“Vegas Baby, Vegas!” Stock Market (and Sentiment Results)…

2023.08.10 11:33

Market Outlook+

On Friday night, I joined Phil Yin on CGTN America. Thanks to Delal Pektas and Phil for having me on the show. As always, Phil asked me for some stock picks along with my view of economic developments and market outlook, so here they are. China, Disney, Jobs, the Fed, and more:

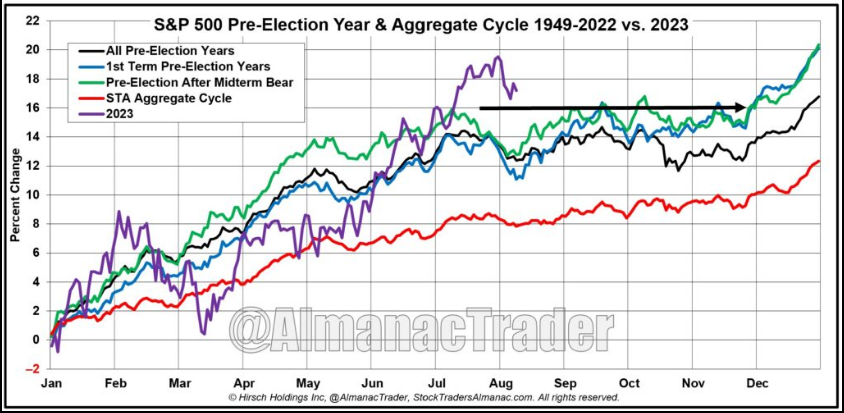

S&P 500 Pre-Election Year & Aggregate Cycle 1949-2022 vs. 2023

S&P 500 Pre-Election Year & Aggregate Cycle 1949-2022 vs. 2023

image source: Jeff Hirsch

CPS Update

As many of you know, Cooper Standard started as one of our largest three positions (by capital deployed) in May of 2022 and has grown into our largest position through price appreciation.

Cooper-Standard Holdings Inc.

Cooper-Standard Holdings Inc.

Those of you who listen to the podcast|videocast and were in at the $4-6 range are now up at least ~3x+ or ~200%+. Even if you first heard about it on Liz Claman’s The Claman Countdown on Fox Business on June 7, 2022:

Or on December 28, 2022 with Kelly O’Grady:

You still have at least a double or triple so far.

We most recently talked about the stock publicly on Yahoo! Finance on July 18, 2023:

