What if the Fed Is Content With Core Inflation Above 3%?

2024.12.12 04:52

Last month’s had set up an uncomfortable situation for the FOMC, where too-high inflation was colliding with a Fed that had launched too soon into ease mode – for what appears to be mostly political reasons although there is some mild weakness in economic growth. Preemptively attacking slightly soft growth, in a time of frothy markets and that is sticky at a too-high level, might still turn out to be a clever policy move, but that’s a narrow window.

So the would like to see softer CPI, which validates their professed confidence that it is returning to quiescence like an obedient puppy that has been scolded by the wise people in the Eccles building. Wouldn’t we all like that?

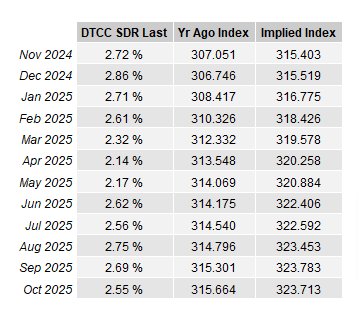

There is some cover provided by inflation markets. Before yesterday’s number, here are the most recent prints taken from the CPI ‘fixings’ market, showing that the market is pricing year-over-year headline inflation to be at 2.14% by April’s print (in May), before rebounding as those quirky low prints from earlier this year are pushed out of the average.

But is that all there is? If the headline can only get to 2.1%, briefly, despite soft energy markets, then can the Fed really be very optimistic that core (in the mid-3s) and median (in the low 4s) will show inflation fully tamed? It’s hard to believe.

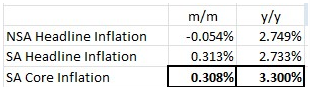

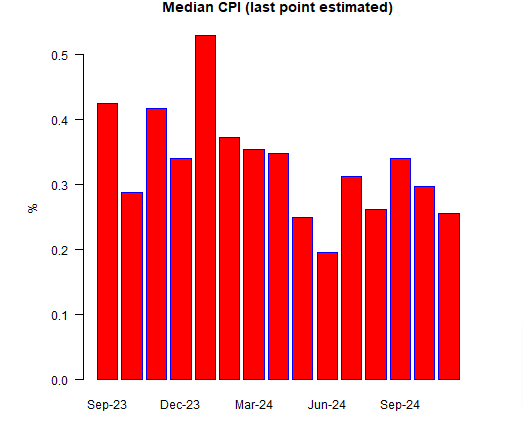

So the Fed has a lot at stake here and needs inflation to keep decelerating. Not just on a y/y basis; the m/m numbers need to start looking better. We have had three straight uncomfortably high readings in a row after the it-now-seems-like-an-aberration-low blip earlier in the year, and four straight median CPI figures. The consensus before yesterday’s report was for 0.26% on the seasonally adjusted headline figure and 0.28% on core. Neither of those is what the Fed is really looking for. Worse, they didn’t even get that.

These are not alarmingly high, 0.31% when the market was looking for 0.26% or 0.28%, but keep in mind that our recent benchmark for alarm has been a bit skewed by a period of time when the forecasters were missing by 0.1% and 0.2% on a regular basis! It’s a modest miss. But it’s a modest miss on the wrong side.

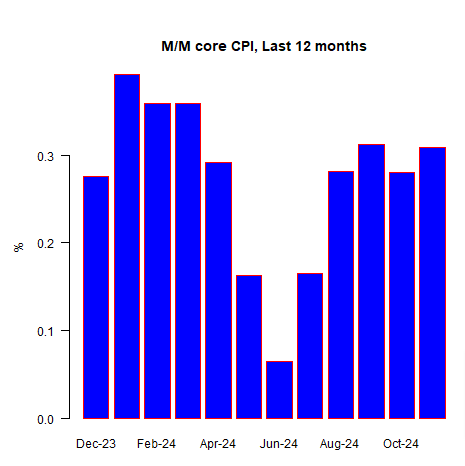

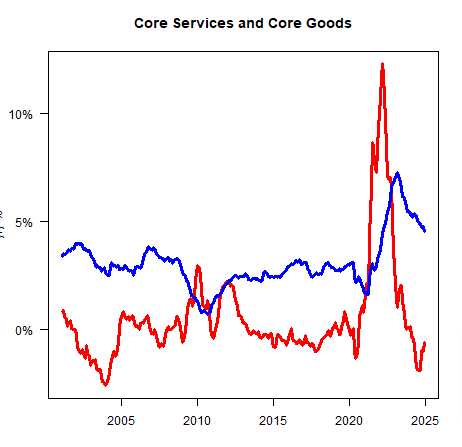

Core Goods Continue Rebound

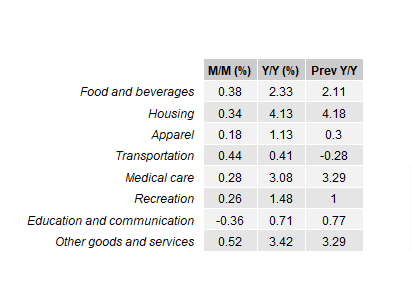

Core goods continued to rebound slowly back towards 0%, now -0.6% y/y, while core services slowed further to 4.6% from 4.8%.

