Weak Chinese Data Pushes Risk Assets Lower

2023.05.31 05:42

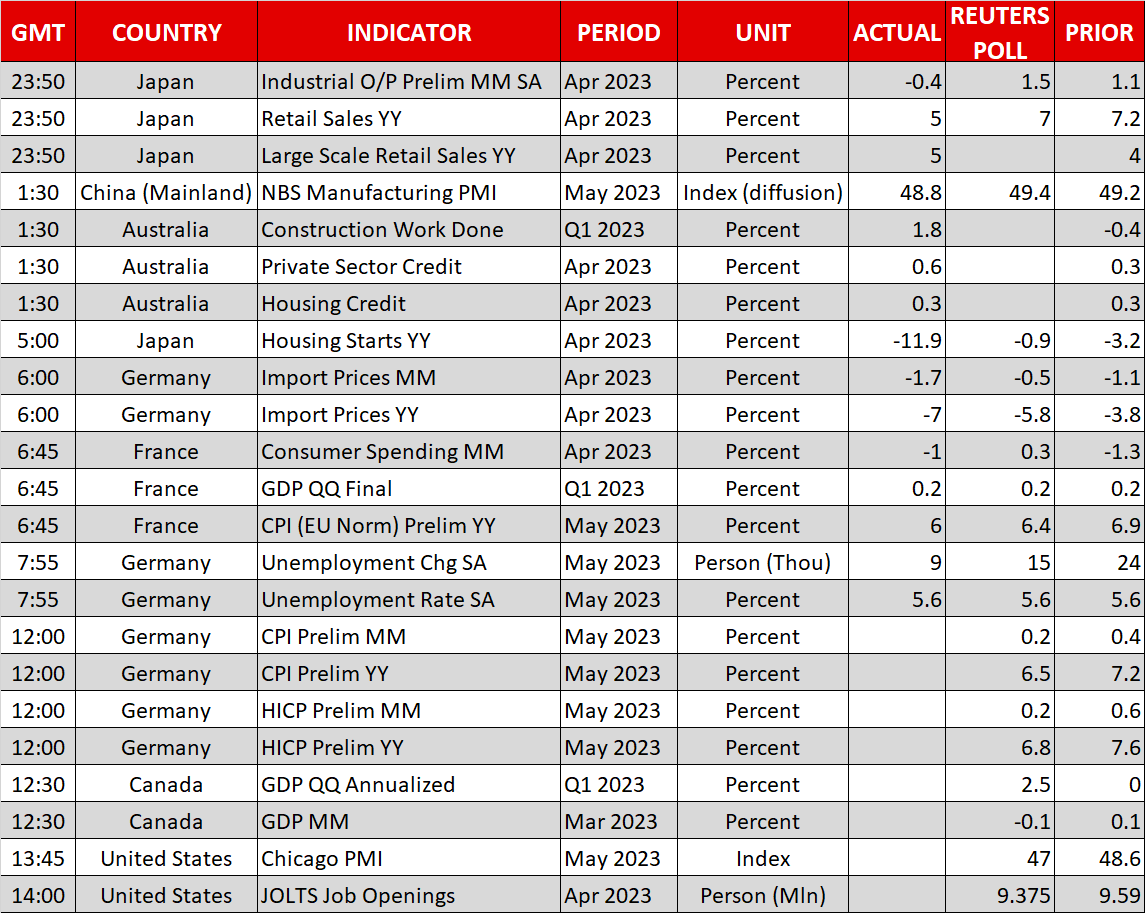

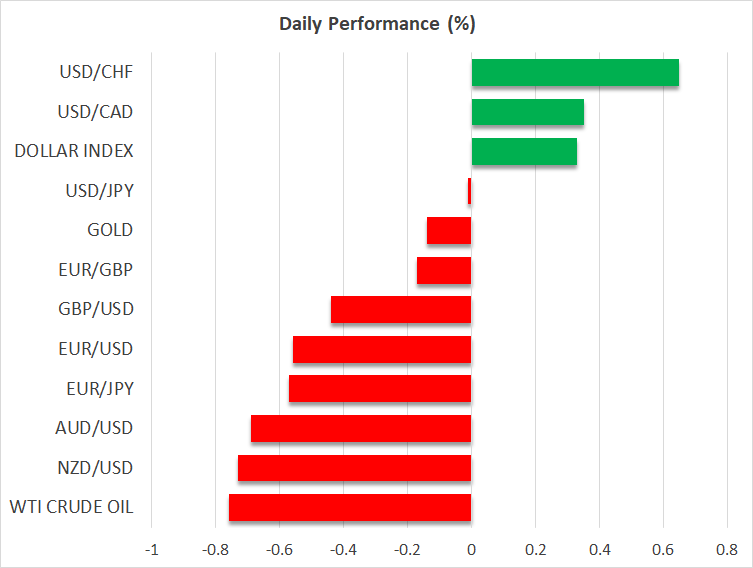

- China PMIs disappoint, dragging down risk-sensitive currencies

- Yen recovers, helped by safe-haven flows and Tokyo FX warning

- Euro turns to German inflation data, tech stocks close stellar month

Chinese business surveys miss estimates

Global markets woke up in a foul mood on Wednesday, following some disappointing data from the world’s second-largest economy. China’s manufacturing sector fell deeper into contraction in May, while services growth also lost steam according to the latest batch of business surveys.

It’s clear that the reopening boom has started to fade, piling more pressure on Chinese authorities to juice up economic activity by rolling out fresh stimulus measures. The drawback is that with private debt levels sitting at almost 300% of GDP, further stimulus can also amplify financial stability risks, making it a double-edged sword.

Investors responded by dumping the currencies of nations that rely on China to absorb their commodity exports, with both the Australian and the New Zealand dollars sinking to their lowest levels in over six months. Asian equities caught the blues too, pulling shares in Hong Kong down by 2.5% to enter a new bear market.

The silver lining in all this is that China will continue exporting factory-gate deflation to the rest of the world for a while longer, helping central bankers in America and Europe bring inflation under control faster.

Euro slides, yen shines

In euro land, the single currency is under heavy fire. The post-pandemic manufacturing hangover has pushed Germany into a technical recession, dampening economic growth. Meanwhile, inflationary pressures are cooling rapidly as demonstrated by the numbers from Spain and France this week.

