US inflation, ECB decision to test markets’ nerve

2023.03.10 11:11

US inflation, ECB decision to test markets’ nerve

The US inflation report and the European Central Bank’s policy meeting will share the limelight next week amid another round of ratcheting up of rate hike expectations by investors. Other critical data such as Chinese industrial output, Australian employment and New Zealand GDP estimates might thus get overshadowed. Meanwhile in the UK, it’s budget time again, although the event is not expected to generate as much volatility as last time.

CPI report could make the case for 50-bps hike

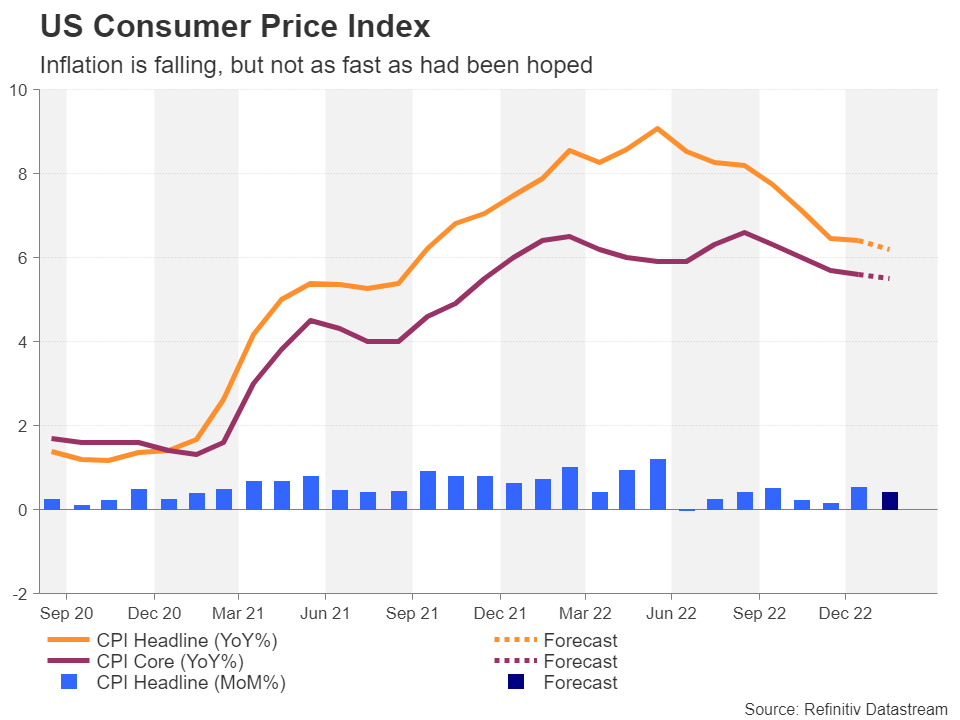

There’s been no let-up in the ‘higher for longer’ bets for the Fed after a string of hot labour market and price data, pushing expectations for the terminal rate to a new cycle high of 5.65%. Fed Chair Powell gave the thumbs up to the markets’ shifting expectations for higher rates and opened the door to a re-acceleration of the tightening pace as early as the March meeting.

Tuesday’s CPI numbers will therefore be vital as they could determine whether FOMC members vote for a 25- or 50-basis-point increase. In January, the slowdown in the CPI rate was less than expected, sparking fears that high inflation will persist for longer than anticipated. The February forecasts point to a similarly slow process as the month-on-month increases are projected at a somewhat elevated pace of 0.4% for both the headline and core CPIs.

The producer price index will follow on Wednesday, along with retail sales figures for February. After a surprisingly robust rebound in consumption in January, investors will be watching to see if this was a blip or whether consumers continued to spend in the face of rising interest rates.

In other data, the New York and Philadelphia Feds’ manufacturing gauges on Wednesday and Thursday, respectively, will shed some light on how the sector fared in the early days of March. Building permits and housing starts are due on Thursday as well. Wrapping things up on Friday are industrial production numbers and the University of Michigan’s preliminary survey readings on consumer sentiment in March.

The US dollar is likely to receive another leg up on the back of a hotter-than-expected CPI report, though the gains might be muted ahead of the Fed meeting on March 21-22.

