Week Ahead: Investors Hoard Cash Amid Recession Fears

2022.10.10 11:57

[ad_1]

According to Bank of America, investors are holding on to more cash, saying the pace was the highest since April 2020 amid fears of a looming recession. That means stocks could fall further as they don’t fully reflect that risk.

Markets are likely to see new lows in October as the specter of recession weighs on corporate earnings, although had its best week since late June, and the short-rally could be continued till important resistance levels.

US stocks were starting to price in an economic contraction. Conversely, in Europe, equity outflows continued for a 34th straight week, the longest streak since 2016. Therefore, it’s so contrarian to be ‘’Bull’’ at this very moment due to the cheaper valuations of US stocks.

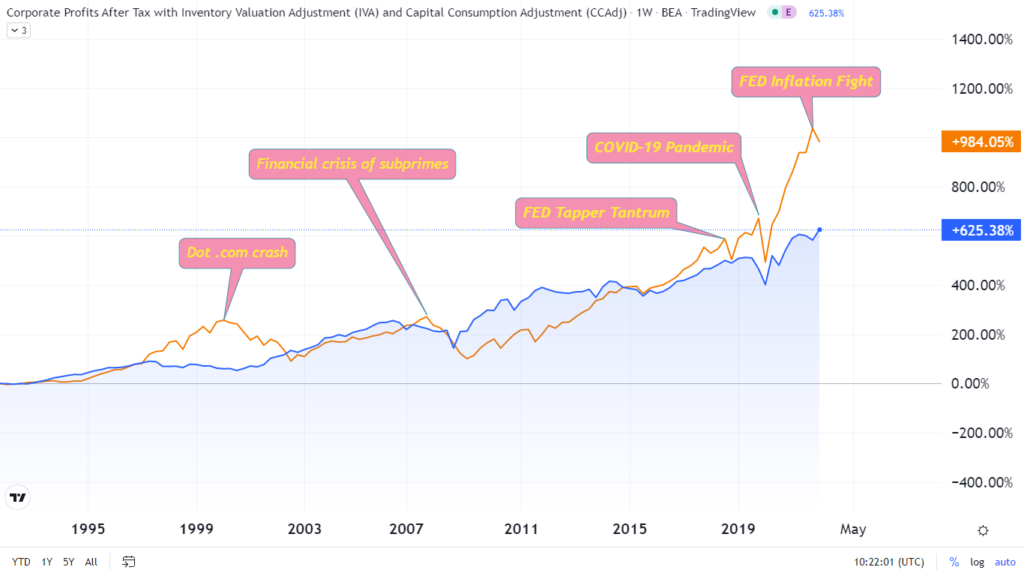

Why is that? Because the strong dollar puts the profit of US companies at risk and simultaneously undermines the Fed. Thus, as demand weakens globally and domestically, investors should not expect corporate earnings to remain near record levels. The current gap between corporate earnings and asset prices, or even better S&P 500, as you can see on the chart, is at its widest on record.

Current gap between corporate earnings and S&P 500.

Current gap between corporate earnings and S&P 500.

However, it’s not just commodity costs that are rising. International sales consist of 40% of revenue for S&P 500 companies, so with a strong dollar, these products become too costly for global consumers to purchase.

Fed is raising interest rates and shrinking its balance sheet to suppress economic activity to reduce inflationary pressures. The Fed’s rate hikes will work as expected and could lead to a controlled economic downturn. But this is just another ‘’hope’’ than a reasonable chance to be everything under control.

On a weekly basis, the S&P 500 gained 1,51%, 1,82%, only 0,62%, 2,82%, and finally 1,31%.

The Economic Calendar of the week has very interesting readings, such as for October, U.S NFIB for September, UK GDP MoM and YoY, UK for August, Eurozone for August, , US and for September.

Followed by the US API Crude Oil (weekly reading), for September, US CPI for September, U.S (weekly released), U.S (weekly release), US Fed Budget Balance, Eurozone for August, US for September, including the speaking of Mrs. Lagarde and Mr. Powel.

[ad_2]

Source link