Wall Street Week Ahead: Jobs Report Signals Cautious Fed Ahead of Key US CPI Data

2024.10.07 03:17

- Strong US jobs report shifts Fed rate cut expectations from 50 bps to 25 bps.

- Geopolitical tensions in the Middle East drive up oil prices and safe-haven assets.

- Upcoming US inflation data and RBNZ rate decision in focus for the week ahead.

- Oil prices surge on Middle East tensions, with key support and resistance levels identified.

Week in Review: Strong Jobs Report Support Fed Narrative of 25 bps Cut

What a difference a week can make. It seems just yesterday that market participants were a 50 bps rate cut at the Feds November meeting and the appeared to be teetering on the brink. However, renewed geopolitical risk and a blockbuster jobs report have left markets with a few new angles to consider heading into the new week.

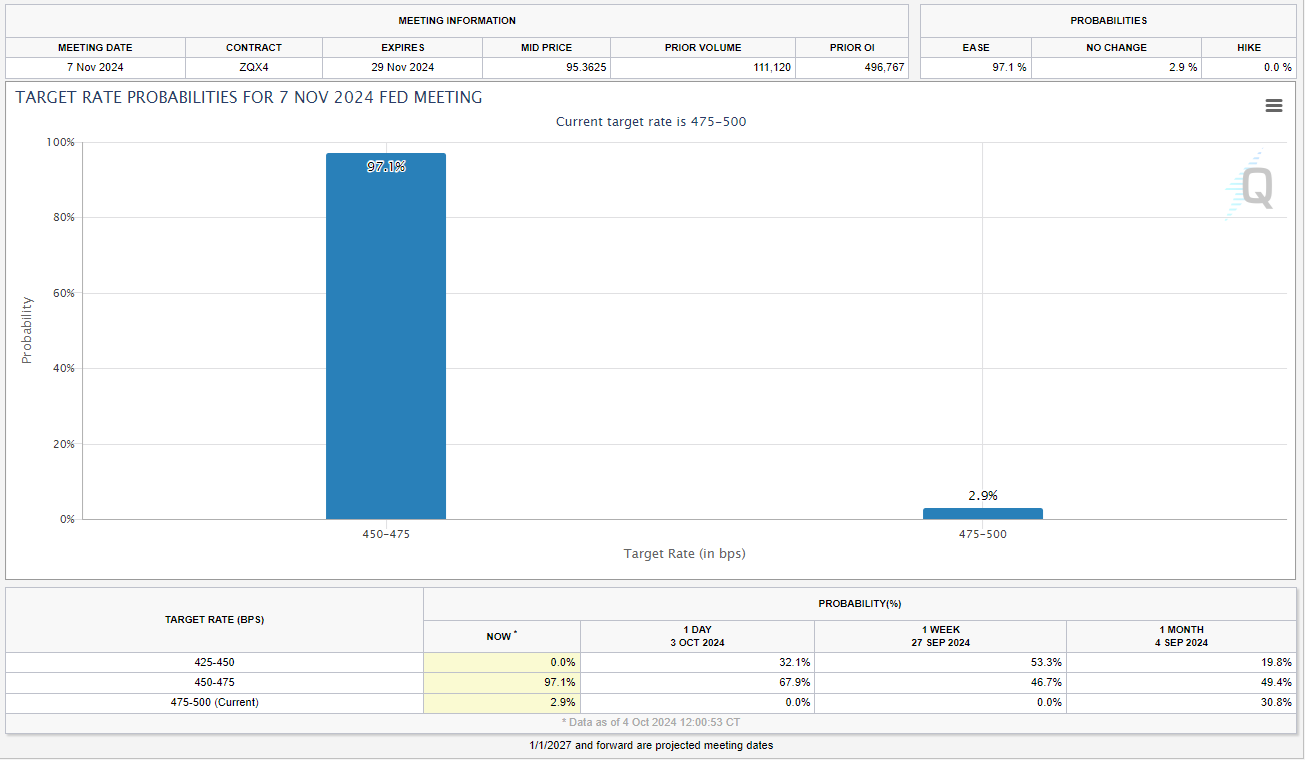

Markets have all but priced out a 50 bps cut in November with a 97% chance of a 25 bps cut. This is a remarkable change from 7 days ago when markets were pricing in a 50 bps cut at around 60%.

