Week Ahead: Investors Brace for NFP Amid Fed Rate Cut Speculation

2024.08.30 08:17

- Traders see a decent chance for a 50bps Fed cut in September

- Powell adds extra importance to jobs data, NFP awaited

- BoC decides on rates, third consecutive cut is fully priced in

- Aussie traders lock gaze on GDP numbers

Bets for Double Fed Cut Remain Elevated

Here comes another week, with investors eagerly awaiting the results as they try to discern the size and pace of the Fed’s forthcoming rate cuts.

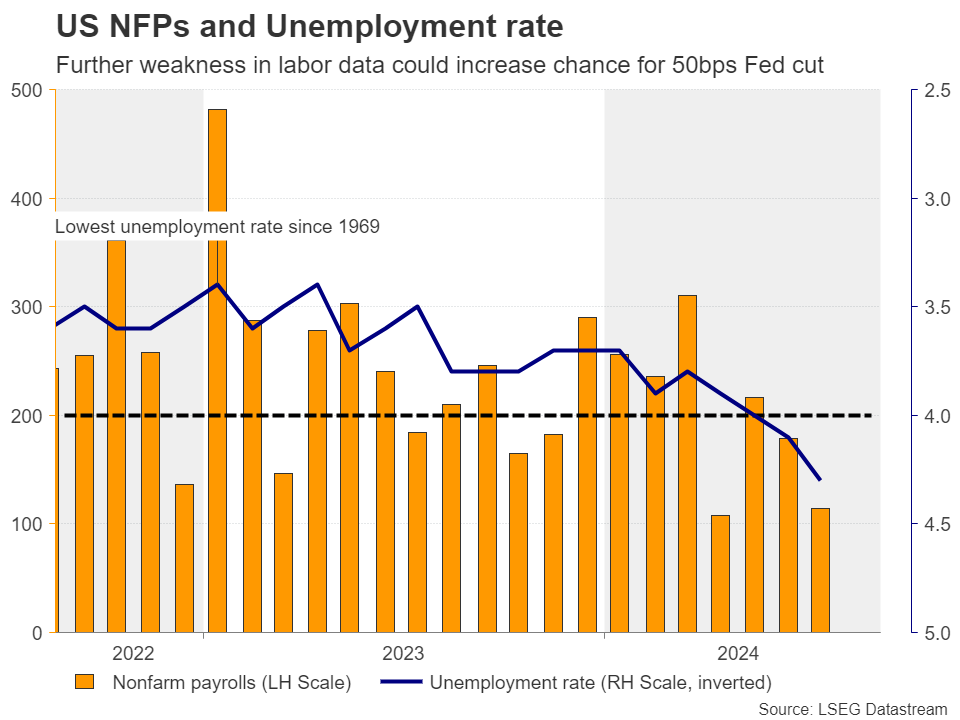

The weaker-than-expected July numbers triggered market turbulence, instilling fears about a potential recession in the US and prompting investors to price in around 125bps worth of Fed rate cuts by the end of the year.

