Warning: Inflation Could Resurface Despite Recent Progress

2023.07.14 03:28

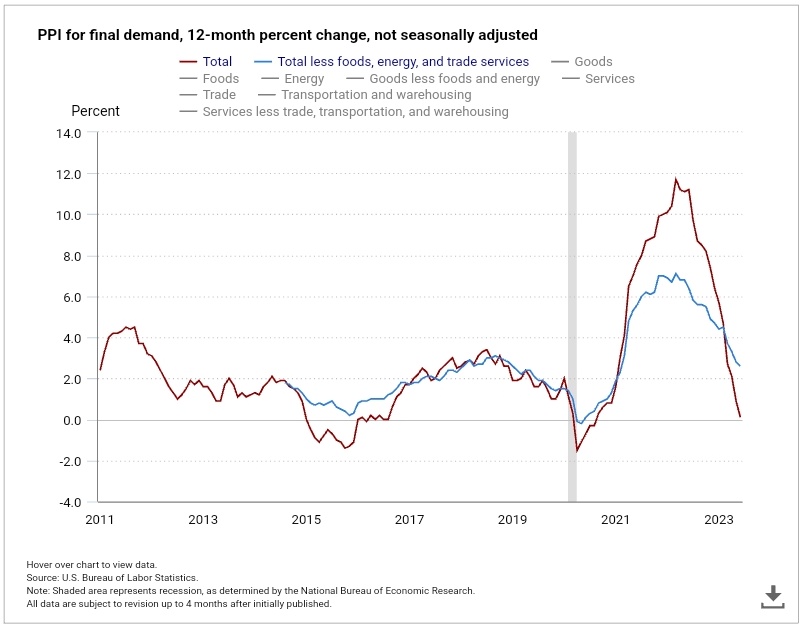

I wish I could say that the clearly impressive trend from the peak until now in and is sustainable.

However, I am more inclined to say “trough” with more chance of rising inflation numbers going forward rather than the chance of inflation falling further.

Here are some of the top reasons why:

- increase in the UK: Highest rate since records began in 2001.

- Canada: High inflation expected until 2025 because of higher demand, upward revision to housing prices, and higher imported goods prices.

- Geopolitics: Russia, China, North Korea, Israel – Jeffrey Sachs says that geopolitical risks are the biggest threat to companies’ bottom lines. He also says that China and the US are straining the supply chain.

- Weather issues El Nino: Gulf of Mexico temps soared-highest on record for this time of year. The headline in the WP- Flooding, extreme heat waves, and hot oceans will continue — and get worse.

- Supply chain strikes: potash shortages due to Port of Vancouver strike

- Grain prices: Will Russia extend the UN-brokered deal to allow the flow of grain from Ukraine? Food exports are dwindling, esp. to the poorest nations.

- and : Time to watch the ratio between the two precious metals and the relationship between and GLD (NYSE:)

- Cocoa at 14-year highs, Rice-highest price in 2 years due to drought in China and a holdback of exports from India

- : SRP is at its lowest levels since, 1983-leaving little room for the US to increase supply if prices continue to ascend.

We like to let the charts be our guide. Here are a few relevant ones.