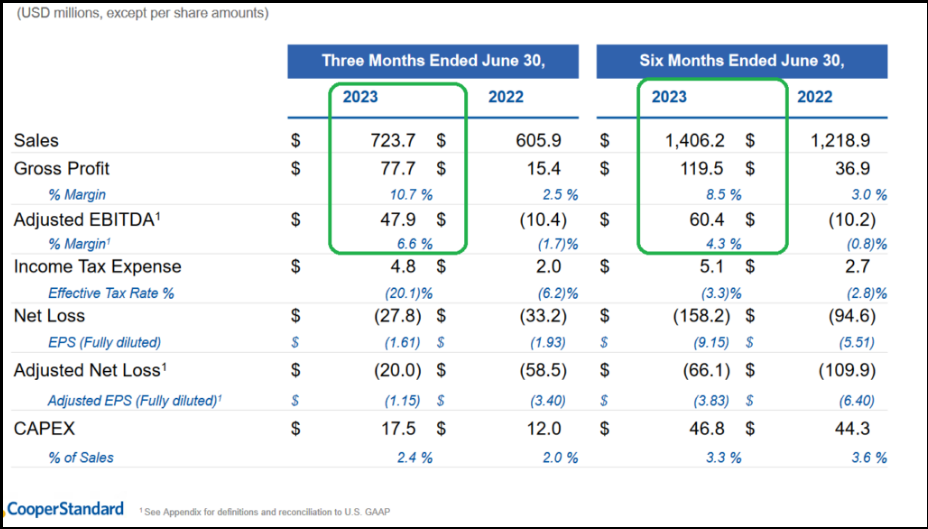

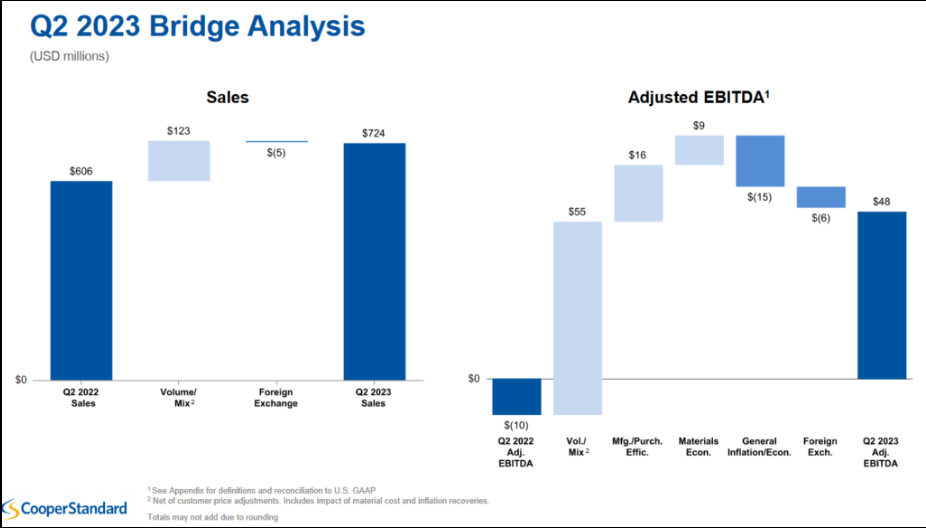

Last Thursday the company reported after the bell. Here were the key points:

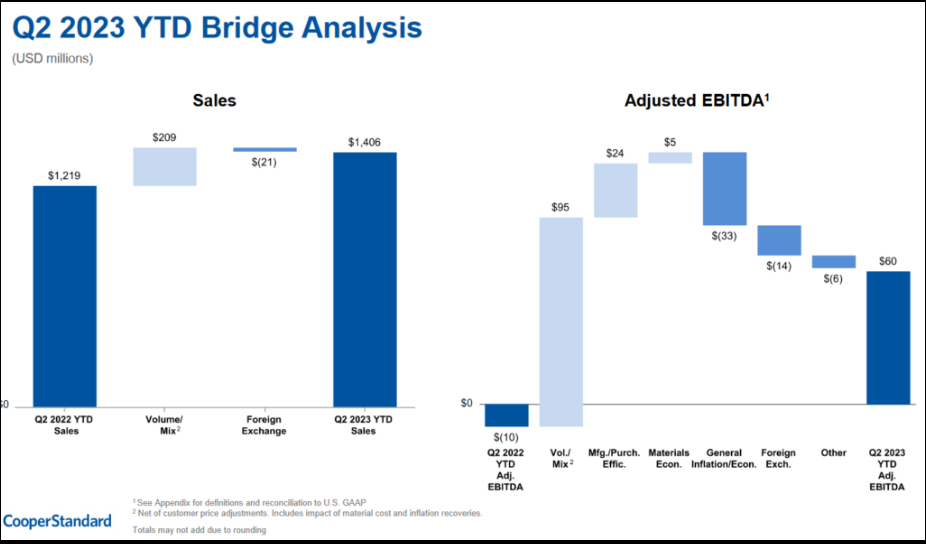

Q2 2023 YTD Bridge Analysis

Q2 2023 YTD Bridge Analysis

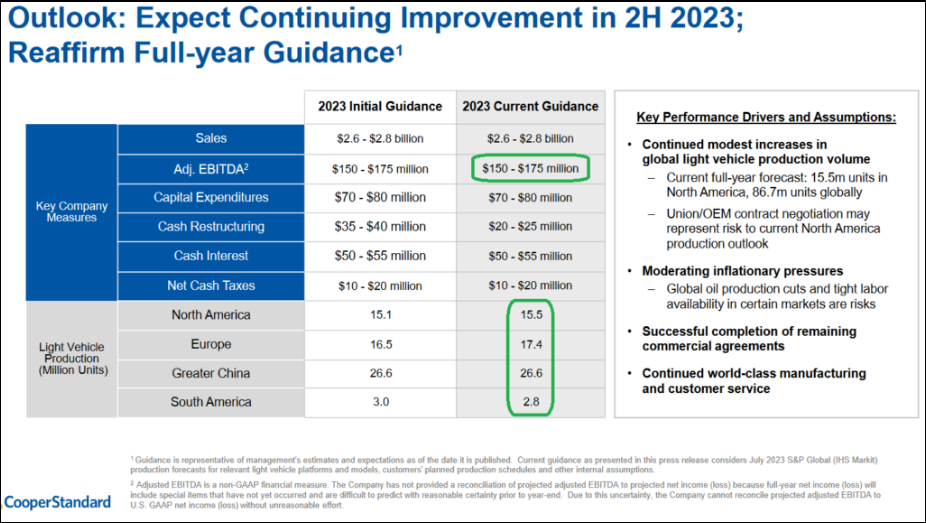

Outlook: Expect Continuing Improvement in 2H 2023

Outlook: Expect Continuing Improvement in 2H 2023

***We are hopeful that there may be some short term overhang on the stock (until the UAW contract is negotiated with the OEMs) so that we can put new money to work at a lower price, but we are not holding our breath…

