Week Ahead – BoC to Speed Up Rate Cuts; Flash PMIs Eyed for Growth Clues

2024.10.18 11:38

- Bank of Canada meets; may opt for bigger 50-bps cut

- October flash PMIs to set the mood amid some growth concerns

- A relatively quiet week otherwise, with mostly second-tier releases

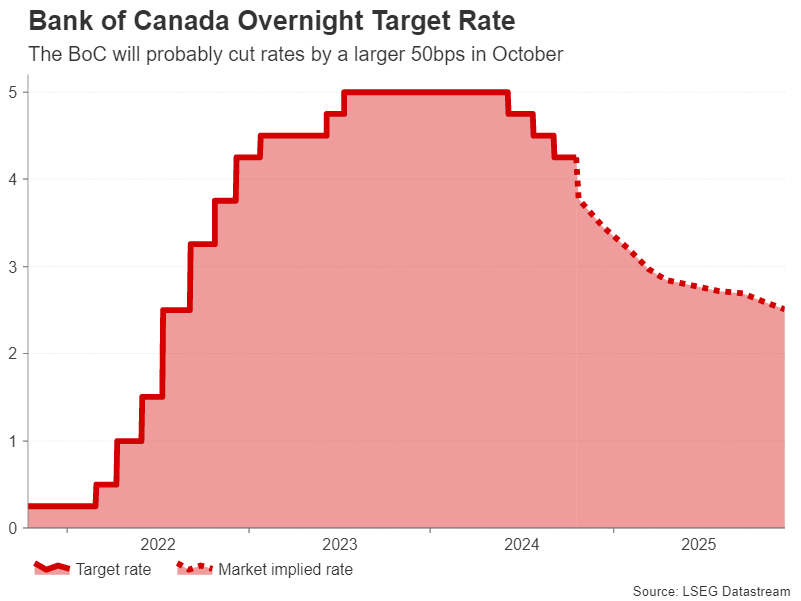

BoC to Likely Cut By Half a Point

Expectations that the will cut rates by 50 basis points at its October meeting firmed up after the latest CPI data.

Nevertheless, markets are not fully convinced of an outsized move, hence, there is a little bit of uncertainty heading into Wednesday’s decision by Canada’s central bank.

On the face of it, the Canadian economy is not in great shape. Growth has been sluggish at best since late 2022 and the jobless rate has jumped from a post-pandemic low of 4.8% to around 6.5%. More importantly, the Bank of Canada has seen great progress in getting inflation down, which fell to a 3½-year low of 1.6% in September.

Governor Tiff Macklem even signalled at the last meeting that policymakers are “prepared to take a bigger step”. Furthermore, the BoC’s own survey indicates businesses remain quite pessimistic amid weak demand.

Yet, there are signs that the worst may be over as GDP growth has been stronger this year and employment is rising again after two months of declines. Some investors were also disappointed that the underlying measures of inflation were flat in September. All this could be seen as limiting the scope for further 50-bps reductions in the overnight rate even if policymakers back one at their October gathering.

For the , any hawkish surprises could provide a much-needed boost as it’s depreciated by about 2.6% against the from its September peak. But a 50-bps cut is the most likely outcome even though it’s only 75% priced in. The loonie could therefore come under pressure if the expectations are confirmed.

But investors will also be on the lookout for any hints about future cuts. If Macklem keeps the door open to further 50-bps reductions, this would put the loonie at risk of a deeper bearish trend. However, if he sounds somewhat more upbeat about the outlook, investors might price out some rate cuts in the months ahead, potentially lifting the loonie.

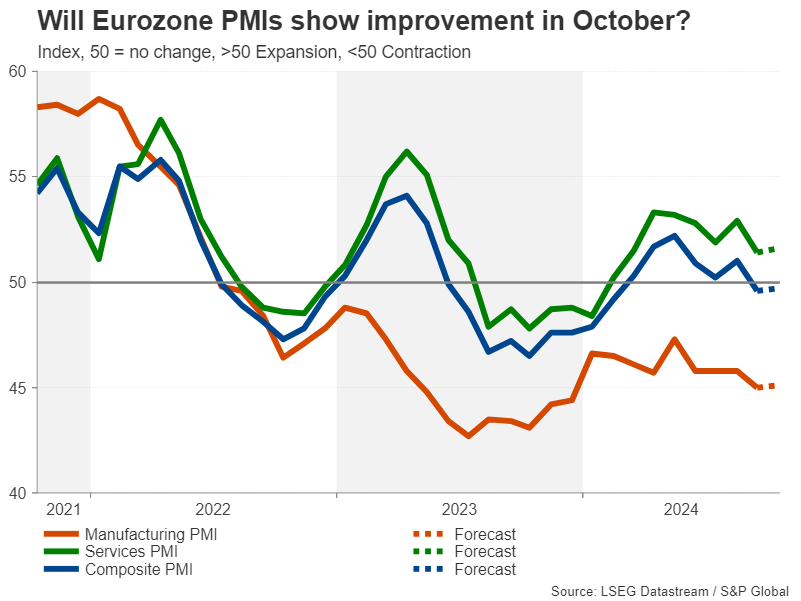

Will Eurozone PMIs Worsen the Euro’s Woes?

Last month’s PMI reports for the Eurozone were so bad that it prompted an about-turn by the European Central Bank on the likelihood of a back-to-back cut in October, having signalled the opposite at the September meeting. The ECB has now cut rates three times, totalling 75 bps, and more easing is on the way, as the risks to inflation and growth are tilted to the downside.

