What Would it Take for the Fed to Pause in December?

2024.11.15 02:18

- After a (slightly) hotter-than-expected PPI report and strong jobless claims this morning, the door is cracked open to a Fed pause in December.

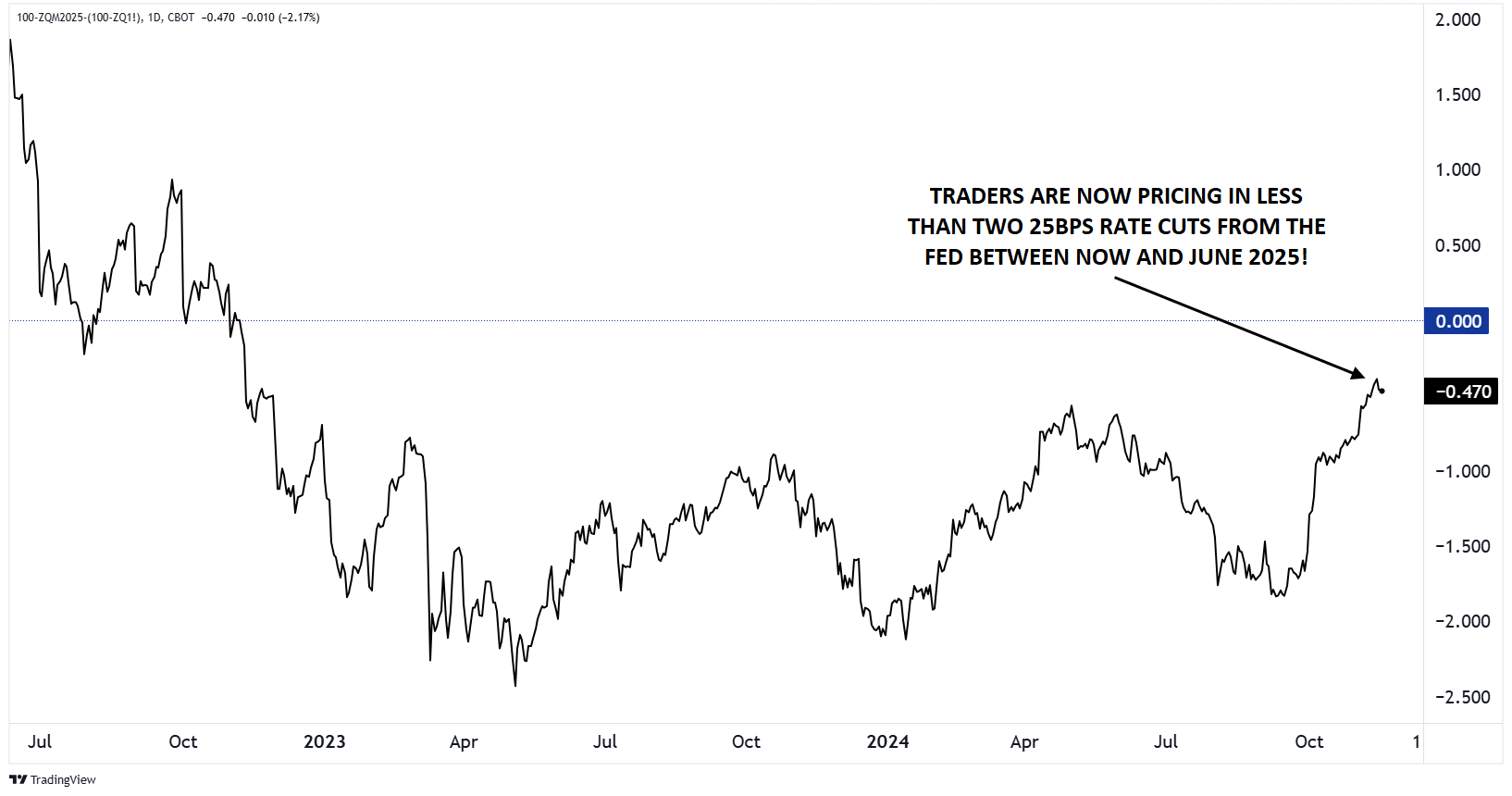

- Traders are already pricing in a meaningful pause in the first half of next year, with only -46bps of interest rate cuts priced in between now and June 2025.

- Gold’s now testing its 100-day MA and the 14-day RSI is at its lowest level in a year, hinting at a near-term bounce.

When you vow to be data-dependent when making decisions about monetary policy, one of the risks is, well, that your monetary policy decisions should be dependent on the data.