Alibaba (NYSE:) Update

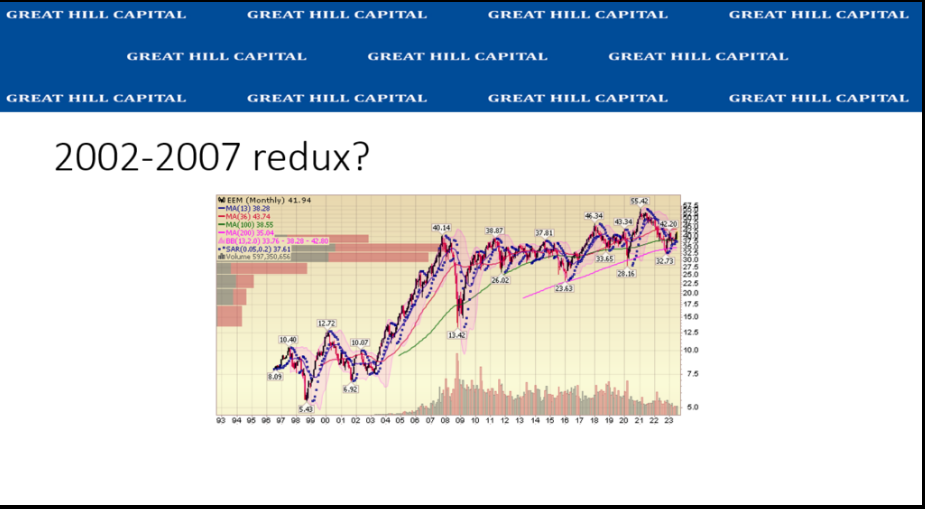

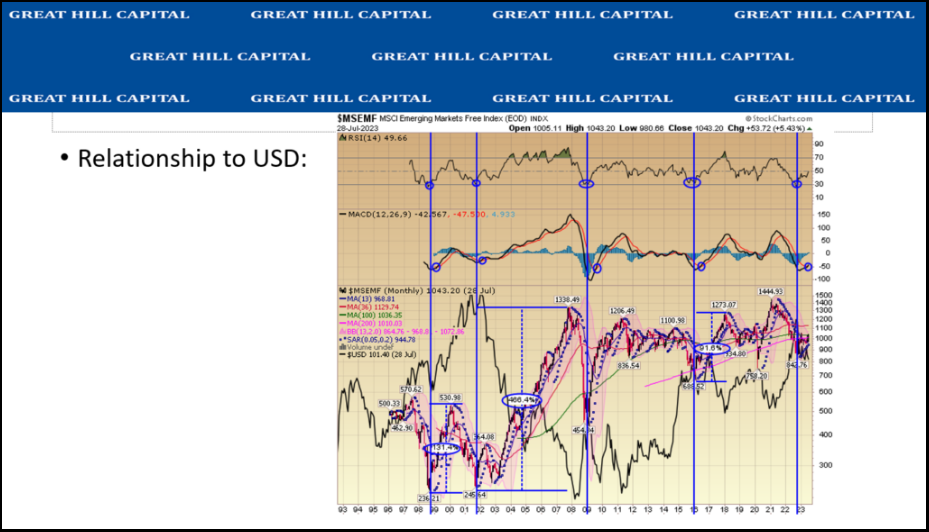

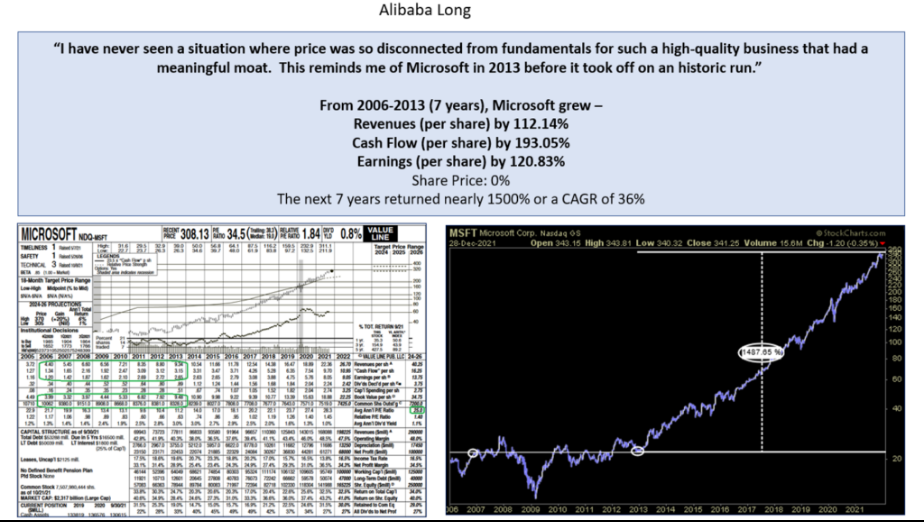

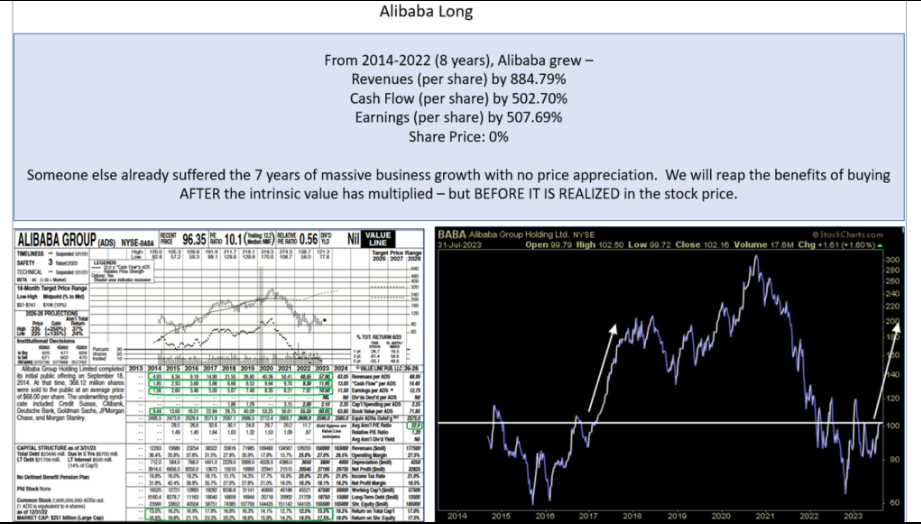

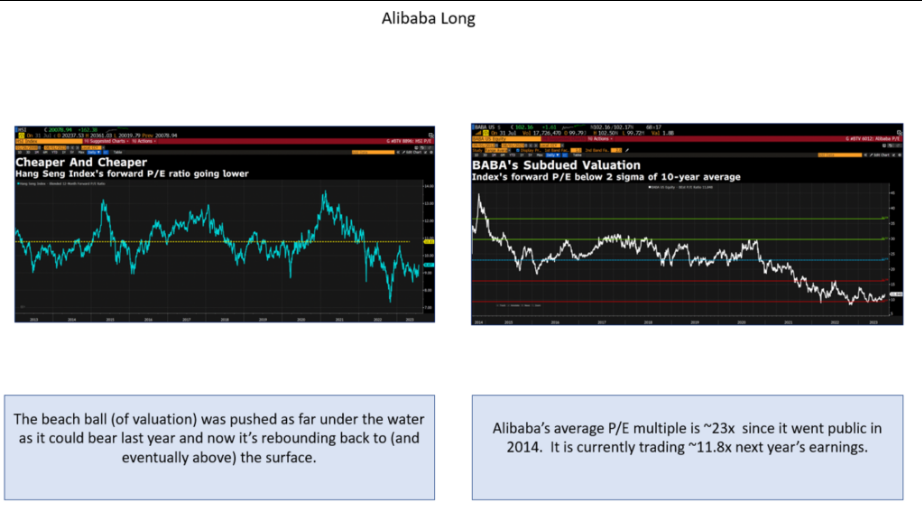

On Tuesday, I had the pleasure to speak at the Money Show in Las Vegas. Thanks to Kim Githler, Mike Larson, Debbie Osborne and Aaron West for having me on the main stage. In this segment I covered why we believe Emerging Markets/China/Alibaba will outperform over the next 12-36 months. There were great questions from the live audience at the end as well:

FULL Slide Deck To Follow Along Presentation

Key Slides:

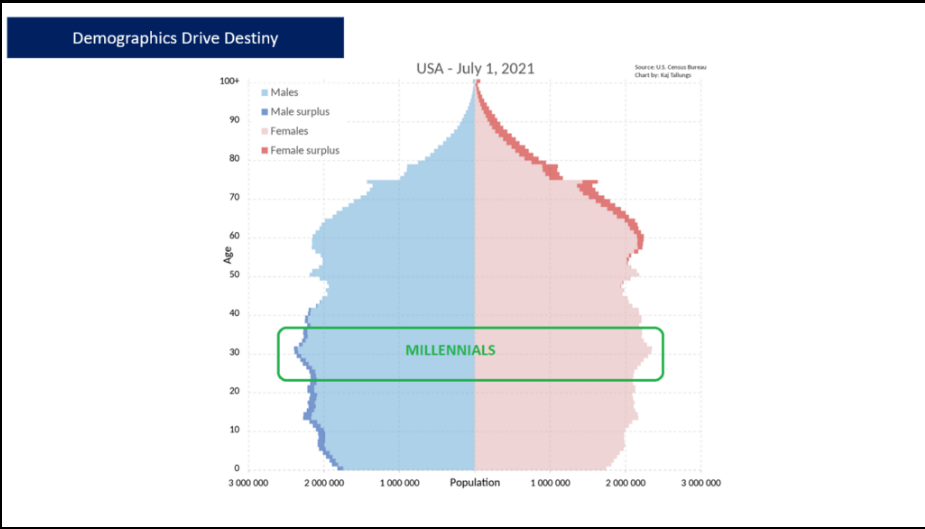

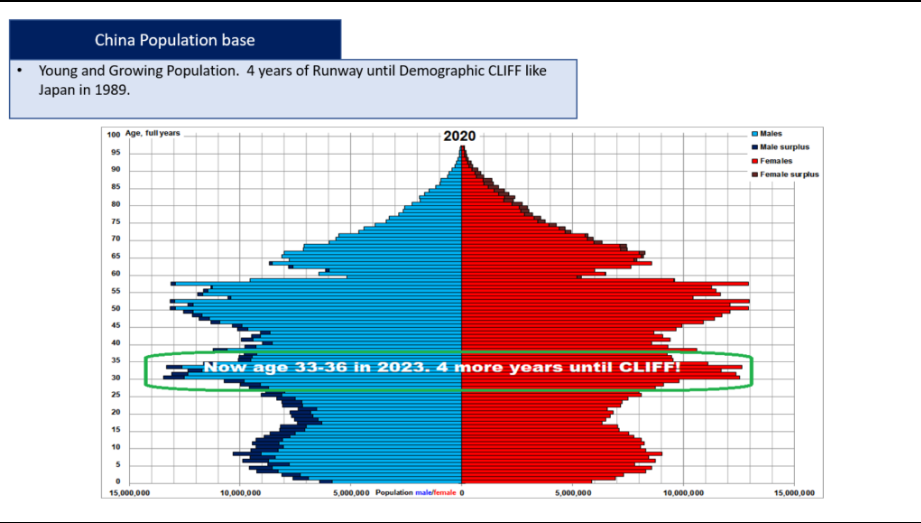

Demographics Drive Destiny

Demographics Drive Destiny

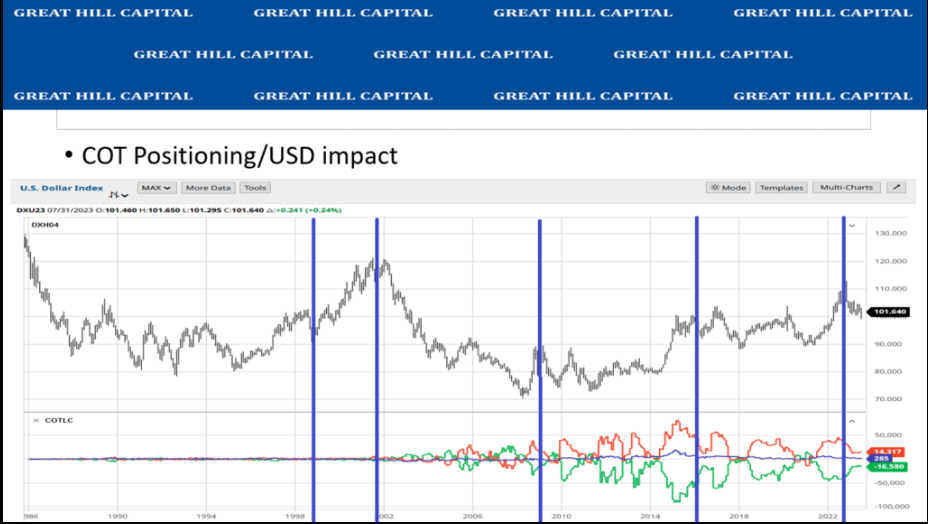

COT Positioning/USD impact

COT Positioning/USD impact