Source: CME FedWatch Tool

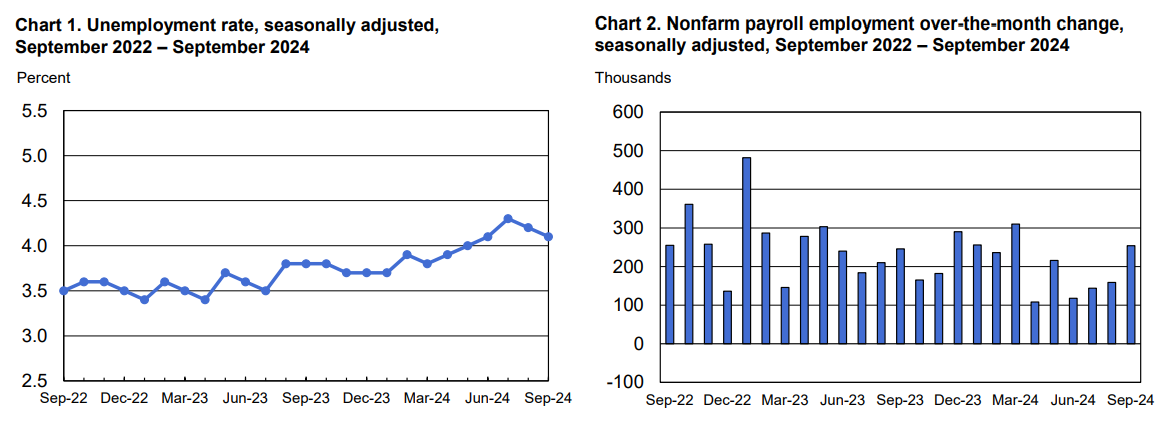

The US showed exceptional strength across all areas—job creation, unemployment, wages, and hours worked. However, caution remains due to the absence of supporting data.

Inflation is on the right path as well but as Fed policymaker Goolsbee stated “powell’s message that there are balanced risks is wise”. Goolsbee also warned that external factors have derailed many soft landings in the past.

Source: BLS

Now of course the next major market-moving event this week was geopolitical risks. We are starting to see a return of the risk premium and safe haven flows in markets following Iran’s strike against Israel this week raised the alarm of a wider Middle East war. prices were the largest beneficiary in this regard, rallying some 9.7% for the week.

, , and the also benefited in varying degrees from the safe haven appeal and demand created after the event. This is something that needs to be monitored as Israel has promised to retaliate and has even threatened Iran’s Oil production. This definitely spooked markets and led to the surge in Oil prices as markets look and ponder the effects on oil supplies of a wider regional war.

US Stocks also finished the week on a high following the jobs data. The and the started the week with losses before finishing the week strong, trading almost flat at the time of writing. Emerging markets however came under renewed pressure this week as risk sentiment soured from a geopolitical risk perspective.

