US Dollar, Stocks Rally on Trump Victory: Here’s What This Means for Investors

2024.11.06 10:32

- Dollar has rallied as Donald Trump’s policies are seen as inflationary.

- Stocks celebrated prospect of tax cuts and deregulation.

- Bitcoin has hit fresh record high, but oil has retreated.

Trump Knocks the White House Door

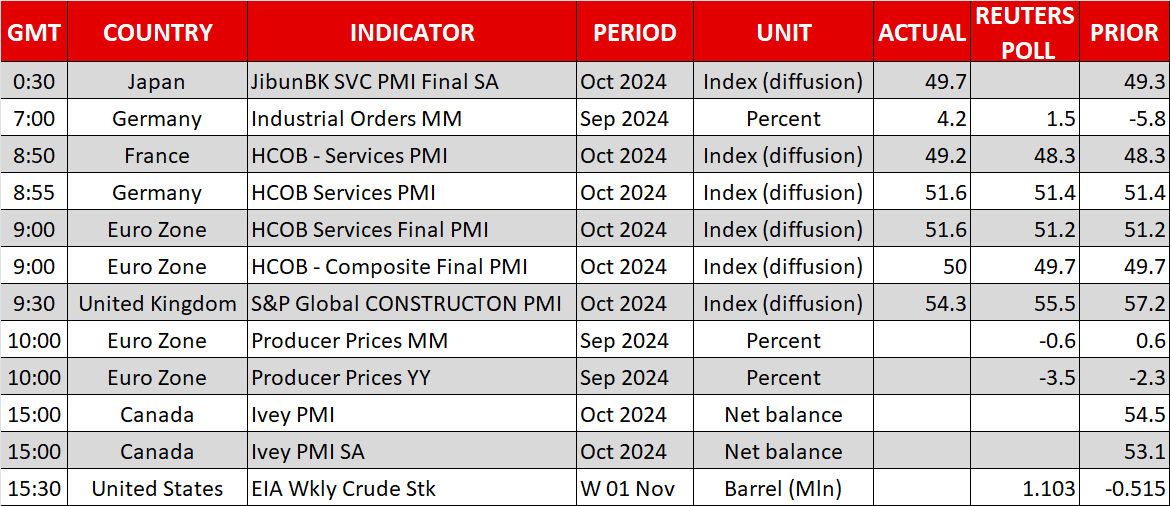

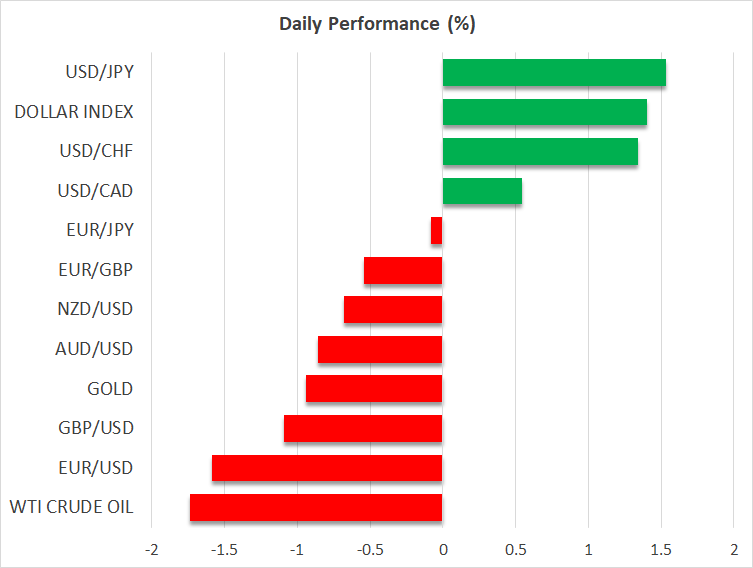

The skyrocketed during the Asian session on Wednesday, and it appeared to be headed for its biggest one-day gain since March 2020.

Following the closing of the election ballots in the US, former president Donald Trump’s return to the White House fueled the so-called ‘Trump trades’, with the US dollar beginning to climb north on early indications that the Republican candidate was likely to secure the key battleground state of Georgia.

Trump also defeated Democrat candidate Kamala Harris in the critical states of North Carolina and Pennsylvania, with the latter putting him three electoral votes short of winning the presidency.

Inflationary Policies Imply Slower Fed Cuts

The former president’s policies, which include massive tax cuts and tariffs on imported goods from around the globe, especially from China, are seen as inflationary, thereby raising the likelihood of the proceeding with slower rate cuts from here onwards. That’s why his lead turbocharged the US dollar.

Indeed, Treasury yields also rose, and according to Fed fund futures, although investors remained convinced that the by 25bps on Thursday, speculation of a pause in December has increased. The probability of not acting in December rose back to 32%. Now, it remains to be seen whether the Fed will indeed sound more cautious this week about future policy moves.

Wall Street Surges on Tax Cuts and Less Regulation

The prospect of lower taxes and less corporate regulation under a Trump presidency buoyed stocks, with all three of Wall Street’s main indices gaining more than 1% on Tuesday and the futures market pointing to a stronger open on Wednesday.

However, the Trump 2.0 era may not be smooth sailing for Wall Street, as the imposition of tariffs and bets of even slower rate reductions by the Fed may be reasons for steep corrective pullbacks.

Some policies may need to pass through Congress to become laws. But with Republicans securing the Senate and leading the battle for the House, a unified government under President Trump will have a lot of freedom in deciding on fiscal policy.

Gold and Oil Pull Back, Bitcoin Enters Uncharted Territory

surrendered to the stronger US dollar, but the losses were contained, and a recovery began during the early European hours, as the uncertainty surrounding a Trump government may be a reason for some investors to maintain exposure to this safe-haven asset.

was also part of the ‘Trump trade’, flying more than 9% today and reaching a fresh record high of around $75,390.

on the other hand pulled back after hitting resistance slightly above the key territory of $72.70.

Besides the pullback in commodities due a stronger dollar, the pressure on the Chinese economy from Trump’s policies could weigh on demand from the world’s top crude importer.