USD/JPY: Hot Inflation Report Could Send the Pair Back Above 144

2024.09.11 02:35

- US CPI expectations: 2.6% y/y headline inflation, 3.2% y/y “core” inflation

- As the last major economic release ahead of next week’s Federal Reserve Monetary Policy meeting, the US CPI report may well decide which path Jerome Powell and Company choose.

- The USD/JPY battle lines are clear: Bulls are making their stand at the 2024 low near 142.00, while previous-support-turned-resistance at 144.00 is capping near-term bounces

The inevitable corollary of the Fed shifting its focus from inflation to the labor market when deciding the path of monetary policy moving forward is that inflation data, including today’s report, will become less market-moving than it had been.

Despite that logical observation, this month’s CPI report may still lead to some market volatility as traders are not 100% certain what the US central bank will do later this month.

Per the CME’s FedWatch tool, Fed Funds futures traders are discounting about a 75% chance of a 25bps rate cut next week, with a roughly 1-in-4 probability of a larger 50bps “double” interest rate reduction.

As the last major economic release ahead of next week’s Federal Reserve Monetary Policy meeting, the US CPI report may well decide which path Jerome Powell and Company choose.

As many readers know, the Fed technically focuses on a different measure of inflation, , when setting its policy. Still, for traders, the CPI report is at least as significant because it was released weeks earlier.

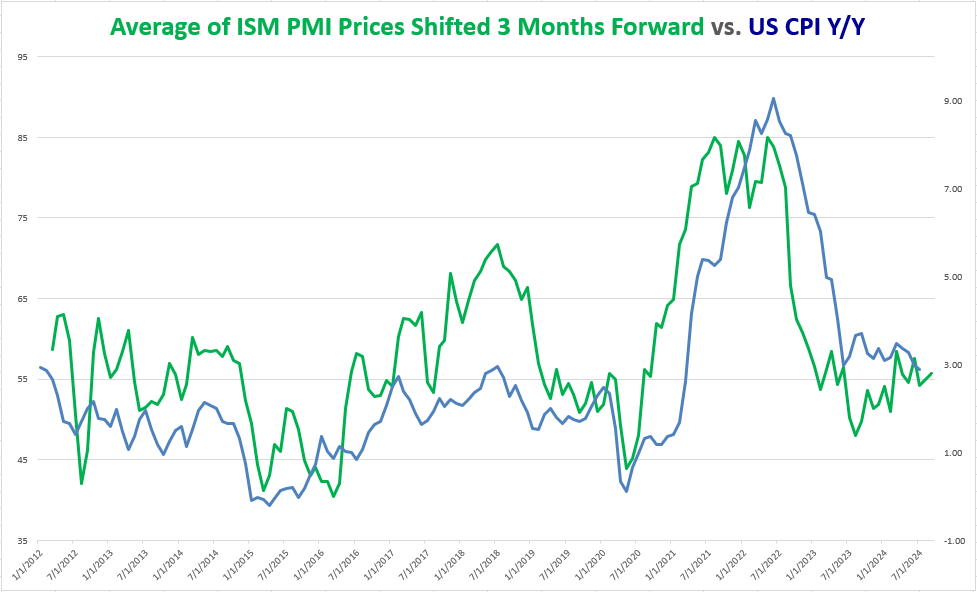

As the chart below shows, the year-over-year measure of US CPI has resumed its decline from the 2022 peak in recent months, though one of the best leading indicators for future CPI readings, the ISM PMI Prices component, has stopped falling:

Source: TradingView, StoneX

As the chart above shows, the “Prices” component of the PMI reports has remained in the mid-50 region, corresponding to CPI inflation holding steady its same 3% range in the coming months.

Crucially, the other key component to watch regarding US CPI is the so-called “base effects,” or the influence that the reference period (in this case, 12 months) has on the overall figure.

Last August’s 0.6% m/m reading will drop out of the annual calculation after this week’s reading, opening the door for a drop in the headline year-over-year CPI reading.