If the flash PMI numbers for October are equally disappointing, investors are sure to reinforce their bets of additional rate cuts over the coming months.

High interest rates have taken their toll on the Eurozone economy but as businesses start to feel the relief of lower borrowing costs, the block’s largest economies – France and Germany – are grappling with other issues. German manufacturers are struggling to stay competitive on the global stage, while weak demand in China is adding to their pain. In France, the political turmoil has created uncertainty for businesses.

On the bright side, German exports to China may get a boost from Beijing’s recently announced measures to support growth, while the political deadlock in France appears to have ended for now.

This may bode well for the outlook, but the present situation in Europe remains very worrying for policymakers. So unless Thursday’s PMIs offer a glimmer of hope that business confidence is returning, the euro is likely to remain on the backfoot. Traders will also be keeping an eye on Friday’s Ifo Business Climate out of Germany.

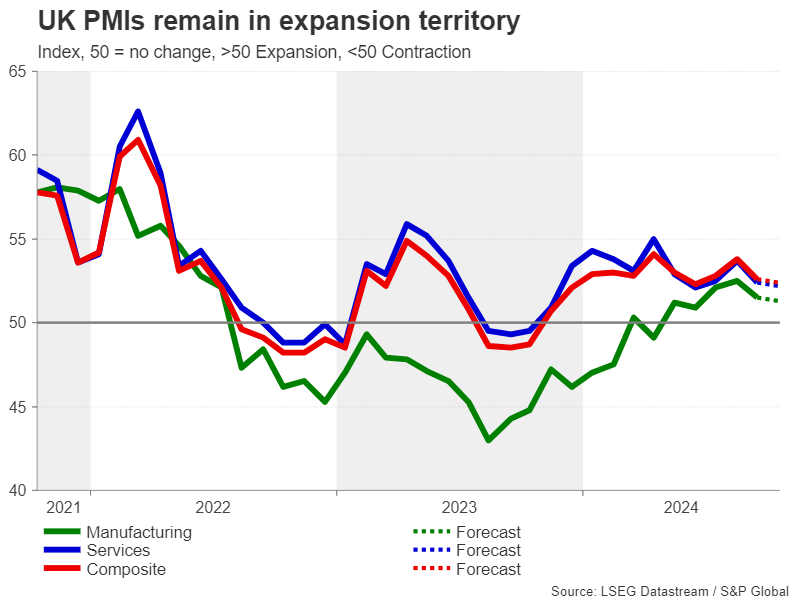

Pound May Find Some Support in UK PMIs

UK economic indicators have been somewhat mixed lately, but the picture is much clearer for inflation. Headline CPI fell below the Bank of England’s 2% target in September and there was a significant drop in services CPI too. Even if growth picks up momentum again, the BoE will almost certainly continue cutting rates.

However, the strength of the economy will still determine the pace of easing, and this is key for sterling as the Bank of England may not have to cut rates as many times as other major central banks if growth holds up, bolstering GBP crosses in the medium term.

Both the services and manufacturing PMIs ticked slightly lower in September but remained above 50. An improvement in October could help the pound recoup some of its recent losses on Thursday. But any rebound will struggle to go far with expectations high that the BoE will cut rates on November 7. The will also be paying close attention to Governor Bailey’s remarks as he is scheduled to make several appearances over the coming week.

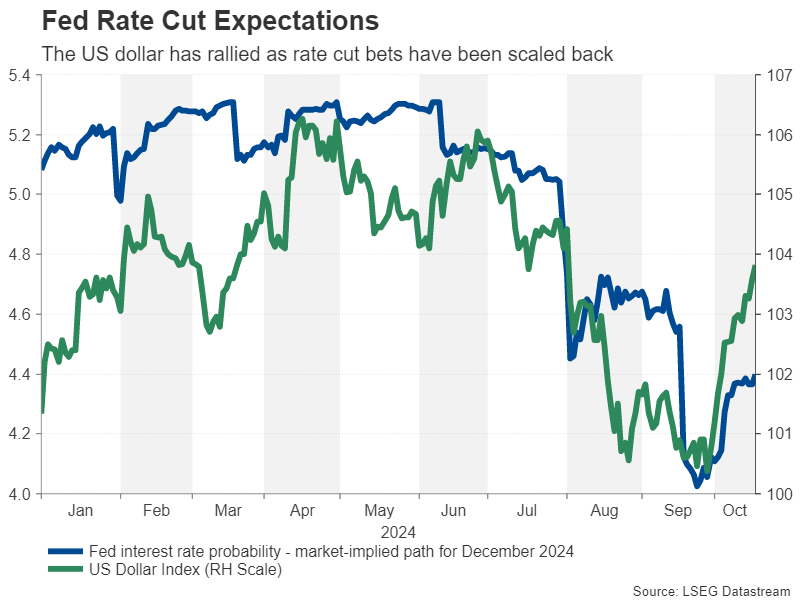

Another Light US Calendar Week

Over in the US, the flash PMIs will be vital too. Investors will be dissecting the details of the S&P Global survey to get a fresh update on employment conditions and price pressures across the services and manufacturing sectors.

The Fed is widely expected to trim rates again this year but following the recent run of upbeat data, not only has a 50-bps cut been priced out, but also a 25-bps reduction in both November and December is not seen as a done deal by some investors. If the PMIs extend the streak of upside surprises, the US dollar may climb to fresh highs against its peers as investors further scale back rate-cut bets.

However, with no big releases due until the last week of October, any reaction is likely to be modest, with traders probably more preoccupied with corporate earnings. Other data will include existing home sales on Wednesday, new home sales on Thursday and durable goods orders on Friday.