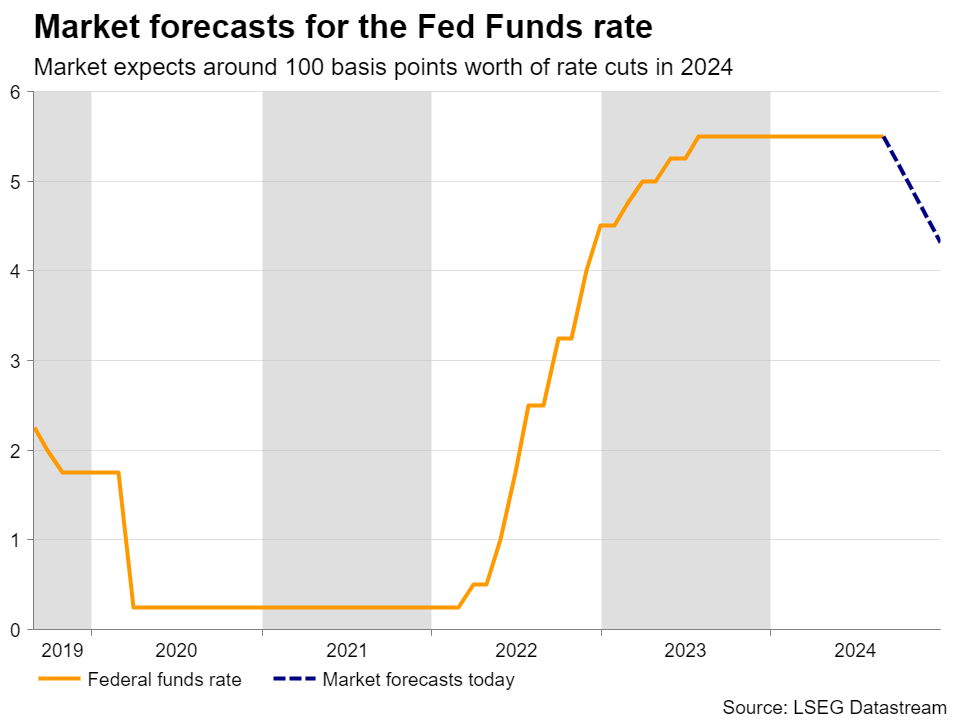

Nonetheless, subsequent data after the jobs report alleviated investors’ concerns, encouraging them to scale back their bets. That said, a dovish speech by Fed Chair Powell at Jackson Holec did not allow them to materially alter their dovish view. Investors are still expecting interest rates to end the year around 100bps below current levels, while penciling in a decent 35% chance for a 50bps reduction at the September 18 gathering.

Employment Data Take Center Stage

At Jackson Hole, Powell said that the “time has come for policy to adjust” and that the timing of rate cuts “will depend on incoming data”. He also placed extra emphasis on the labor market, saying that they would “not seek or welcome further cooling in labor market conditions.”

This makes next Friday’s nonfarm payrolls even more important as signs of further cooling may convince more traders that the Fed may start its easing cycle with a bold 50bps reduction. This could push Treasury yields lower and exert more pressure on the .

