What to Expect With Precious Metals and Energy While Powell Stays Hawkish

2023.06.22 13:55

Since I on May 25, and look ready to hit their fresh targets after wobbly weeks amid increased uncertainty over interest rate hikes. Gold futures started to melt down after showing some strength on June 14 and 15 at the Fed’s post-rate decision news conference.

As I explained in on June 6, the contrary behavior of both gold and natural gas futures seems to be confirmed by movements during this week.

Technical Formations Explain a Lot

Gold

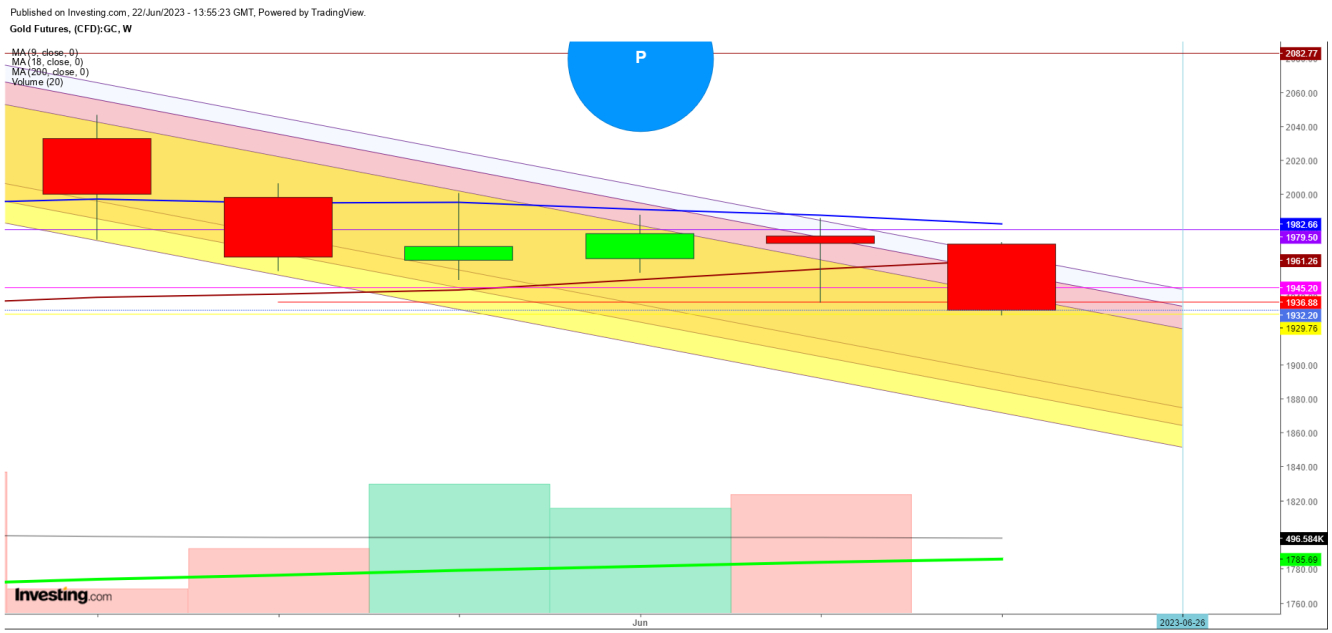

Gold Futures Weekly Chart

Gold Futures Weekly Chart Gold Futures Weekly Chart – Zoomed in View

Gold Futures Weekly Chart – Zoomed in View

On June 22, the weekly chart indicated a steep slide was likely to continue during upcoming weeks if the gold closes this week below $1897 as it is trading much below the 18 DMA, which is at $1961.

Rallies in gold attract bears above $1979 and prices are likely to hit the 200 DMA, which is at $1785, during the coming weeks as this week’s bearish candle confirms the continuation of selling sprees ahead.