After coming out firing with a 50bps interest rate cut in September and following on with another 25bps interest last week, the Fed clearly believed that the downside risks to the labor market were more pressing than the upside risks to inflation. However, the recent economic data suggests that balance may be shifting.

Looking just at this morning’s figures, the US Producer Price Index () came in a tick above expectations at 2.4% y/y, and the “” PPI reading also was a touch hot at 3.1% y/y. At the same time, the initial reading fell by more than expected to just 217K, the lowest reading since mid-May and back near the historical lows that characterized most of 2022-2023. In other words, inflation remains stubbornly above the Fed’s target, and the brief fears of a slowing labor market have seemingly dissipated over the last few weeks.

Perhaps more to the point, Fed officials have started to hint at the potential for a pause in the nascent rate-cutting cycle. Just this week, Minneapolis Fed President Neel Kashkari alluded to the potential for a higher “neutral interest rate,” implying that there may be less need to keep cutting interest rates from here. Then, Dallas Fed President Lorie Logan noted that the current interest rate may be “very close” to the neutral rate and that she “anticipate[s] the FOMC will most likely need more rate cuts,” far from a full-throated endorsement of a series of once-every-meeting 25bps rate cuts.

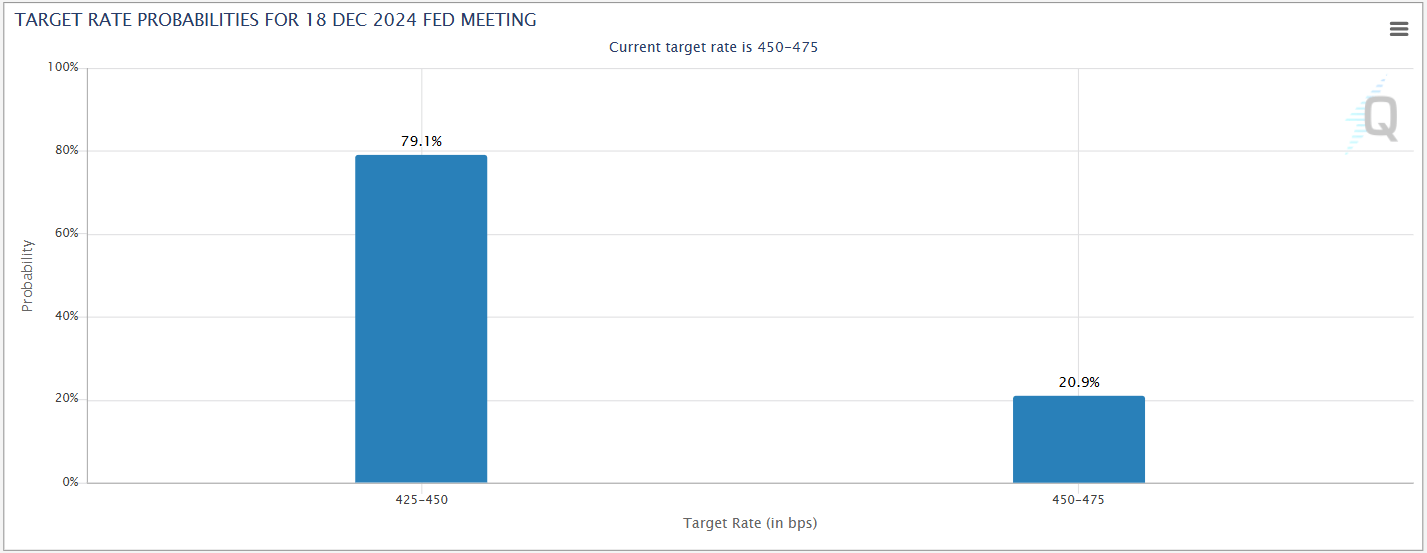

As it stands, traders are still pricing in about 80% odds of another 25bps interest rate cut from the Fed next month, and barring unanimously hotter-than-expected inflation data (, CPI, and PPI) and stronger-than-expected employment figures (NFP, initial jobless claims), a 25bps rate cut still looks more likely than not:

Source: CME FedWatch

That said, the picture looking out into H1 of 2025 looks a lot murkier. Indeed, traders are already pricing in a meaningful pause, with only -46bps of interest rate cuts priced in between now and June 2025. Put differently, the market is only anticipating about two 25bps interest rate cuts across the Fed’s next five meetings, or less than one cut every other meeting.

Source: TradingView, StoneX

Evolving data and Fed comments will continue to influence the market’s expectations, but as it stands, a substantial pause in the Fed’s rate cutting cycle – if not an outright end to it – is looking likely by the first half of 2025 at the latest.