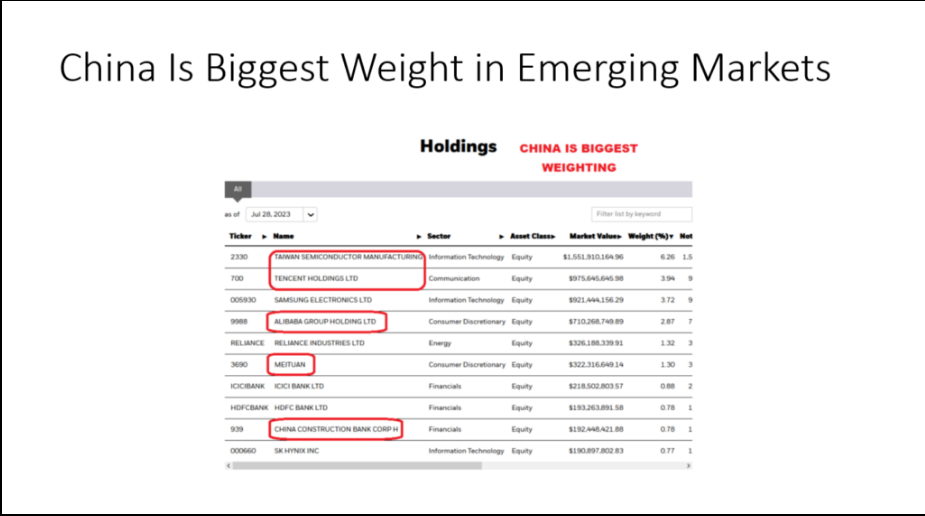

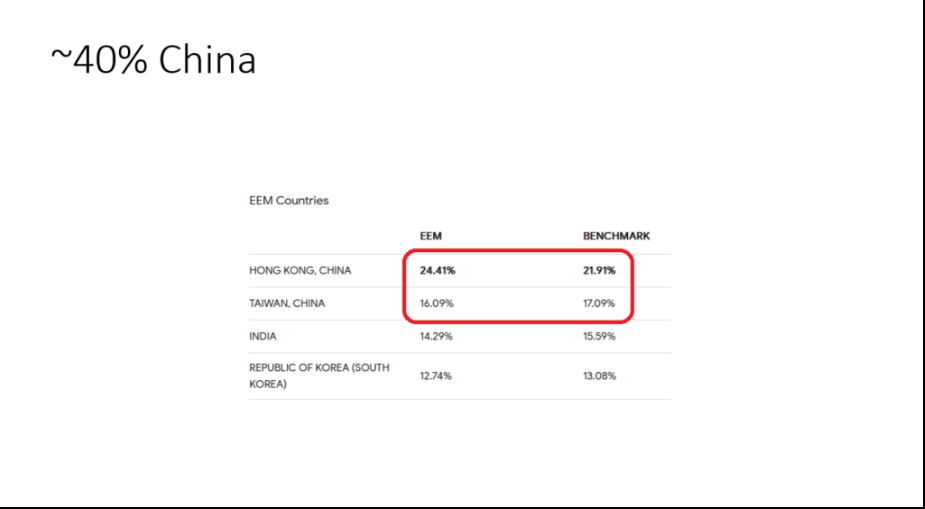

China is Biggest Weight in Emerging Markets

China is Biggest Weight in Emerging Markets

Now onto the shorter term view for the General Market:

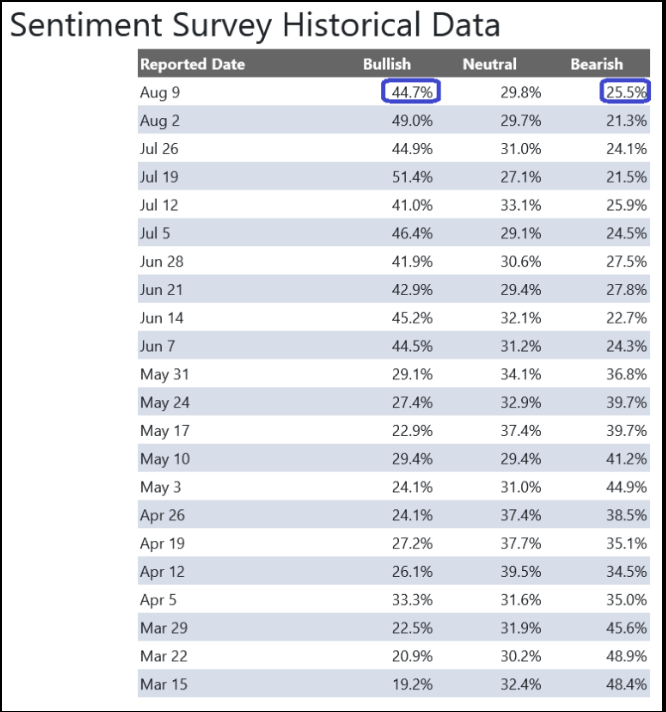

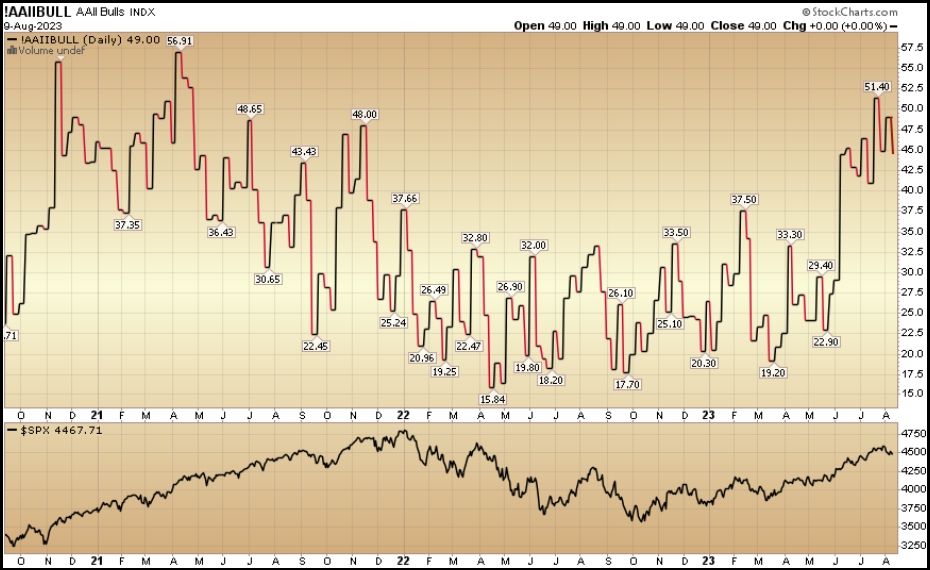

In this week’s AAII Sentiment Survey result, Bullish Percent (Video Explanation) moderated to 44.7% from 49% the previous week. Bearish Percent rose to 25.5% from 21.3%. The retail investor is still optimistic.

Sentiment Survey Historical Data

Sentiment Survey Historical Data

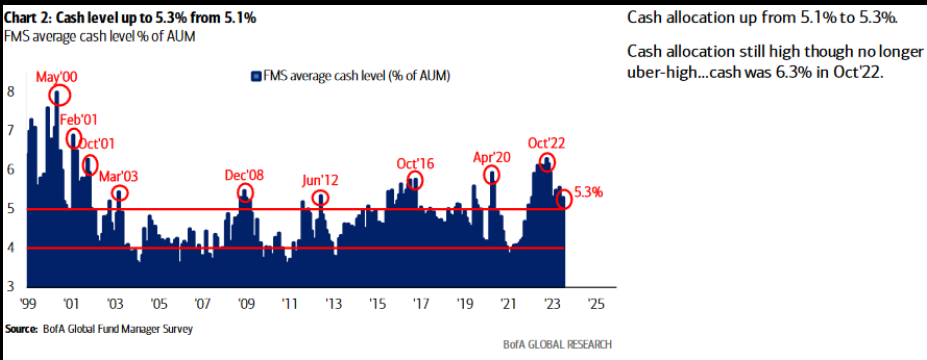

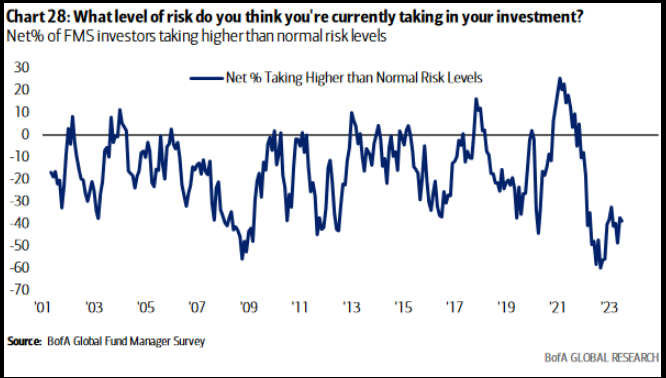

Keep in mind, institutional investors are nowhere near fully invested yet, so there will be a persistent bid on any bumpy/seasonal pullbacks through year-end.

