Week Ahead: Inflation, Earnings in Focus as Market Looks Ahead to 2023

2023.01.08 13:50

[ad_1]

- December’s CPI expected to show slowing inflation

- Q4 2022 earnings season begins with large Wall Street banks reporting

- Markets continue to focus on “bad news is good, good news is bad” theme

- Fed Chair Powell to participate in panel discussion

- Balance between corporate earnings and inflation will be key driver for market in coming weeks

- This will be my last post on Investing.com

The Fundamentals

As we start the new year, the market is focusing on corporate earnings and inflation as critical drivers for the market. While inflation is expected to continue slowing in December, prices are moving up faster now than in recent years. This challenges consumers, investors, and the Federal Reserve as they navigate slowing but fast inflation. The December release on Thursday will be closely watched for signs of easing price pressures on consumers and companies.

In addition to the focus on inflation, Q4 2022 earnings season begins this week with many of the large Wall Street banks reporting, including Wells Fargo (NYSE:), Bank of America (NYSE:), JPMorgan Chase (NYSE:), BlackRock (NYSE:), and UnitedHealth Group (NYSE:). Investors will be interested to see how higher interest rates have impacted the performance of these banks, as the Federal Reserve has indicated that it will not cut rates in 2023. However, markets are currently pricing in a cut for Q4 of this year, as a potential recession may be on the horizon. While net interest margins and income may be positives for the banks, investment banking may remain challenging due to a lack of deals and listings.

Last week, markets continued to follow the theme of “bad news is good, good news is bad,” which has been present since the Fed began raising interest rates in March last year.

Fed Chair Jerome Powell will participate in a panel discussion this week, and the U.S. will release CPI data for December. Investors and the Federal Reserve will closely watch these events to see if the markets’ assumptions of a dovish Fed are correct. In addition, released last week showed the U.S. adding 223,000 new jobs to the economy in December and the falling to 3.5%. However, markets paid more attention to the decrease in , hoping for a slower pace of from the Fed. The combination of lower wage growth and a contracting services sector could allow the Fed to slow its pace of interest-rate increases at their next meeting on Feb 1.

The balance between corporate earnings and inflation will be necessary to watch as the market looks ahead in the coming weeks. While a slowdown in inflation may be welcomed, the potential for a recession and its impact on corporate profits remain concerns for investors.

The Technicals

Source: Investing.com

The may have blown out a , but it remains within its downtrend. Bulls have gotten excited with every rebound. Each time the price reached the channel top, I pointed out that each previous rally had ended there. Each time, bulls have ridiculed me. Since the last time I said it, the benchmark has fallen for five straight weeks, the longest losing streak since mid-May’s seven-week drop. The downtrend’s test will be the 200-week moving average, which bears could not break through in June, September, or October.