Combined, these developments make it difficult for the ECB to live up to the market pricing and deliver another two quarter-point rate increases this summer. If the German inflation stats validate this notion today, traders could unwind more rate-hike bets or bring forward the timeline for rate cuts, keeping the euro on the retreat.

In an environment characterised by global growth risks and risk aversion, it was the yen’s turn to shine. The Japanese currency is back on the offensive, capitalising on a decline in global bond yields and a warning shot from officials in Tokyo that FX intervention is still on the table if things get out of hand.

In reality, the likelihood of another round of FX intervention is quite low as the recent moves have not been fast or sharp enough to warrant such extreme action. Instead, these verbal warnings are probably a cost-free strategy from Japanese authorities to flush out speculators betting on heavy yen losses, in essence ‘talking up’ the currency.

Dollar keeps going, tech closes stunning month

Staying in the FX arena, the dollar has been one of the main beneficiaries of the troubles in the euro and China-sensitive currencies. The is currently testing its recent highs, with safe-haven flows helping to fuel the advance. Looking ahead, there is a barrage of Fed speakers on the schedule for today, alongside the latest JOLTS report.

Crossing into the stock market, the month is about to close with sensational gains for tech shares, mostly thanks to the AI mania. What is striking is that the negative relationship between the tech-heavy Nasdaq and bond yields vanished earlier this month, with both advancing in tandem.

Hence, interest rates are no longer the dominant force behind moves in tech stocks, and since earnings have been pretty much flat, it seems that liquidity flows are in the driver’s seat. This suggests the stunning rally in risk assets might be approaching its finale, as the Treasury is set to siphon liquidity out of financial markets this summer to replenish its cash levels after the debt ceiling is lifted.