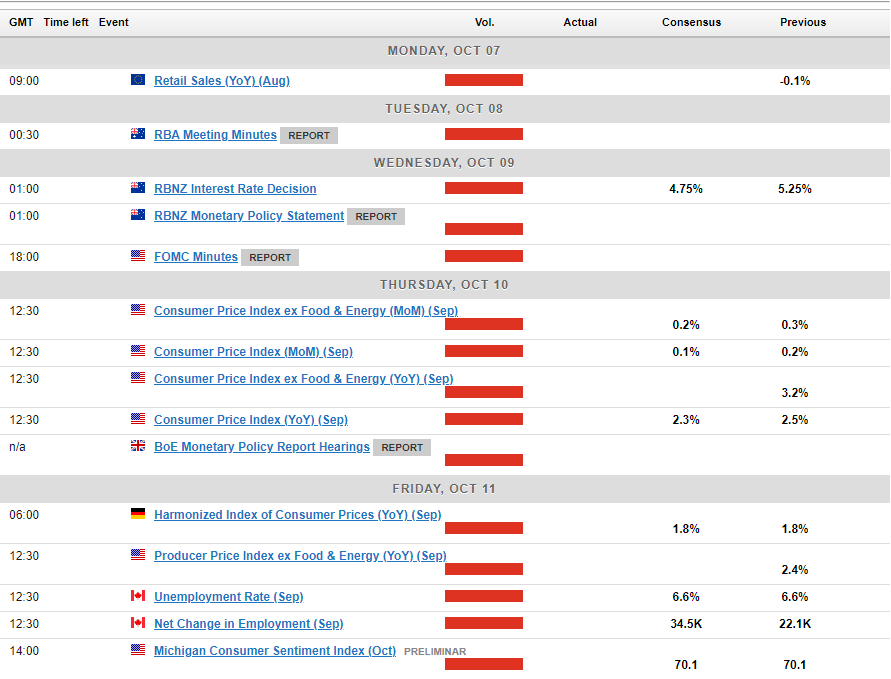

The Week Ahead: US Inflation and RBNZ Rate Decision

The week ahead sees high-impact data take a bit of a breather but we do have a lot of risks to navigate nonetheless. The most pertinent of which is the geopolitical risk which hangs in the balance as the weekend approaches. Various scenarios could develop on this front next week with Oil being the major asset which could be directly affected.

US inflation data may be due but it does not hold the same weight as it did a few months ago. However, following the strong wage numbers and the job report today, markets may pay a lot more attention to this week’s print to ensure an uptick in inflation isn’t on the way.

Asia Pacific Markets

In Asia, data is sparse from the major economies with China and Japan not releasing any high-impact data this week. China’s data calendar is relatively quiet for the upcoming week, as the country resumes work next Tuesday following the Golden Week holiday. We can expect some data on holiday travel and consumption, along with possible updates on the stimulus rollout as the week unfolds.

The New Zealand interest rate decision will be at the forefront of Asia Pacific data releases this week. Investors are confident that the RBNZ will reduce interest rates by 50bps next week, followed by another 50 bps in November. This suggests that the risks for the might lean towards the upside. If officials implement a double cut and indicate further aggressive easing, it would merely confirm market expectations, making significant depreciation of the kiwi unlikely.

Europe + UK + US

In developed markets, the Euro Area gets a break in terms of data releases whereas the UK releases GDP data on Friday. Besides that it will be a quiet week from both Europe and the UK.

The US will get the attention once more with US inflation and FED minute releases. There is also a host of Fed speakers which could give more insight to the FED policymaker’s thinking heading toward the November interest rate meeting.

Preliminary S&P Global PMIs indicate that prices charged by businesses increased at the quickest pace in six months. While the ISM manufacturing survey showed a decline, the non-manufacturing report supported the idea of rising price pressures. This coupled with wage data this week and improving unemployment does hint at the fact that resurgent price pressures may rear their head once more.

Chart of the Week

This week’s focus is on Oil following the commodity recording its best weekly gain in nearly two years.

The rising tensions in the Middle East have led to a host of risks both from a supply and demand perspective. Iraqi militias who are seen as Iranian proxies just yesterday threatened global energy and Oil supplies should any attack take place on Iran. There is also the risk that a wider regional war could result in Iran potentially shutting down the Strait of Hormuz, through which 20-25% of the world’s Oil passes through.

Israel has touted potentially attacking Iranian oil infrastructure as well with the Kharg Island (Iran’s biggest oil export terminal) being named as a possible target. Such a move as well could send Oil prices hurtling higher and have a knock-on effect globally. A delicate situation heading into the weekend.

Oil was up almost 10% for the week at the time of writing, reaching a daily high just shy of the $80 a barrel mark. We could see a retracement if there are signs that escalation in the region may not materialize. However, anything else could push Oil beyond the $80 a barrel mark.

From a technical standpoint, immediate support rests at 76.35 before the confluence area around the 75.00 handle comes into focus.

Conversely, on the upside immediate resistance rests at 79.00 before the psychological 80.00 handle comes back into focus. We have the 100-day MA just above 80.00 as well making the level even more crucial if further upside is to occur. Beyond this, we have key levels at 81.58 and 81.92.

Oil Daily Chart – October 4, 2024

Source:TradingView.Com

Key Levels to Consider:

Support:

Resistance:

- 79.00

- 80.00

- 81.58

- 81.92

- 83.00

Read More:

Original Post