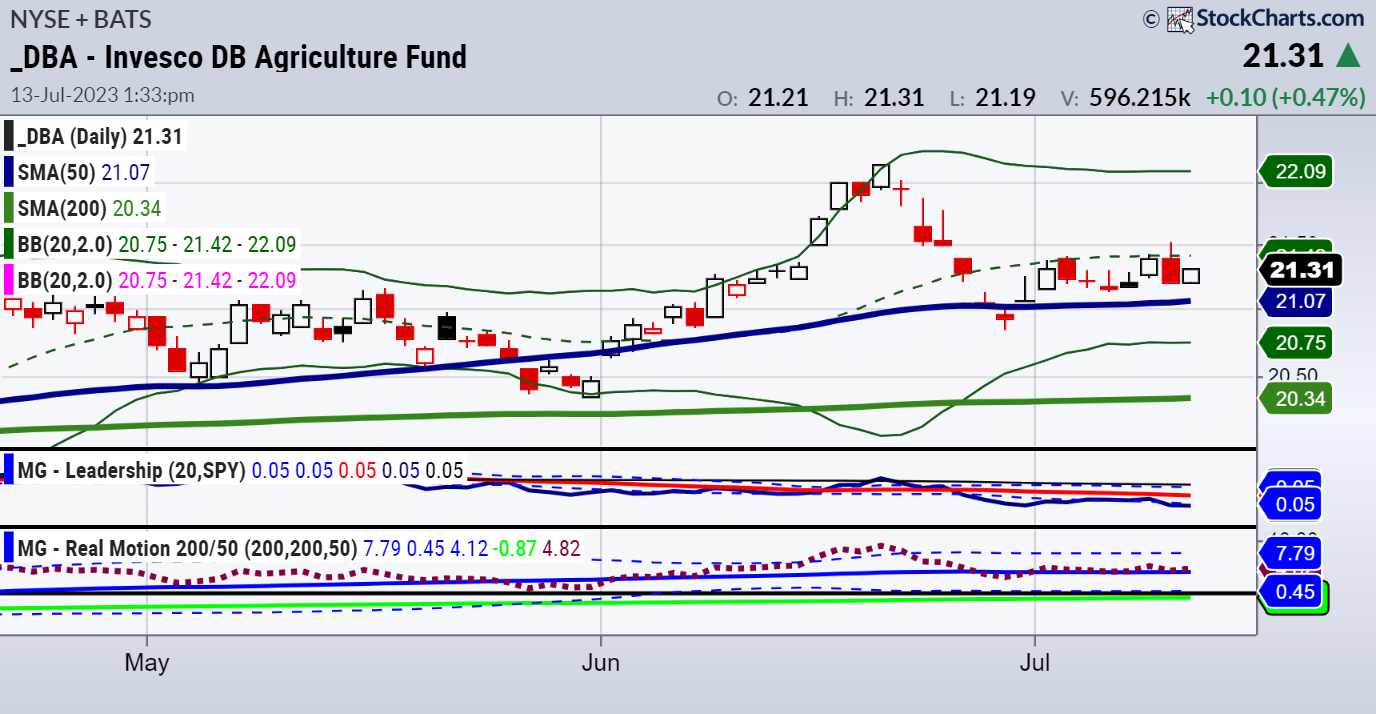

Invesco DB Agriculture Fund (NYSE:) is the ETF for many grain and soft commodities. In a bullish phase, underperforming the SPY and momentum is flat at this point, not flashing any major concerns as a whole ETF basket. But not to be ignored either.

GLD ETF is testing a potential return to a bullish phase if clears the 50-DMA. On par in performance or leadership with the SPY. Momentum is in a bit of a bearish divergence versus price. Should GLD start to outperform SPY, the first real sign of risk off and potential spike in inflation?

Silver and Silver to Gold Ratio. Most interesting and alarming of the 3 charts. Price confirms SLV is back in an uptrend. And the Leadership clearly shows iShares Silver Trust (NYSE:) outperforming GLD, which, if sustains, is a huge warning of inflationary factors ahead. Momentum in our Real Motion indicator is also in a bull phase, with momentum on the rise.

We love a good re-set. Next week the July 6-month calendar range will do just that. We will have a range to look at which, after this month’s moves thus far, should be really interesting to see.

Which instruments will break out or down, and which will stay trading between the top and bottom of the range?

ETF Summary

- (SPY) 450 pivotal

- Russell 2000 (IWM) Through the 23-month MA-can it hold?

- Dow (DIA) 34,000 pivotal

- Nasdaq (QQQ) Do I hear 404?

- Regional banks (KRE) 42.00-44.00 range

- Semiconductors (SMH) Wonder Woman is back!

- Transportation (IYT) After an unchanged close yesterday, now an inside day

- Biotechnology (IBB) 121-130 range

- Retail (XRT) closed red-second day in a row-barometer?