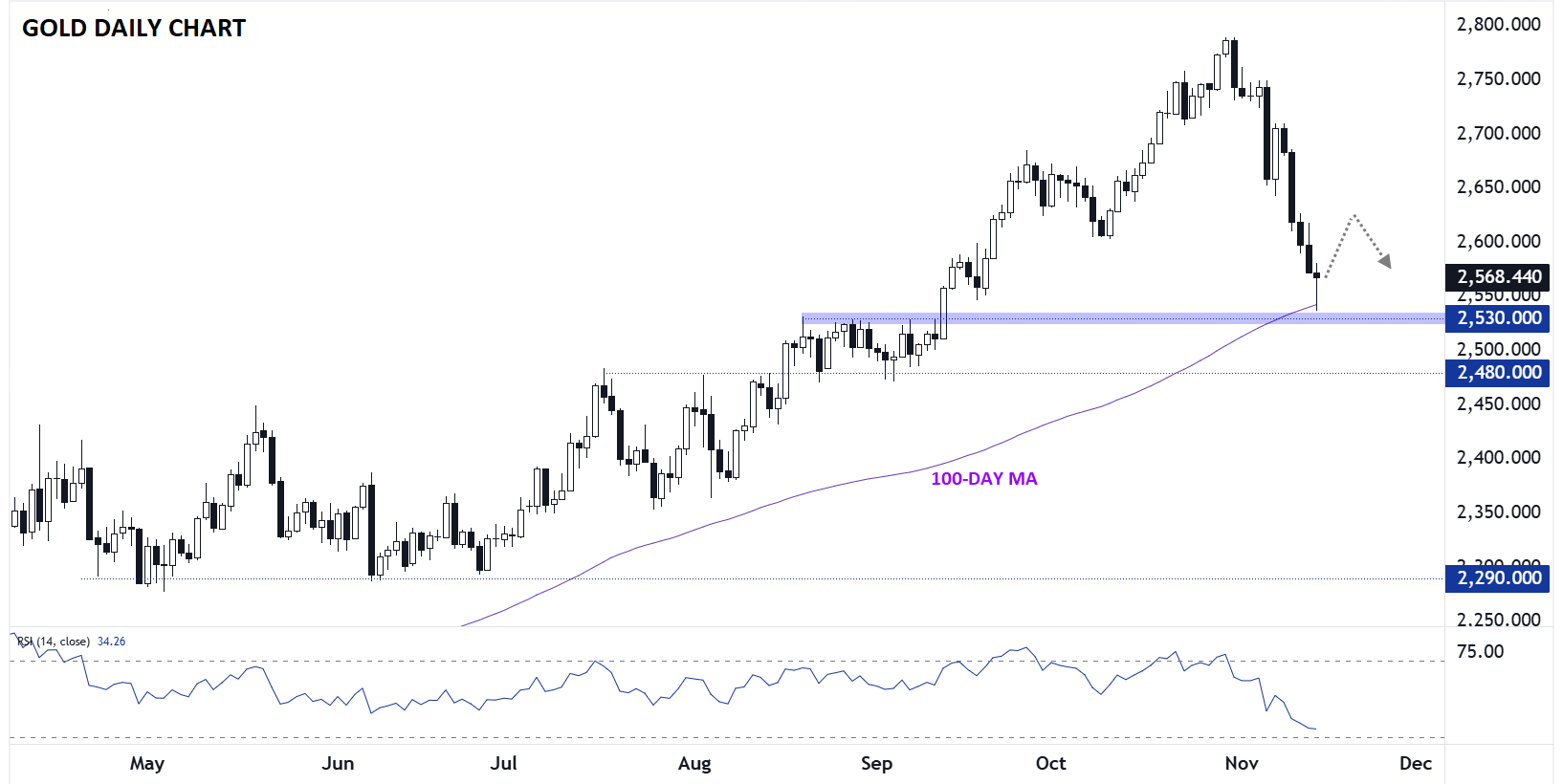

Gold Technical Analysis – XAU/USD Daily Chart

Source: TradingView, StoneX

Perhaps more than many other assets, gold has struggled to extend its gains as traders have priced out ongoing Fed rate cuts, raising interest rates in the process. The yellow metal peaked at the end of October just below $2800 before rolling over aggressively and slipping all the way down to the mid-$2500s today.

’s now testing its 100-day MA, and as the sub panel on the chart shows, the 14-day RSI is at its lowest level in a year, hinting at a near-term bounce from here. If we do see gold recover, a move back to the mid-$2600s could be in play, especially if traders grow more confident in a December Fed rate cut. Looking further out though, it will be difficult for gold to regain the record highs of a few weeks ago unless US economic data tips the central bank back toward more aggressive rate cuts.

Original Post