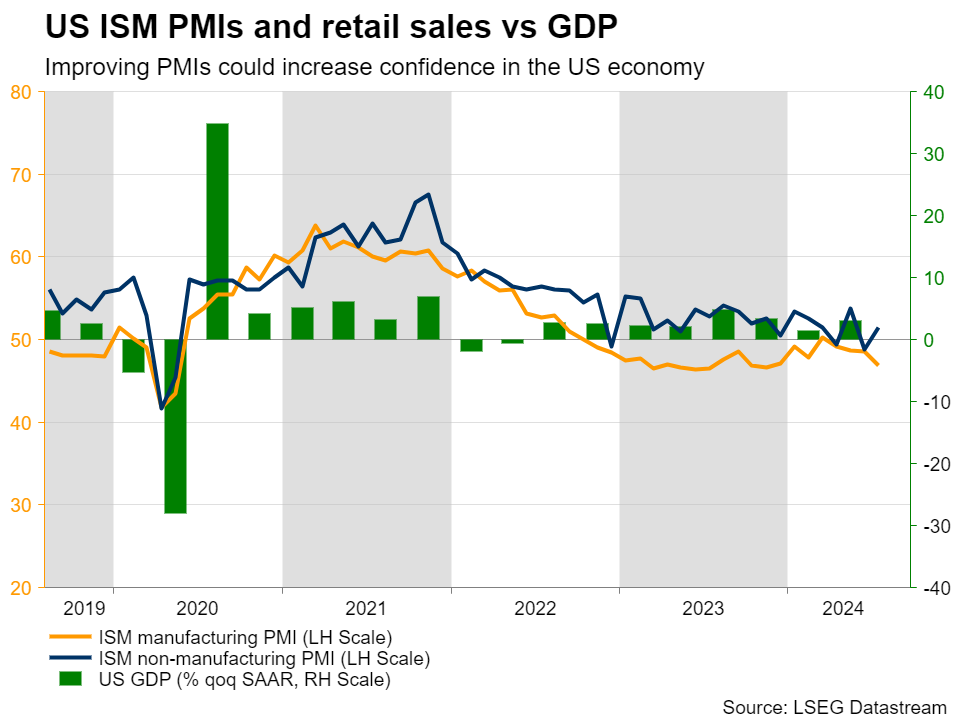

The question is: How will Wall Street react? Will another tepid employment report rekindle recession fears, or will equity investors cheer the prospect of even lower borrowing costs? Perhaps the answer lies on the outcome of the ISM manufacturing and non-manufacturing PMIs for August, due out on Tuesday and Thursday, respectively.

The Atlanta Fed GDPNow model estimates a respectable 2.0% real GDP growth for the third quarter, and if the ISM prints point to improving activity, investors may retain their confidence in the world’s largest economy, thereby increasing their risk exposure.

Market participants may get some information about the state of the labor market ahead of Friday’s NFPs. On Tuesday, the JOLTS job openings for July are due to be released, while on Thursday, the ADP employment report will be published. Thursday’s agenda also includes data on Nonfarm Productivity and Unit Labor Costs for Q2.

BoC Preparing for a Third Straight Cut

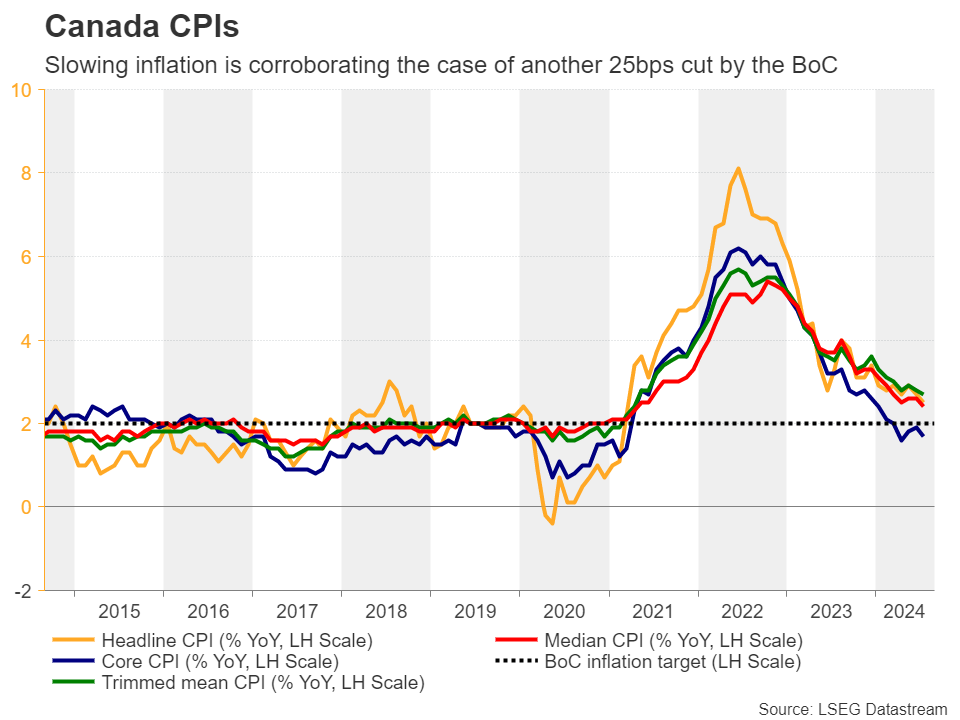

In neighboring Canada, the BoC is scheduled to announce its interest rate decision on Tuesday, with Canada’s overnight index swaps (OIS) suggesting that a third consecutive quarter-point cut is virtually assured. There is even a 15% chance of a more substantial 50bps cut.