Cash level up to 5.3% from 5.1%

Cash level up to 5.3% from 5.1%

What level of risk do you think you’re currently taking

What level of risk do you think you’re currently taking

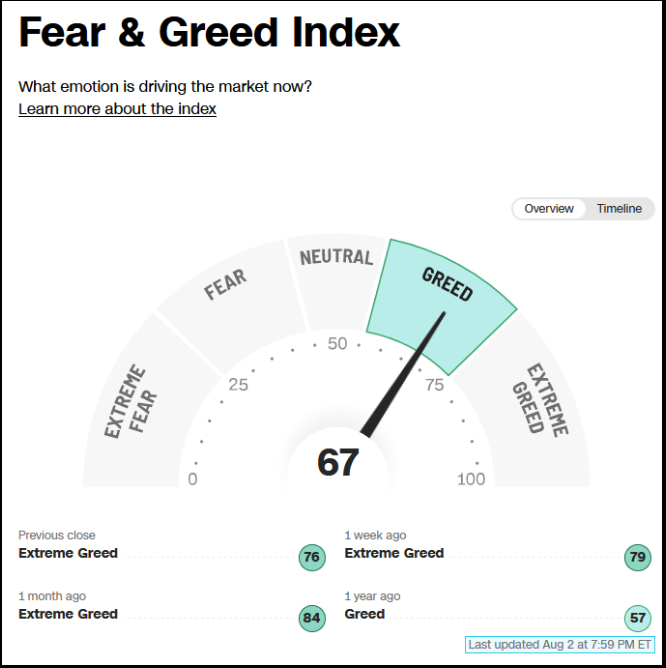

The CNN “Fear and Greed” flat-lined from 67 last week to 67 this week. You can learn how this indicator is calculated and how it works here: (Video Explanation)

UN – CNN Fear and Greed Index

UN – CNN Fear and Greed Index

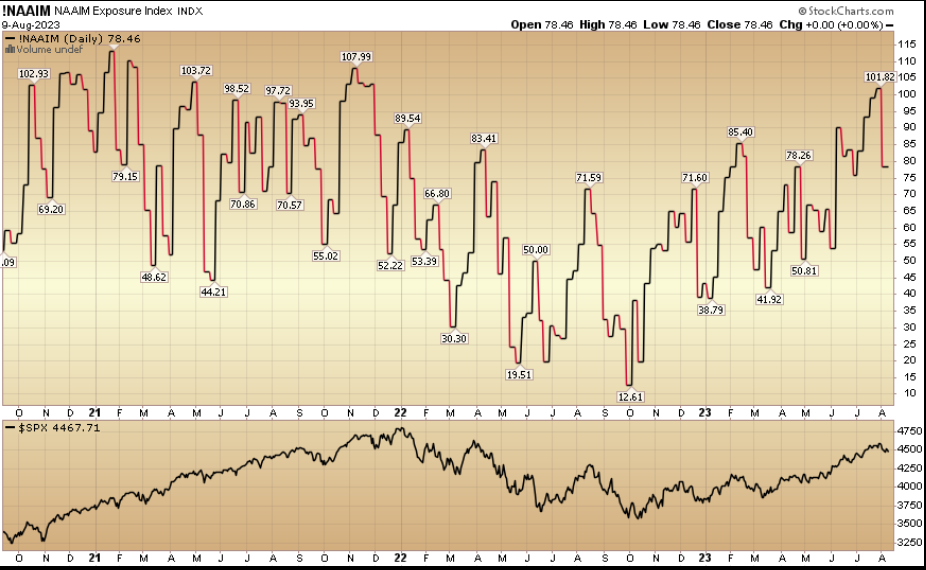

And finally, the NAAIM (National Association of Active Investment Managers Index) (Video Explanation) dropped to 78.4% this week from 101.02% equity exposure last week.

This content was originally published on Hedgefundtips.com.