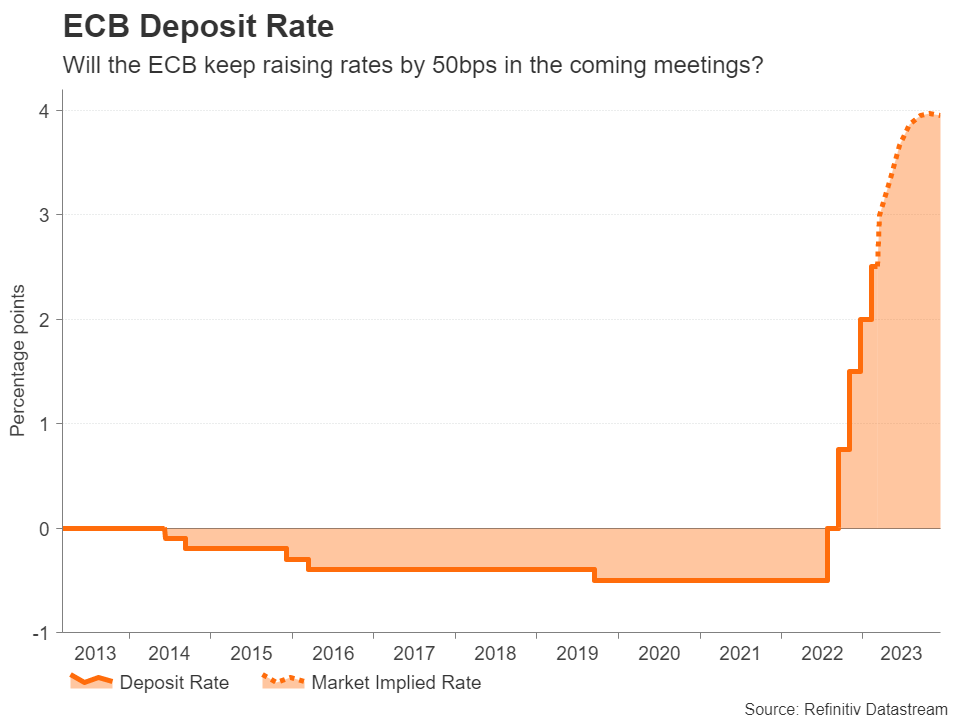

ECB to hike again, all eyes on future pace

The ECB is almost certain to deliver its third straight hike of 50 bps on Thursday, raising the deposit rate to 3.0% – the highest since 2008. However, the path forward may get more complicated as there is a growing split between the hawks and the doves within the Governing Council.

The final readings of Eurozone inflation out on Friday are expected to confirm that the core CPI rate that excludes food and energy prices jumped to 7.4% – an astronomical figure in the eyes of ECB hawks.

However, dovish members are worried about the impact that surging borrowing costs might have on weaker members such as Greece and Italy.

As in other countries, there is an intensifying debate about the appropriate speed of rate increases now that most of the major central banks are one year into their tightening cycle. Going too fast risks a hard landing but going too slow could be even more dangerous if it makes way for second-round effects.

The ECB will publish its latest quarterly staff projections after the meeting and it will be interesting to see how quickly inflation is forecast to drop to its 2% target. But the bigger question is whether President Christine Lagarde will signal another 50-bps hike in May as the failure to do so would suggest that doves may be winning the argument.

Such an outcome could be slightly negative for the euro, though not much, as rates could still peak as high as 4.0% by year-end.

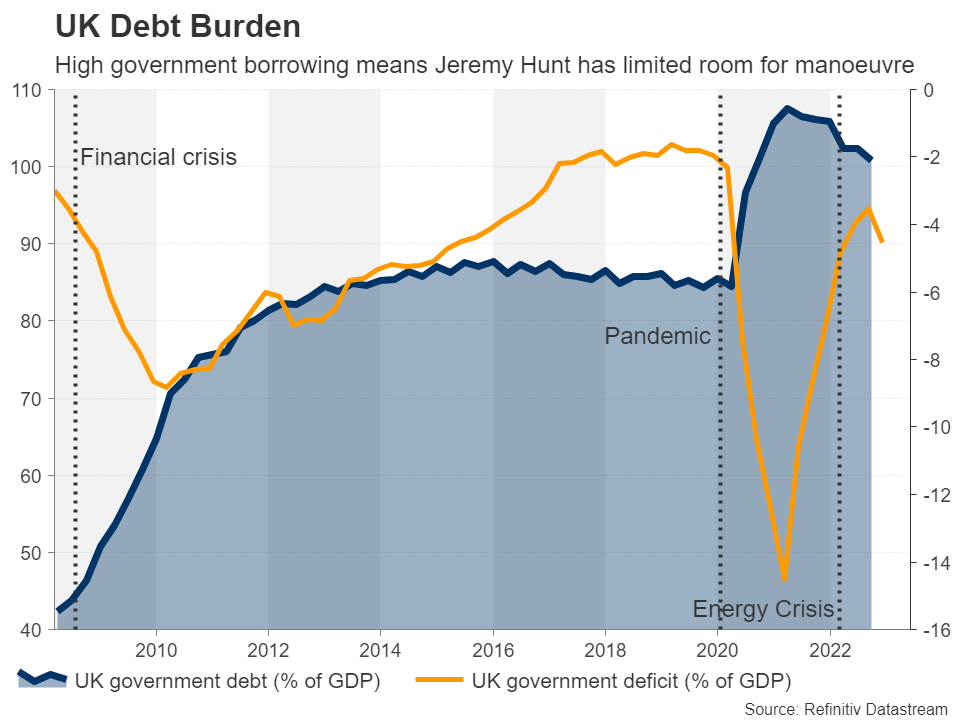

Will the Spring Budget rattle the pound?

