support zone has held again, suggesting that the yellow metal may be building a durable base from which to rally.

It’s difficult to imagine fundamental reasons to be long gold given the likely rise in real rates if the Fed continues to hike as nominal prices drop, but the current short covering pop may have a way to go. Therefore, the prospect of a move towards the $1750 level is not out of the question after such a long moribund decline that saw the most consecutive monthly drops for the commodity in more than 5 decades.

Gold Spot/USD Chart

Crypto

Back from the dead? That seems to be the story that crypto bulls are peddling as rises above the $20,000 mark while holds steady at $1600. After such long and protracted declines it’s natural for crypto to see some sort of a dead cat bounce. Indeed various crypto exchanges reported more than a billion of forced liquidations last week as short positions were forced to cover.

Still it’s hard to imagine that crypto is anything more than a side show at this point as the use case for the product remains elusive at best. It is no doubt the simplest way to circumvent capital controls for most retail accounts but that is hardly a mass market appeal product and until the sector can prove its worth as a true investment or transaction instrument we remain skeptical of any fundamental case for its existence.

Therefore it remains a purely speculative instrument driven by technicals and sentiment alone and as such will require another massive wave of buying to entice new participants into the market. Therefore as with all technically driven trades, the only factor worth watching with crypto is volumes and until those pick up the price action will remain choppy – but now that we have formed a reasonable bottom volume will be the key variable to watch.

ETH/USD Daily Chart

Foreign Exchange

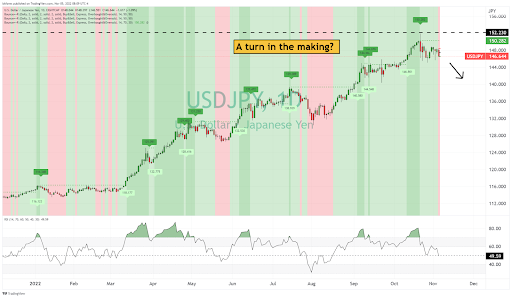

peak? Well if you go by that may be the case at least for the near term. The pair has been the poster child for dollar strength, but recent price action suggests that we may be entering a corrective phase as the FX market runs ahead of everyone else and anticipates a Fed pause.

The dollar has been on an unstoppable run driven by the relative growth and interest rate advantage in the G-7 universe, but as other central banks grudgingly play catch up with their monetary policies while the Fed begins to slow, the massive rally in the buck is starting to reverse.

With USD/JPY now holding below the 150.00 mark the greenback may have carved out a short term top and as long as that level holds every rally in the dollar is a sell opportunity.

Meanwhile the foreign exchange market itself may be the best clue as to the prospects of US growth going forward. If the dollar weakens materially so may US economic performance into next year forcing the Fed to reconsider its hawkish stance.

USD/JPY Chart

[ad_2]

Source link