Weekly Inflation Outlook: Core Services Ex-Rents Is As Bad As Advertised

2022.10.17 08:58

[ad_1]

Another week, another upside surprise on an inflation indicator. reached a fresh y/y high for the move, marking at least the third time we’ve been expecting the peak to be in—and, as it turns out, it isn’t.

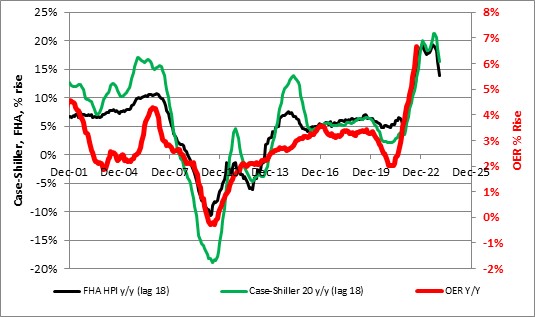

I mentioned last week that my focus was going to be on core services ex-rents. The rent story itself is very important, but it’s a slow-moving train wreck and one that we could see coming from a long way away. Lagged home prices highly influence rents; consequently, we’ve been able to see this coming for at least 18 months (see chart, source Bloomberg). We should be seeing a plateau in rents soon, although it will be a while before the rent figures decelerate much.

House Price Index, Case Shiller 20 Y/Y, Owners’ Equivalent Rent

But rents don’t have a built-in feedback loop. That is, higher rents don’t cause higher wages, although higher wages (as we have now) can help support higher rents.

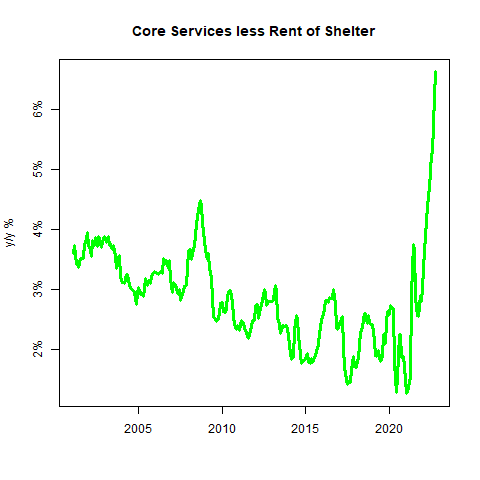

Core services ex-rents is a different kettle of fish, however. That category—services, fewer energy services, less rent of shelter—is about 25% of the overall and about a third of core CPI. It includes things such as hospital services, doctors’ services, financial services, legal services, telephone services, tuition, and so on. All of these services have a significant connection to wages, as labor is a large input into them. Here is a chart of core services ex-rents, y/y.

Core Services Less Rent Of Shelter

Source: Enduring Investments

That is disturbing because of the wage component of these categories. Emblematic, perhaps, is the Food-Away-From-Home category. While food commodities prices have started to recede somewhat so that Food-At-Home’s y/y increase rolled over this month, the Food-Away-From-Home category continues to accelerate as waitstaff, and other employees get more and more expensive. (See chart).

U.S. CPI For Food Away From Home

U.S. CPI For Food Away From Home

Source: Bloomberg

Why is this especially relevant this month? In the latest (also released last week, representing last month’s meeting), there was this little snippet worth noting:

“Participants agreed that the uncertainty associated with their economic outlooks was high and that risks to their inflation outlook were weighted to the upside. Some participants noted rising labor tensions, a new round of global energy price increases, further disruptions in supply chains, and a larger-than-expected pass-through of wage increases into price increases as potential shocks that, if they materialized, could compound an already challenging inflation problem. A number of participants commented that a wage-price spiral had not yet developed but cited its possible emergence as a risk.”

If you wanted to look for a wage-price spiral, the core-services-ex-rents category is where you’d start your sleuthing. Inflation, once it has gone on long enough, starts to develop momentum. Some of that is organic as we, wage slaves, start pressing for more compensation given our rising cost of living. And some of it is automatic: on the basis of this last year’s worth of inflation, Social Security benefits will rise 8.7% next year. That just caused a big increase in the deficit for next year and put more money into retirees’ pockets to spend on goods and services that are no more plentiful. While this isn’t technically a wage, the mechanism is very similar to other automatic wage adjustments, and this is where inflation gains and/or retains momentum.

Taking A Step Back

Last week’s inflation data cements a 75bps hike at the Fed’s next meeting. But they’re also closer to the end of the hikes than they are to the beginning—even if we don’t yet know where that is, exactly. Had we gotten this data when the Fed funds rate was at 1%, then further acceleration in tightening would be plausible. It’s hard to envision at this point.

Indeed, I think the Fed will start tapering its hiking soon unless inflation accelerates further. Some think the FOMC will keep hiking 75bps per meeting until inflation recedes. The Fed, though, has a notion of where they think the ‘neutral’ rate is, and they won’t hike rates arbitrarily high above it.

Remember, the Federal Reserve is the world’s largest employer of Economics PhDs. One thing they have faith in is models. I suspect that after this next hike, we will get 50bps at the next meeting and 25bps at the next after that, and then a pause.

If inflation is still rising at that point, they’ll keep with 25s or perhaps an extra 50bps first and then 25s, but they’ll start to back off. It’ll happen sooner if something breaks, as recently in the UK. UK’s pension debacle is a stark reminder to the Fed about why they don’t want to break things. Once they feel they are at least caught up to the inflation cycle, they’ll start to be more careful.

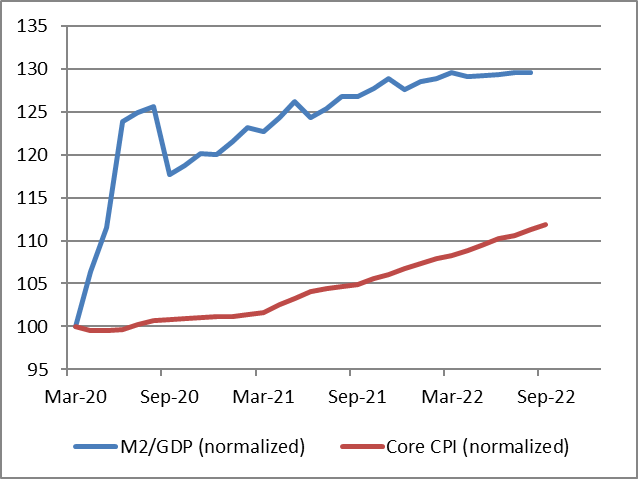

But where the rubber meets the road is still the balance sheet. Its reduction has a long way to go if we don’t want to see greater than 5% core CPI in 2023 and still in the 4% range for 2024. The price level is still catching up to the growth of money, as the chart below shows—and there is still a long way to go.

M2 GDP (Normalized), Core CPI

***

Disclosure: My company and/or funds and accounts we manage have positions in inflation-indexed bonds and various commodity and financial futures products and ETFs that may be mentioned from time to time in this column.

[ad_2]

Source link