Week Ahead – A Decisive Week for USD with NFP and More; BoJ Meets

2024.10.25 17:40

The Federal Reserve’s surprise decision in September to cut rates by a larger-than-expected 50-basis-points seems like a distant memory now, as policymakers are once again sending out hawkish soundbites.

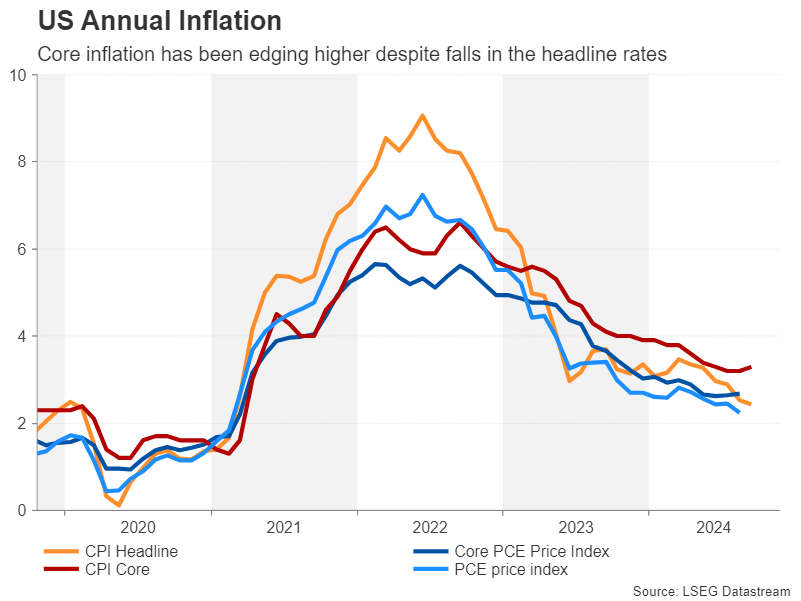

US economic indicators since the September meeting have been on the strong side, including the CPI report, with Fed officials cautioning that another 50-bps cut is unlikely in the near term. The sudden switch in the narrative from ‘hard landing’ to ‘soft landing’, or possibly even a ‘no landing’, has spurred a sharp reversal in Treasury yields, which in turn has pushed the US dollar higher.

With the Fed’s November policy decision fast approaching, next week’s data will serve as a timely update on the strength of the US economy as well as on inflation.

Slowdown, what slowdown?

Kicking things off are the October consumer confidence index and the JOLTS job openings for September on Tuesday. But the top-tier releases do not start until Wednesday when the first estimate of third quarter GDP is due.

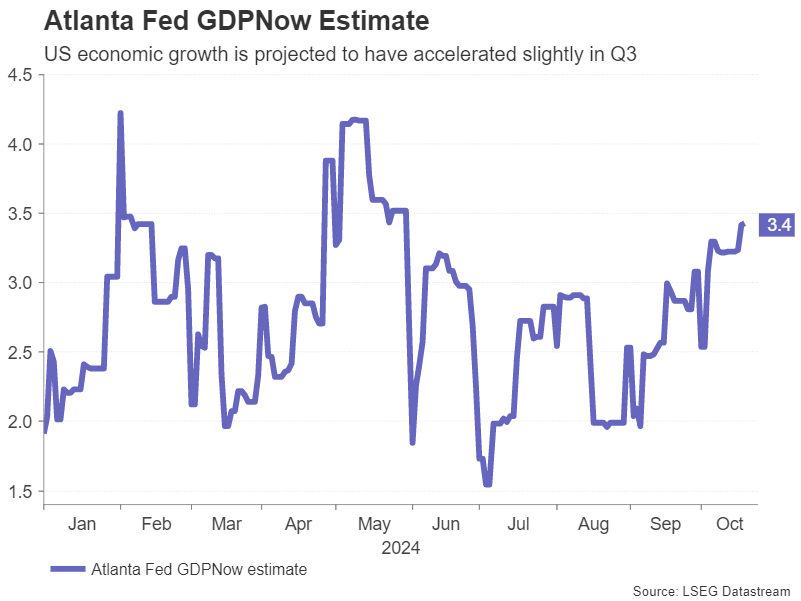

The US economy is expected to have expanded by an annualized rate of 3.0% in Q3, the same pace as in Q2. Not only is this above average growth but an upside surprise is more likely than a downside one as the Atlanta Fed’s GDPNow model puts the estimate at 3.4%.