At its July meeting, the BoC announced its second cut in a row, keeping the door wide open for more action in upcoming gatherings. Since then, the monthly GDP data revealed that the economy slowed in May from April and approached stagnation in June. The employment report revealed a greater loss of jobs in July compared to June, and, most importantly, inflation continued its downward trajectory.

The data justifies the expectation that the Bank will cut again at this gathering, suggesting also that policymakers will maintain a highly accommodative stance. The loonie may slide in such a case but considering that rate cuts have already been anticipated for each of the remaining meetings this year, the broader outlook for dollar/loonie is unlikely to change.

Due to its risk-sensitive nature, the loonie has recently been enjoying inflows, as risk appetite remains elevated in the face of aggressive Fed rate cut bets, and should the US data corroborate that view, the prevailing downtrend in may stay intact.

The Canadian jobs data are due to be released on Friday, at the same time with the US employment report.

Will Australia’s GDP Numbers Halt the Aussie’s Rally?

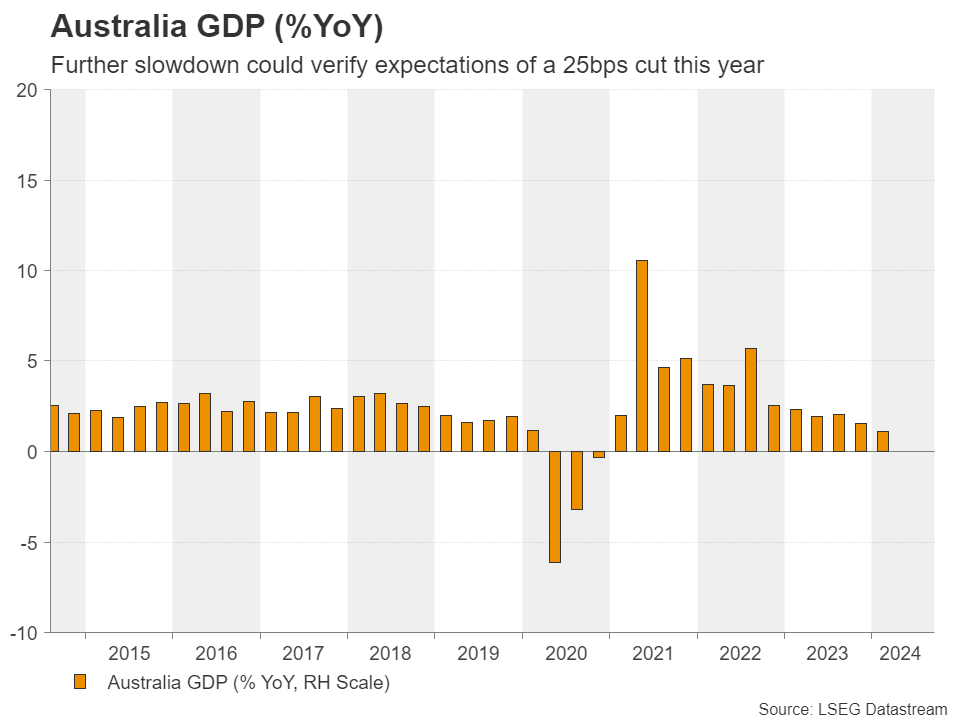

traders will also stay busy next week as apart from changes in the broader market sentiment, they will also have to digest Australia’s GDP data for Q2 on Wednesday, as well as China’s Caixin manufacturing and services PMIs on Monday and Wednesday.

When they last met, RBA policymakers decided to keep interest rates unchanged at 4.10%, adding that they remain willing to further tighten policy as inflation, although declining, remains elevated. Yet, the market is not penciling any additional rate hikes. On the contrary, traders are almost fully pricing in a 25bps cut by the end of the year and soft data may verify their view.

If so, the Aussie could give back a portion of its latest aggressive gains, but the fact that RBA expectations are way less dovish than other major central banks, combined with the broader risk appetite, may keep any GDP-related losses limited and short-lived.