US Dollar Recharges, EUR/USD Drops on French Politics

2024.12.03 08:48

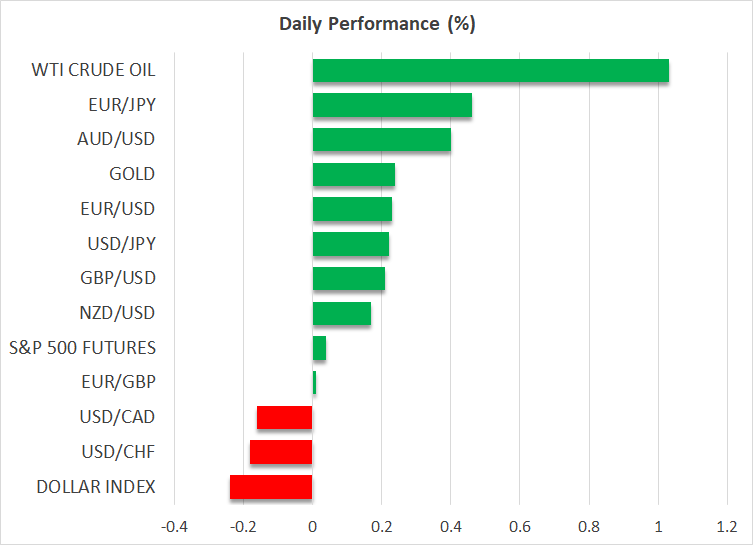

- Dollar rebounds on more tariff threads and better US PMIs.

- Euro feels the heat of France’s budget turmoil.

- S&P 500 and Nasdaq climb to fresh record highs.

Trump’s threats continue, US data reveal improvement

The entered the week on a strong footing, gaining against all its major peers on Monday and corroborating the notion that last week’s retreat may have been due to liquidation of long positions ahead of the Thanksgiving break. Today, the greenback is pulling back somewhat.

Trump reminded traders why they have been buying dollars lately, after he threatened to impose 100% tariffs on BRICS nations if they were to move away from the dollar and create their own currency, with the better-than-expected US data also helping. The increased to 48.4 in November from 46.5, while the final S&P Global manufacturing print was revised up to 49.7 from 48.8.

Trump’s rhetoric and the data corroborated investors’ view that the may need to take a break at the turn of the year and although the probability for a December pause slipped from 40% to around 30% after Fed Governor Waller said that he was inclined to favor a in December, the likelihood of the Fed taking the sidelines in January rose to 62%.

What’s also interesting is that the probability of the Fed refraining from pushing the cut button at both meetings is being held at a decent 23%.

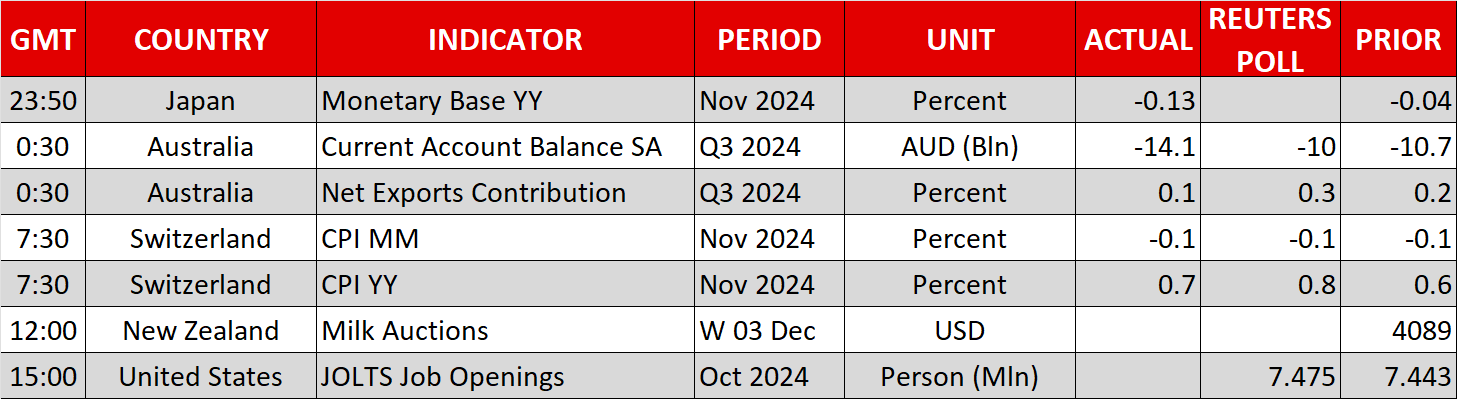

More US data in focus ahead of key NFP report

Today, traders may pay extra attention to the data for clues as to how the jobs market has been performing as the Fed has been placing extra emphasis on the labor market lately. Tomorrow’s will also be very important for the dollar, but this week’s highlight will most likely be Friday’s NFP report.

A strong report suggesting that NFP growth has returned to healthy levels after October’s mere 12k gain could convince more market participants to bet on a Fed pause at the turn of the year, thereby keeping the US dollar supported.

Following Waller’s remarks, today dollar traders may also monitor speeches by Chicago Fed President Goolsbee and Fed Governor Kugler.

French political uncertainty increases, weighs on euro

The was among Monday’s main losers, feeling the heat of growing concerns about French politics, with the nation headed for a government collapse over a budget deadlock.

On Monday, the far-right National Rally (RN) President Bardella said that they would support a no-confidence motion against the interim government unless their budget demands are met. What is adding to the risk is that if the government loses now, a new election is not allowed until the summer.

The increased anxiety about French politics resulted in a surging risk premium for holding French debt rather than German bonds, with the spread between the French and German 10-year yields climbing to its highest since July 2012.

Equity investors keep adding to their risk exposure

On Wall Street, the slid somewhat, but both the and the climbed to record highs, with the latter gaining nearly 1%. Both indices were driven by strong gains in the Magnificent 7 high-tech stocks, with Meta (NASDAQ:) and Tesla (NASDAQ:) jumping 19% and 12%, respectively.

It seems that equity traders are not that concerned about Trump’s tariff policies. They may even feel confident that, if he is sticking to his tariff pledges, he will be similarly determined to proceed with the massive tax cuts as well. With regards to a potential Fed pause, given that equity traders are longer-term investors than forex participants, they may not care that much about delayed rate cuts, as long as the rate path remains to the downside.