Other data on Wednesday will include the ADP private employment report, which will provide an early glimpse into the labour market, and pending home sales.

Spotlight on PCE inflation after mixed CPI

Both the CPI and PCE measures of inflation show a divergence between the headline and core readings. The core PCE price index, which the Fed puts the most weight on in its decision making, ticked up to 2.7% y/y in August even as headline PCE eased to 2.2%. It’s likely that both prints stayed unchanged in September or fell slightly. Hence, the inflation numbers may not be particularly helpful for the Fed or investors.

Still, the personal income and consumption figures due the same day will offer additional clues for policymakers, while October Challenger Layoffs and the quarterly employment cost will be watched too.

NFP report may hold the cards

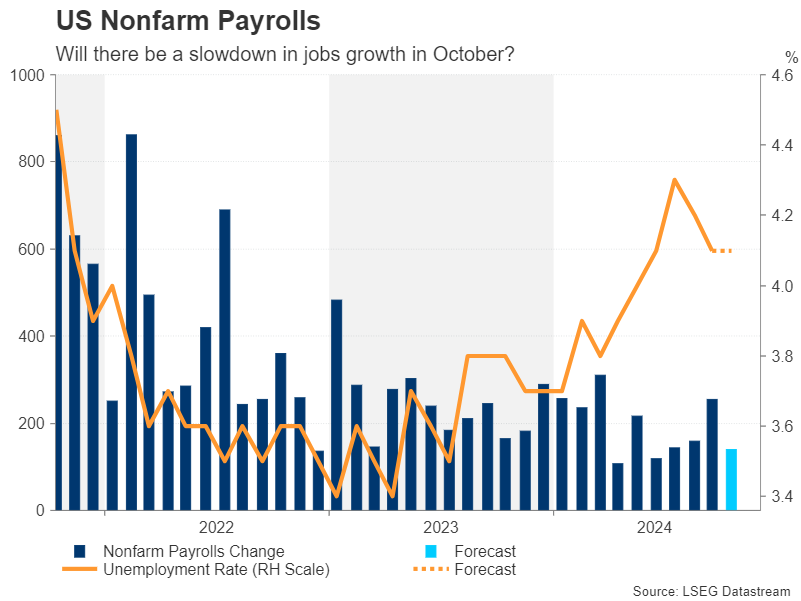

Finally on Friday, the week’s highlight – the October nonfarm payrolls report – will come to the fore. After a solid 254k rise in September, it’s projected that the US labour market created 140k new jobs in October, signalling a marked slowdown. Nevertheless, the unemployment rate is expected to have held at 4.1%, while average hourly earnings are forecast to have moderated slightly from 0.4% to 0.3% m/m.

Also important will be the ISM manufacturing PMI, which is expected to improve from 47.2 to 47.6 in October. With the Fed now more worried about the jobs market than inflation, soft payrolls could set the tone back to a more dovish one.

Can the US dollar extend its rebound?

Moreover, any signs that the American economy is cooling is likely to push up market bets of back-to-back rate cuts for the next few meetings. However, if growth remains robust and more significantly, PCE inflation points to some stickiness, rate cut bets will probably suffer a further blow.

At the moment, only one additional 25-bps reduction is fully priced in for 2024. If a rate cut in November starts to come into doubt, the US dollar could climb to fresh highs but stocks on Wall Street would probably come under selling pressure.

For the latter, however, a busy earnings week might keep the positive momentum going if results from Microsoft (NASDAQ:), Apple (NASDAQ:) and Amazon.com (NASDAQ:) don’t disappoint.