The rise in core goods was driven significantly by a second monthly jump in used car prices, +2.72% m/m after +1.99% last month. The lengthy mean reversion of used car inflation is over. That was one big factor keeping core goods prices submerged, and without it (New Car prices were +0.58% m/m also, for what it’s worth) core goods should go back to roughly flat or slightly positive.

The strength in the dollar would normally keep core goods from getting too out of hand, but of course if you believe Trump’s tariff threats – and even if you don’t, but figure it implies more nearshoring – then you should expect Core Goods to be positive going forward.

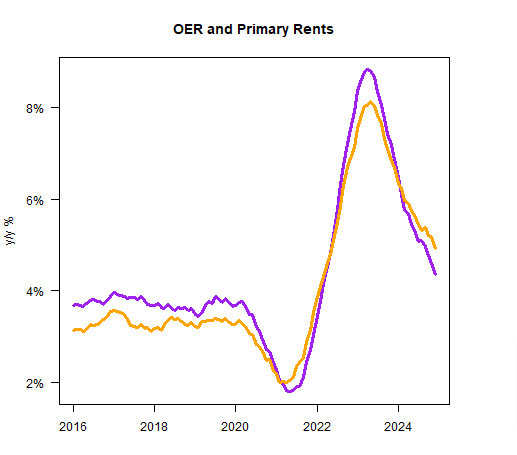

Core services have a lot to do with rents, which this month were much lower than last month’s change (0.23% m/m vs 0.40% last month on OER; 0.21% on Primary rents vs 0.30%). The deceleration here continues, although remember that last year we had been promised healthy deflation in rents this year. Never got even close to that.

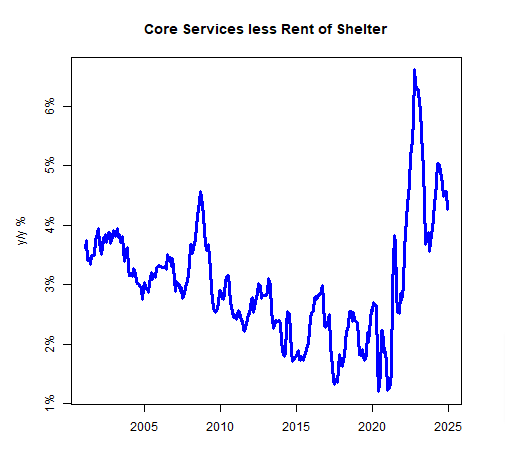

Now, there is some good news here. Some of the overall miss this month can be traced to a 3.16% m/m rise in Lodging Away from Home. This means that Core Services ex-Shelter (“Supercore”) had a healthy deceleration and that’s good because that’s the sticky stuff. It’s still far too high, though.

Similarly, the more-well-behaved measure of Median CPI was up only 0.255% m/m (my estimate), which brings y/y Median to about 4.04% y/y (was 4.08%). This looks a little better? Anyway the lowest m/m since June.

I don’t want to make too much of this, the fact that Lodging Away from Home was a significant part of the miss doesn’t make this a great number. Nor does the continued deceleration in rents. 0.255% for twelve months would still leave a Median CPI of over 3%. The major groups look alarmingly normal without four of the categories above target and four of them below target.

Bottom Line

And I guess that leads us to our conclusion. I had said last month that I thought the Fed would find a reason to hold rates steady at this upcoming meeting, rather than continuing to cut. But markets don’t believe that, and market pricing implies a good chance of a further 25bps cut at this month’s meeting.

To be fair, Fed speakers have been seeming to guide markets in that direction with expressions of concern about the weakening labor market. But I think there’s something worse than investors starting to be concerned that the Federal Reserve makes policy moves on the basis at least partly of political ideology.

After all, that’s at best an every-four-years thing. What would be worse would be for investors to believe that the FOMC is content with inflation above 3% and willing to focus on employment if there’s even a hint of weakness there.

That’s the wrong approach because employment is cyclical while inflation isn’t. While I don’t believe that ‘inflation expectations anchoring’ is a real thing we should be concerned about, ‘Fed credibility’ is. While inflation was decelerating, the Committee could, with some hand-waving, pretend that it was addressing both inflation and growth and merely getting ahead of the recession. If inflation is hooking higher again, that story will be harder and harder to sustain.

I don’t know that core or median are yet hooking higher. But they’re no longer placidly declining. My guess is that the Fed will pause the rate-cutting campaign shortly, but stop the balance-sheet runoff, and try to play both sides of the net. The game is getting much harder from here.

Original Post