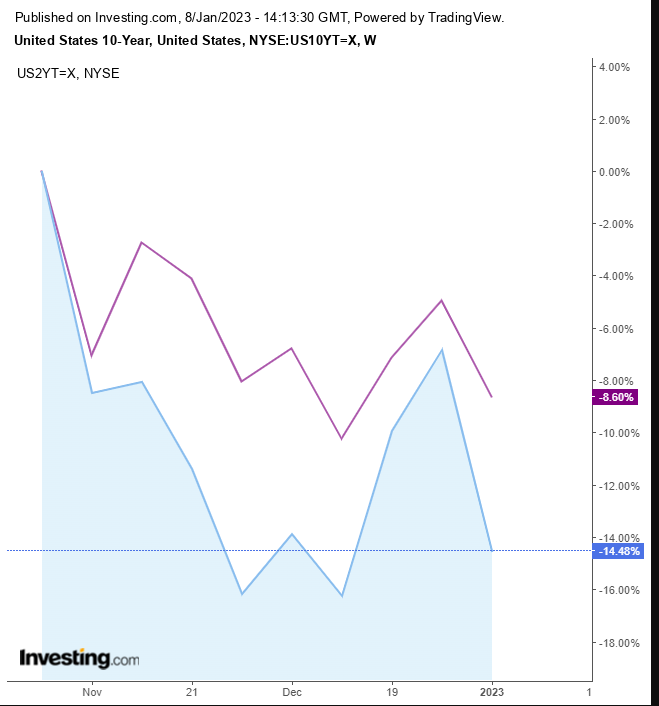

Bond-market bulls are taking advantage of the recent rally in shorter-dated Treasuries following the December jobs report, which showed slowing wage growth and a contraction in the service-sector economy. This has led to speculation that the Federal Reserve is approaching the end of its current rate-hiking cycle and may start easing monetary policy by the end of the year. The rally has narrowed the gap between shorter- and longer-term rates, known as a yield-curve inversion, often seen as a potential recession signal. However, it is uncertain whether the market’s recent moves will be sustained given the volatility in the market and the uncertainty surrounding the outlook.

In addition, there is a significant disagreement between the financial markets and Fed officials; the latter plan to continue raising rates until inflation approaches the central bank’s 2% target. Priya Misra, head of global rates strategy at TD Securities, told Bloomberg she believes the market is incorrect in anticipating a return to Fed rate cuts and said she expects the Fed to raise its key rate to around 5.5% and keep it there for the entire year. This could drive the 10-year yield even than the 2-year benchmark. If data shows that inflation is persistent and the economy remains strong, Treasury yields may rise further as the expected easing is removed from the market.

10-Year vs. 2-Year Weekly Chart

10-Year vs. 2-Year Weekly Chart

Source: Investing.com

Swap traders predict that the Fed will continue raising its benchmark rate until it reaches just under 5% in June before it is lowered to around 4.5% by the end of the year. This view may be challenged if the December consumer price index shows faster-than-expected inflation or if Fed officials, including Chair Powell, make public appearances. Some analysts believe that if the economy can handle higher rates and does not decline once the Fed finishes tightening, the long-term yields will return to normal as recession fears dissipate.

Dollar Index Weekly Chart

Dollar Index Weekly Chart

Source: Investing.com

The has been ranging for the sixth week, sinking into the 50-week MA. On the daily chart, the greenback registered a descending series of peaks and troughs, but it is still in an uptrend on the weekly chart. The price fell below the first uptrend line in late October while remaining above the uptrend line since May 2021 low. The weekly MAs are still bullish, each above a longer one, demonstrating that pricing remains healthier now than it had previously been. However, on the daily chart, the 50 DMA crossed last week below the 200 DMA, triggering a Death Cross. Still, the aforementioned range in the price may take out the sting for the dreaded technical event, as the signal is most potent when the price is moving. A fall below the following uptrend line will increase the bearish momentum.

Source: Investing.com

has closed at its highest levels since June 10, and the 50 DMA is inching toward a Golden Cross in a mirror image of the dollar’s Death Cross. On Dec. 12, I made a call and . The yellow metal is still on track.

languishes below $17,000, and has been ranging since Nov 9. A whole year ago, when BTC was near $43,000 and the consensus called “to the moon,” I predicted that the and, if so, that it would continue toward $0 – not necessarily $0, but toward it. I still maintain that position.

Oil traders are gauging the odds for recession, largely depending upon the Fed’s hawkish stance. Bulls hope China’s reopening economy will increase demand, boosting the price.

WTI Daily Chart

Source: Investing.com

On July 25, I wrote a second post about why . At the time, the price was above $95. Beware of the potential head-and-shoulders bottom. If the price makes a new low, it will extend the downtrend.

Goodbye!

This is my final post for Investing.com, bringing my article total to 2,383 in fewer than six years. I hope I gave as much I got – in terms of experience, that is. There have been some scuffles with readers, but it was all good fun, for me at least.

Let me leave you with this: Trading is not a get-quick-rich scheme. Every trade is demanding, and trading for a living is especially taxing. It requires capital and presence of mind, in addition to information and understanding. Trading is nothing more than managing your luck. You play the statistics. So please don’t give it a go unless you’re willing to give it a real shot, to get through the bad and get to the good trades. Take it as an educational experience. Happy trading!

P.S. I’m on social media.

***

Interested in finding your next great idea? InvestingPro+ gives you the chance to screen through 135K+ stocks to find the fastest growing or most undervalued stocks in the world, with professional data, tools, and insights. Learn More »

[ad_2]