“Weak Sisters Flushed” Stock Market…

2023.11.01 10:33

Slowly but surely we are getting all of the weak sisters flushed out of undervalued great companies – while they chase into overpriced momentum vehicles that are set up for a fall.

Despite the garden variety headline correction of 10% in the S&P 500, under the surface weak hands are getting flushed out of some of the best businesses in the world at clearance prices.

As I always say, “Wall Street is the only store in the world that when they mark down inventory at clearance sale prices, everyone runs OUT of the building!”

Let’s look at two examples:

1. PayPal (NASDAQ:)

Here’s a business trading down ~85% from its peak. These sellers are not stupid, but they may be overreacting from fear. What are they afraid of?

1. Declining margins.

2. Increased competition.

What should they (investors) be focused on?

BUSINESS: PayPal Holdings, Inc. operates a technology platform that enables digital and mobile payments by consumers and mer-chants throughout the world. It offers a wide range of payment solutions under the brands: PayPal, PayPal Credit, Venmo, Xoom, Paydiant, and Braintree. Has more than 435 million active users. In 2022, approximately 22.3 billion transactions were completed on its platform.

Paypal has gone from trading at 12x sales just 2 years ago to 2x sales today. It has fallen from an unrealistic ~87x earnings in 2021 to a bargain basement ~10x earnings today.

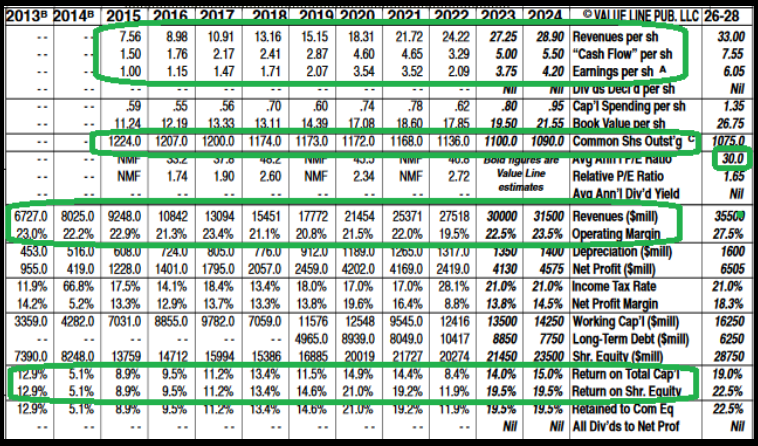

The “temporary impairment” realized in 2022 (when earnings and cashflow dipped) has since recovered back to trend (see above in green). The 5yr long term EPS growth rate is projected at 16.89% which implies a PEG (price to earnings growth) of just 0.59x. For general context 3x+ is expensive, 1x is cheap. This is what we call buying with a “margin of safety.”

The key when approaching these opportunities is:

Zero to minimal leverage. If you think you can pick the exact bottom tick after an 85% drop, you are in fantasy land. However, if you model out worst case, best case and trend assumptions over the next 3-5 years and estimate a fair value in the neighborhood of $150-200+, does it really matter if you buy it at $65 or $45?

Taking the lower case target of $150 over 36 months from present levels you wind up with a 41% IRR. This will likely outperform the S&P 500 by 4x. But in exchange for that benefit, can you sit through a possible short-term drop of 20-30% from forced sellers who were on leverage and are getting liquidated at the bottom? It depends whether you know what you own. The sad fact is MOST market participants are buying this (short term fluctuations – known as the “VOTING MACHINE”) PRICE:

When they should be buying this (long-term fundamentals – known as the “WEIGHING MACHINE”) CASHFLOW:

Since PayPal’s 2015 spinout from EBAY it has generated $29B of free cash flow. They have used $19B to buy back stock.

Paypal will generate a record $5B of free cashflow in 2023 alone. To put that in perspective, they could take the entire company private in a decade or less!

Additional catalyst:

Always bet on the jockey.

Effective as of September 27th, Alex Chriss assumed the roles of President and CEO, succeeding Dan Schulman, who will remain on the board until May of 2024.