Over in the UK, it will be somewhat of a quieter week, with the January employment report due Tuesday being the only major release. However, the Spring Budget Statement on Wednesday will likely attract more attention for the pound.

After the turmoil that followed the previous budget in September, investors are feeling a lot calmer under the safer pair of hands of Jeremy Hunt heading into the event. Hunt has not pivoted away from his belief in fiscal discipline since taking on the role to clean up the mess left by Truss and her chancellor, so the likelihood of significant tax cuts is very low.

However, there is speculation that Hunt may announce tax breaks for businesses, specifically to encourage more investment, amid growing political frustration about the UK’s lacklustre growth prospects. Hunt is also under pressure to extend the energy price guarantee beyond April, and while there have been some indications that he is set to maintain this support, there’s also a chance it might be scaled back from the current generous levels.

For the pound, a budget that is pro-growth but with spending kept in check would be broadly positive.

Aussie and on data alert

China signalled that the days of ambitious GDP goals are over when it set itself a ‘modest’ growth target of 5% for 2023. This suggests that growth will mainly be driven by the reopening effect and the government has no plans to unleash new substantial stimulus measures. Data out on Wednesday is expected to show there was a further bounce back in the economy in February.

Industrial production growth is forecast to have picked up to 2.6%, while retail sales probably rebounded by 3.4% after contracting the previous month.

If the February numbers disappoint, the China-sensitive Australian dollar could slip on fears of a faltering recovery. But traders will also be keeping an eye on domestic employment stats due Thursday. Australia’s economy shed 11.5k jobs in January so another weak report for February would dampen expectations about the RBA hiking rates at its next meeting.

More:

Key Events in Developed Markets and EMEA Next Week

Dollar Awaits the NFPs, BoC Leaves Rates Untouched

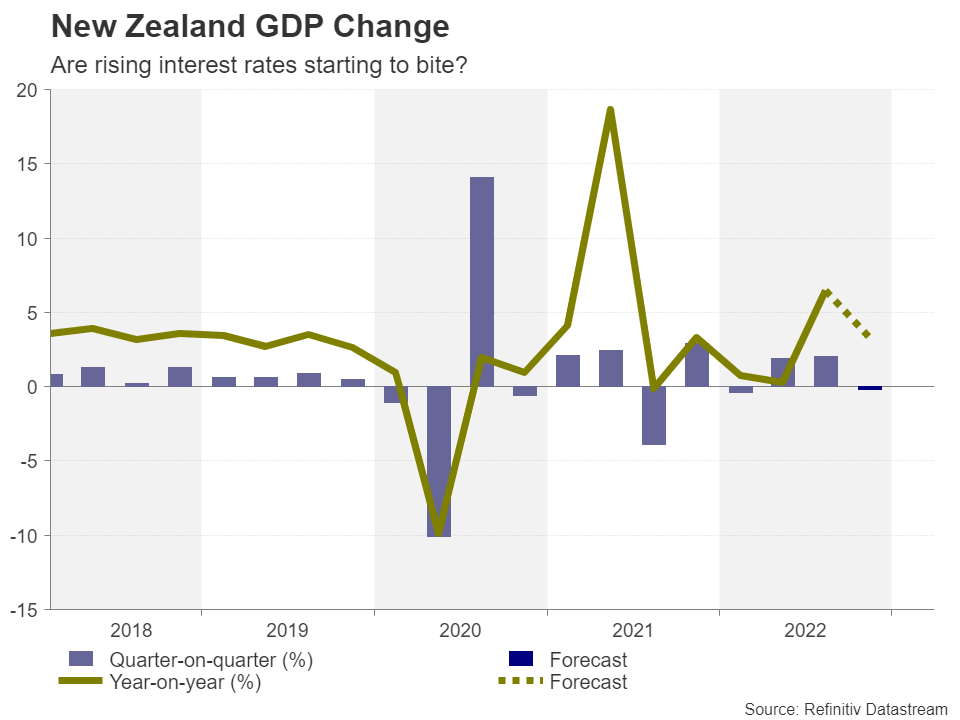

Across the Tasman Sea, Q4 GDP figures for New Zealand are released on Thursday. But the data may not necessarily have a sizeable impact on RBNZ rate hike expectations unless there is a very big beat or miss.

Although the RBNZ has not followed some of its peers in toning down its hawkish rhetoric, it has already been one of the most aggressive central banks over the past year and so there is limited scope for its terminal rate to go much higher. Neither is the RBNZ likely to abruptly turn dovish, thus, there’s not a lot to price into money markets in either direction, meaning the New Zealand dollar will mainly stay attuned to the global risk tone.