Bank of Japan expected to stand pat

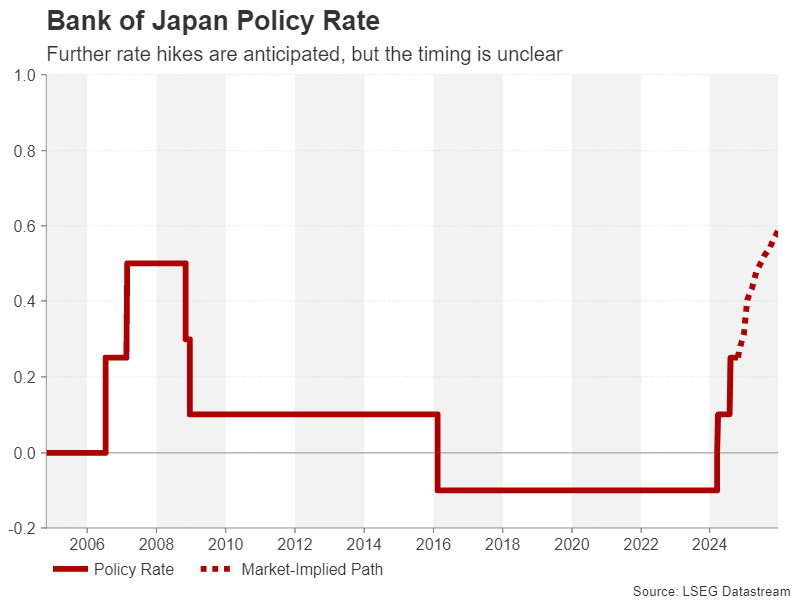

Twenty twenty-four was a turning point for the Bank of Japan’s decades-long fight against deflation. The BoJ abandoned its yield-curve control policy, halved its bond purchases, and raised borrowing costs twice, ending its policy of negative interest rates.

However, despite policymakers’ clear intention to continue the normalization of monetary policy and raise rates even higher, inflation appears to be settling around the BoJ’s 2.0% target, lessening the need for further tightening. The most recent commentary from Governor Ueda and other board members suggests a rate hike is not forthcoming on Thursday when the Bank announces its October decision.

But the updated outlook report with a fresh set of projections on inflation and growth should be quite insightful on the likelihood of a rate hike in December or during the first few months of 2025.

In the absence of any hints about a rate hike anytime soon, the yen will probably continue to struggle against the US dollar. Yet, a renewed weakness in the yen will only incentivize policymakers to hike sooner rather than later and this is a risk investors may be overlooking.

Also on the Japanese schedule are preliminary industrial output figures and retail sales figures for September, both due on Thursday.

Euro awaits flash GDP and CPI

The euro’s double top pattern against the greenback did not let down technical analysis enthusiasts and the pair recently brushed 16-week lows, falling below $1.08. Next week’s releases are unlikely to be of much help to the bulls.

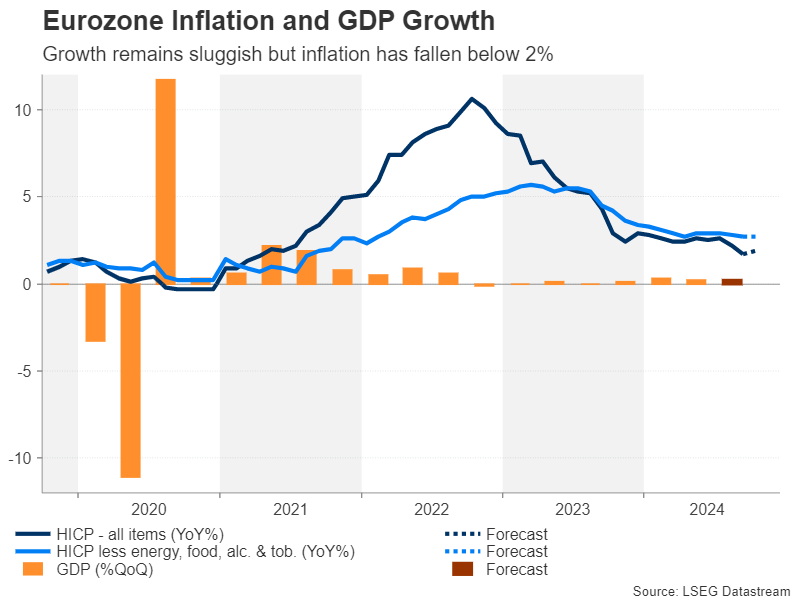

The flash estimate of GDP out on Wednesday is expected to show that the Eurozone economy eked out growth of just 0.2% q/q in the third quarter. On Thursday, attention will turn to the flash CPI readings. The headline rate probably edged up from 1.7% to 1.9% y/y in October, but the ECB is already forecasting a pickup in the coming months.

Nevertheless, stronger-than-expected data could provide the euro with some short-term relief following four consecutive weeks of losses. Alternatively, if the numbers disappoint, investors are sure to ramp up their bets of a 50-bps cut by the ECB in December.