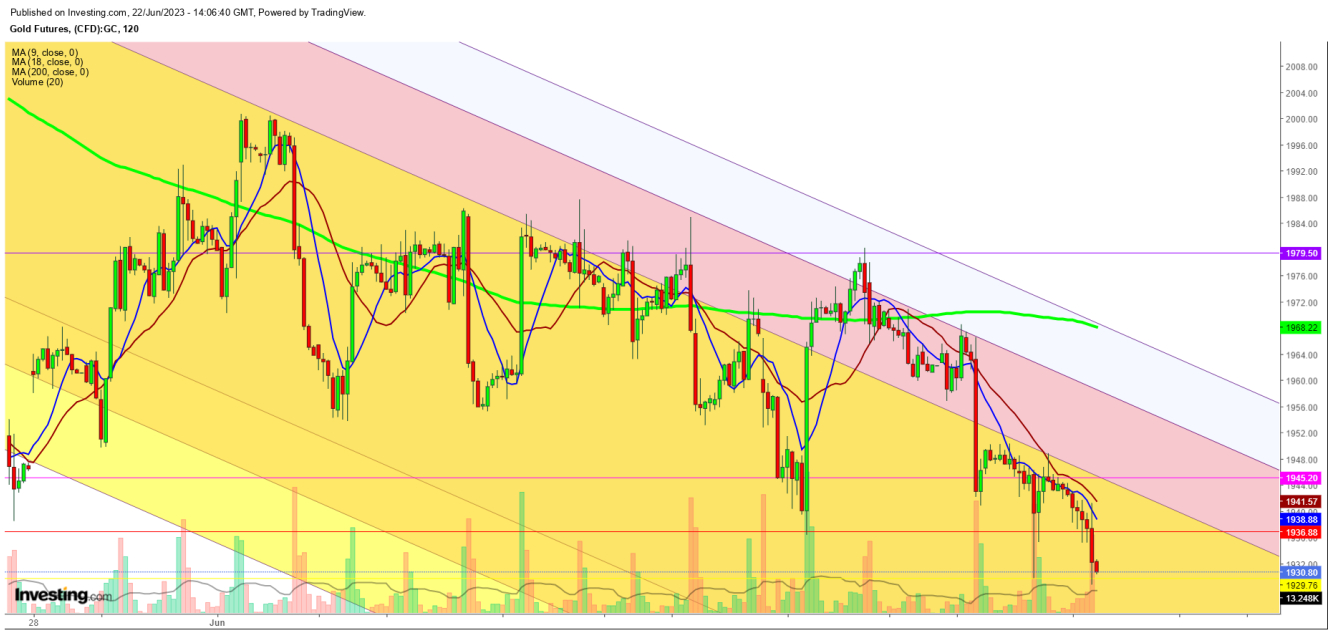

In the daily chart, gold is likely to continue the current meltdown due to the formation of a ‘Bearish Crossover’ on June 20, as the 9 DMA has crossed down below the 18 DMA, which could push the price to hit the next target at 200 DMA, which is at $1858.

The 4-hour chart indicates extreme weakness since June 19 as the price meltdown continued since May 3, 2023, when gold hit a high at $2082.77.

Natural Gas

Natural Gas Futures Weekly Chart

Natural Gas Futures Weekly Chart Natural Gas Futures Weekly Chart – Zoomed in View

Natural Gas Futures Weekly Chart – Zoomed in View

On June 22, the weekly chart for natural gas futures indicated a steep reversal is likely as the formation of a ‘Bullish Crossover’ seems to be forming. The 9 DMA looks ready to cross above the 18 DMA due to summer demand being on the way which has provided a strong base for bulls at $2.448.

A weekly close above $2.767 will confirm this reversal during the coming weeks, and a breakout above $3.448 will be a confirmation.

Natural Gas Futures Daily Chart

Natural Gas Futures Daily Chart

In the daily chart, prices sustained above a significant level at $2.561 on June 22 which ensures a breakout before this week’s close, and a weekly opening with a gap-up will be the second confirmation for the next price breakout to hit the next target at 200 DMA, which is at $3.982. Natural Gas Futures 4 Hr. Chart

Natural Gas Futures 4 Hr. Chart

The 4-hour chart indicates a steep reversal as the formation of a ‘Bullish Crossover’ is about to complete tonight, and prices are sustaining well above the 200 DMA since June 14, 2023.

***

Disclaimer: The author of this analysis does not hold any position in natural gas and gold futures. Readers should take trading positions at their own risk, as both are the most liquid commodities in the world.