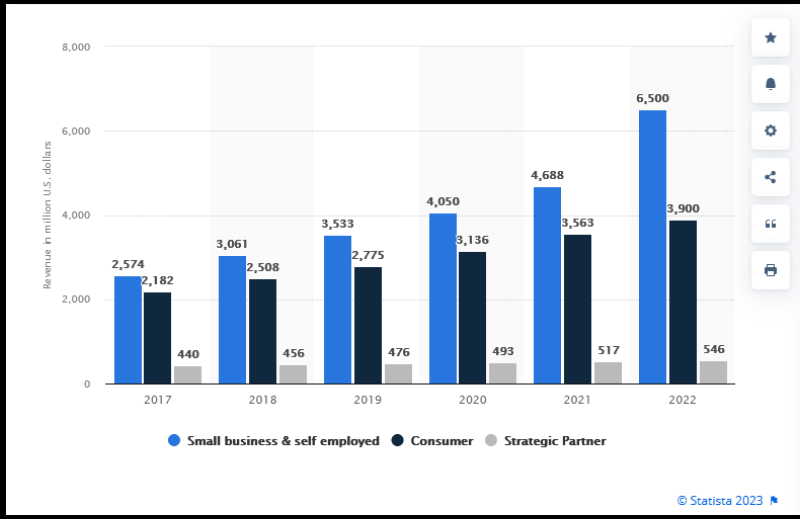

Chriss came from Intuit (NASDAQ:) where he ran the Small Business and Self Employment group [from 2017 forward – which represented the majority of revenues for the company (see blue lines below)]:

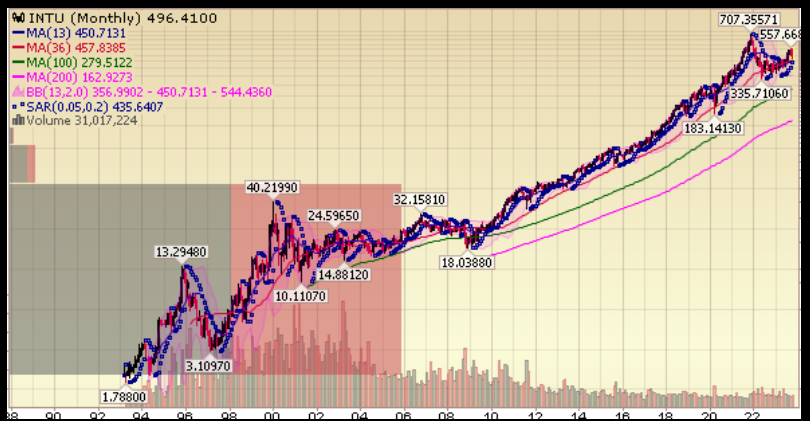

Here were his key roles at the company from 2008-2023 when the company peaked at a 38x – bagger ($18 to $707):

If anyone understands small business, growth, acquisitions and how to manage/perform to Wall Street expectations it is Alex Chriss.

But please, be my guest and sell it in the hole on the next $5 pullback!

But when you do, just ask yourself, “who is buying from me at these levels?”

2. VF Corp (NYSE:).

Last night, VF Corp’s new CEO did what most brand new CEOs do when they come into a turnaround situation – book a “kitchen sink” quarter. Take all losses at once, release all the bad news, cut the dividend and lower expectations so that everything moving forward is GOOD NEWS!

That’s exactly what Bracken Darrell did last night.

While VF Corp actually BEAT on the top-line and came within shooting distance on the bottom line, they took all of their medicine at once by cutting the dividend 70% and pulling guidance. WFC (Wells Fargo (NYSE:)) did this in 2020 before it doubled, VNO (Vornado) did it earlier this year before taking off from the low teens, and most recently DIS (Disney) did it as a new activist (Nelson Peltz) entered the fray. It’s always darkest before dawn…

In his interview with Jim Cramer last night Darrell laid out a clear 4 point plan to return the company to greatness. This is a spectacular interview:

They will achieve part of the deleveraging by selling off their “packs” business that consists of consist of Eastpak, JanSport and Kipling.

To put this “disaster” in context, revenues are down 2% (fundamentals). The stock on the other hand is down 85% (price)!

The last turnaround Bracken Darrell was responsible for was Logitech (NASDAQ:). Under his tenure, the stock went from $5 to $130 (peak 26x bagger).

Bracken started at Logitech in 2013. Here’s what happened next:

Of note, Logitech’s stock was down ~82% from its 2007 peak when he took over in 2013.

But please, be my guest and sell it in the hole on the next $2 pullback!

But when you do, just ask yourself, “who is buying from me at these levels?”

We’ll be back next week at our normal time and place with plenty to cover on general market outlook, Cooper Standard earnings/strike resolution and more…

Until then…

This content was originally published on Hedgefundtips.com.