US Gold and Bitcoin Retreat: Investors Eye Seasonal Trends for Gold Rebound

2024.12.02 07:55

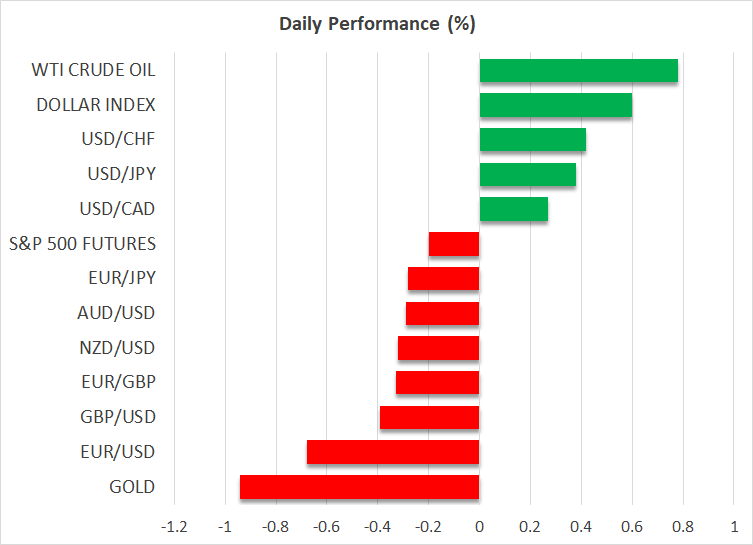

- Political developments cast a shadow over the euro.

- Dollar in a good mood, particularly against the euro.

- Gold and bitcoin in retreat; seasonality favours gold.

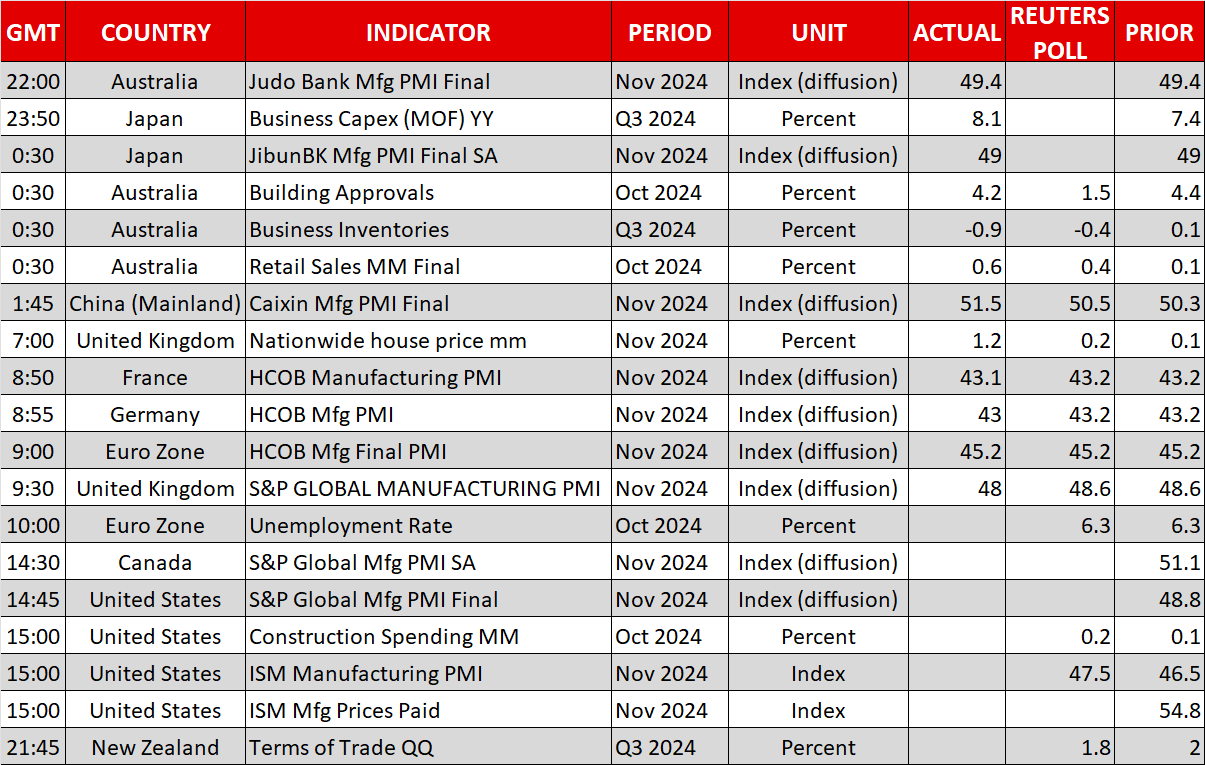

US Data Calendar in the Spotlight this Week

With US market participants returning rejuvenated from the long weekend, an important week commences, essentially marking the start of a period up to December 19, when the last central bank meetings for 2024 will be held. The US economy will primarily be in the spotlight this week, due to the busy data calendar and the plethora of speakers on the wires.

The US and manufacturing surveys will kick off this week’s schedule, and despite the overall positive sentiment for the US economy, both indicators have been on a downward trend in the past few months. The market is looking for a decent correction in the ISM manufacturing survey, although it will likely remain firmly below its 50 threshold. The focus will also be on the subindices, particularly on the employment one, as a gauge for Friday’s nonfarm payrolls figure.

Fed members Waller and Williams, who hold moderate views on monetary policy, are scheduled to speak today.

Investors should prepare for unscheduled appearances from FOMC members as the usual blackout period ahead of the December 18 Fed gathering begins this weekend.

Euro’s Troubles Multiply

The has had a dreadful month, underperforming against almost every major currency and recording the weakest month against the since May 2023. Weak economic data, political shenanigans and Trump’s victory have contributed to this performance, with the situation remaining critical. Monday’s final release of the S&P Global manufacturing PMI for November is unlikely to change the current economic momentum and the current ECB cut expectations.

While Trump is preparing for January 20, when he will officially begin his second tenure at the While House, the eurozone is facing serious political issues. The German pre-election campaign has unofficially started, despite the confidence vote being held on December 16, with Chancellor Scholz seeking a second term. Other parties are gradually beginning to announce their election manifestos, with the far-right AfD party advocating for a withdrawal from both the EU and the euro system.

The situation is equally critical in France, where the 2024 budget is being debated. PM Barnier has announced a mixture of spending cuts and tax increases, similar to the UK budget, aiming to bring France’s finances back under control again. The big difference with the UK is that Barnier’s administration lacks a majority in the parliament and hence relies on opposition votes for approval.

With the opposition parties, especially Le Pen’s National Rally, being openly critical of Barnier’s budget, a confidence vote, and potentially the appointment of another prime minister, could be around the corner. The result of these political shenanigans is that the French 10-year yield briefly rose above its Greek one last week, and the closed November with a negative return, underperforming both the 40 and indices.

Gold and Lose Ground

Both and are in the red on Monday. The king of cryptos has once again failed to stage a move towards the $100k level, prompting the current selloff, while gold is hovering around the $2,620 area at the time of writing. In contrast to crypto’s extraordinary performance in November, gold recorded its weakest month since September 2023.

However, gold buyers should not despair as seasonality points to a markedly better performance for gold during the last month of the year.