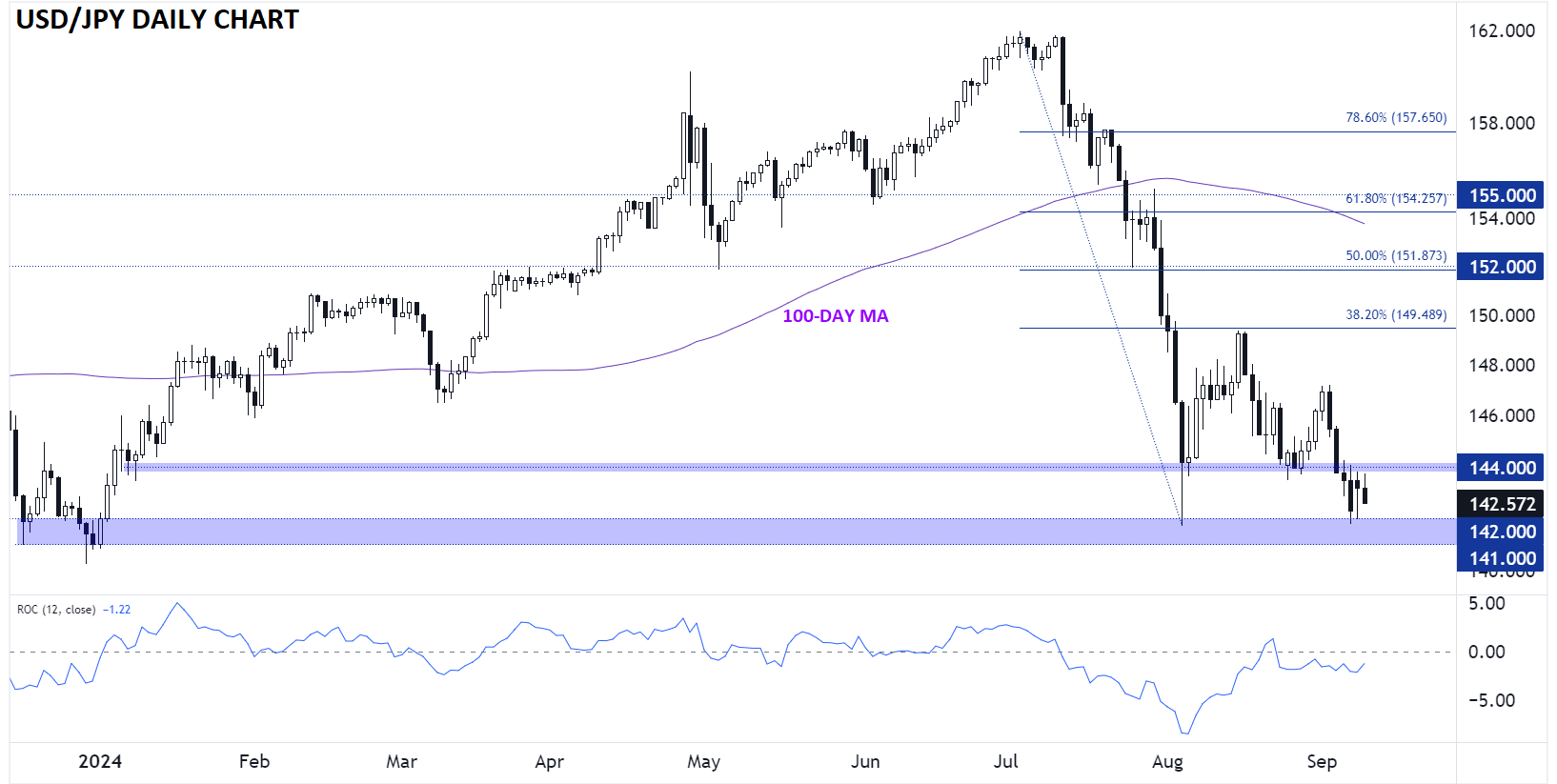

US Dollar Technical Analysis – USD/JPY Daily Chart

Source: TradingView, StoneX

saw a significant breakdown below 144.00 support last week and bears have been able to keep the pair below that key level so far this week.

Traders continue to price in aggressive interest rate cuts from the Fed and the potential for modest interest rate increases out of the Bank of Japan, keeping the pair under fundamental selling pressure ahead of the US CPI report.

Moving forward, the battle lines are clear: Bulls are making their stand at 2024 low near 142.00, while previous-support-turned-resistance at 144.00 is capping near-term bounces.

A hot CPI report that eliminates the potential for a 50bps rate cut from the Fed next week would likely take USD/JPY back up to 144.00, whereas a soft reading brings the 142.00 level into play.

Traders may be hesitant to break this range in the immediate aftermath of the CPI reading unless it’s a truly shocking number.

Original Post