Weekly Inflation Outlook: CPI May Surprise Higher, but the Fed Won’t

2022.12.12 07:54

[ad_1]

- Core CPI is more likely to surprise to the upside than to the downside on Tuesday

- Still, save for an outlier inflation reading, the Fed will raise rates by 50bps on Wednesday

- The equity market is still overvalued for a world in which equilibrium inflation is in the 4%-5% range

This week we see both the on Tuesday and the results of the on Wednesday. The first thing that should be said is this: those two events are most likely not connected, despite their proximity to each other.

Chairman Powell has clearly telegraphed that the FOMC will increase the target Fed funds rate by 50bps, and there hasn’t been any significant pushback to that view since then. The next meeting might be in question, but there isn’t a lot of doubt about this one.

Unless, of course, does have a considerable upside surprise. The forecast of —which would drop the YoY figure to 6.1%—compares very favorably to the outcomes we have seen over the last year (see numbers below, source BLS).

- Nov-21: 0.52%

- Dec-21: 0.56%

- Jan-22: 0.58%

- Feb-22: 0.51%

- Mar-22: 0.32%

- Apr-22: 0.57%

- May-22: 0.63%

- Jun-22: 0.71%

- Jul-22: 0.31%

- Aug-22: 0.57%

- Sep-22: 0.58%

- Oct-22: 0.27%

It has been more than a year since we saw consecutive core numbers of 0.3% or below. The last time was between August and September 2021, when COVID categories were still a thing, and the unwind (e.g., airlines, hotels, used cars, plus apparel) drove the core deceleration. But Median CPI accelerated to new month/month highs on both of those occasions, so there was little reason to think the inflation scare was over.

We have something similar happening here, although in the context of what really does look like a forming peak in inflation. Economists are not calling for 0.3% because there is a general collapse in pricing power. Quite the contrary, in fact: more than half of the inflation basket will still be inflating at faster than 6%-7% annualized.

The drag is coming from one fairly small category: Health Insurance.

Last month, CPI for health insurance dropped 4% (about 50% annualized), and the overall Medical Care subindex fell 0.5%. That was a large part of the reason that core inflation was so low. What’s more, Health Insurance CPI is essentially a plug number that adjusts for health insurance company profits (which is part of what consumers spend for medical care but doesn’t actually go to medical care). It is an adjustment that the BLS calculates annually and smears over 12 months. Ergo, we are pretty confident that there will be another such decline in Health Insurance CPI.

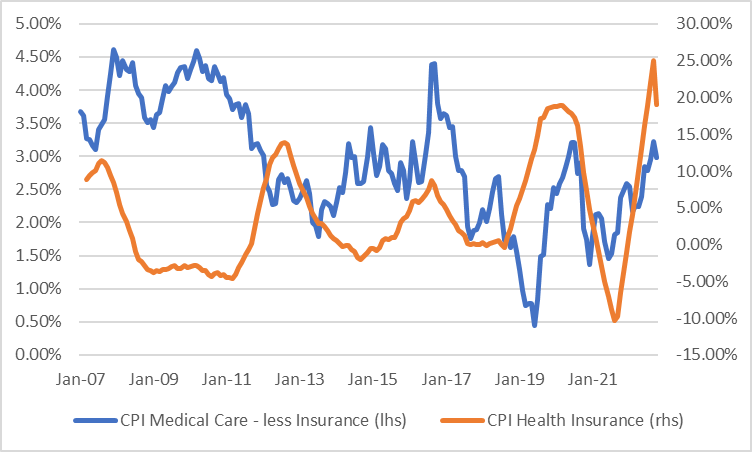

But what does that mean for the rest of Medical Care? Note that Health Insurance in recent years (but only in recent years) has tended to lead to changes in Medical-CPI-less-Health-Insurance (see chart, source BLS with Enduring Investments calculations). What that tells you is that (since Health Insurance is a residual) there have been some costs that are not well-captured by the surveys of the other parts of medical care. That’s not too surprising. Actually…medical care is hard to measure.

Therefore, what last year’s spike in Health Insurance prices told us was that underlying pressure in medical care was more than was being picked up by the straight survey. But that would also mean the current collapse in Health Insurance is picking up drastic declines in Medical Care now. This seems unlikely to me: a 48% decline in health insurance CPI would suggest roughly a -4% decline in medical care costs over the next full year.

Does that seem likely?

A deceleration in overall Medical Care CPI from +5% to -4% would by itself lop almost a tenth of a percent (with rounding) off of the monthly CPI figure, and that’s essentially what economists are pricing. That would be great news, of course. But, if that is happening behind the scenes, why is the iShares Healthcare ETF outperforming the broad market by about 16% over the last year (see chart, source Bloomberg)? That ETF isn’t all insurance companies. There are pharmaceutical companies, medical equipment manufacturers, and diagnostics companies.

SPY Vs. IYH 1-Year Price Chart

SPY Vs. IYH 1-Year Price Chart

In short, I doubt that Medical Care will continue to be a drag on overall inflation. And, while core goods continue to decelerate – Used Car CPI looks to be less of a drag this month, though – the rest of the basket is only just barely starting to show signs of deceleration. A slowdown in rental inflation, which is an article of faith in the prognostication community, has yet to manifest itself.

In sum, Core CPI is more likely to be a high surprise than a low surprise (famous last words, but a soft number is mostly priced in). But, as I said, the Fed is unlikely to care, and on Wednesday, we will get a 50bps hike.

Taking a Step Back

If we, in fact, get a higher CPI than the consensus expects, the stock market is likely to take it poorly.

But taking a step back to the bigger picture, I think the FOMC statement on Wednesday in such a case would show an insouciance about inflation that will please equity investors.

I have been surprised at how heavily the Fed seems to be relying on private surveys of rents and home prices and substituting these private surveys into the CPI to account for the lag in rental inflation reporting. Those other surveys are not without their problems – notably, they tend to exaggerate rents in certain parts of the country and focus on asking rents and new leases.

The composition problem is a thorny one, which is why the BLS takes the measured approach it does. That’s not to say that the BLS method is right, only that there is no reason to think that the private surveys are accurate forecasts of the rent of shelter components of CPI. At some level, who cares: this is an issue for the bow-tied pocket-protector set.

But the fact that the Fed is leaning on that line of thought says that they are looking for ways to validate what they want to do, and that is to slow the rate increases. I suspect that when we hear the statement on Wednesday (and again, assuming there isn’t a serious outlier on Tuesday), it will sound very much like what we have previously heard from the Fed, and stock jockeys will be buyers.

To be sure, the equity market is still overvalued for a world in which equilibrium inflation is in the 4%-5% range, and a recession is on the immediate horizon. Taking a step back, neither of the big events this week will cure that. Only lower prices will.

***

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs, that may be mentioned from time to time in this column.

[ad_2]