US Dollar Rally Pauses Ahead of CPI Report as Fed’s Easing Signals Impact Markets

2024.10.09 06:57

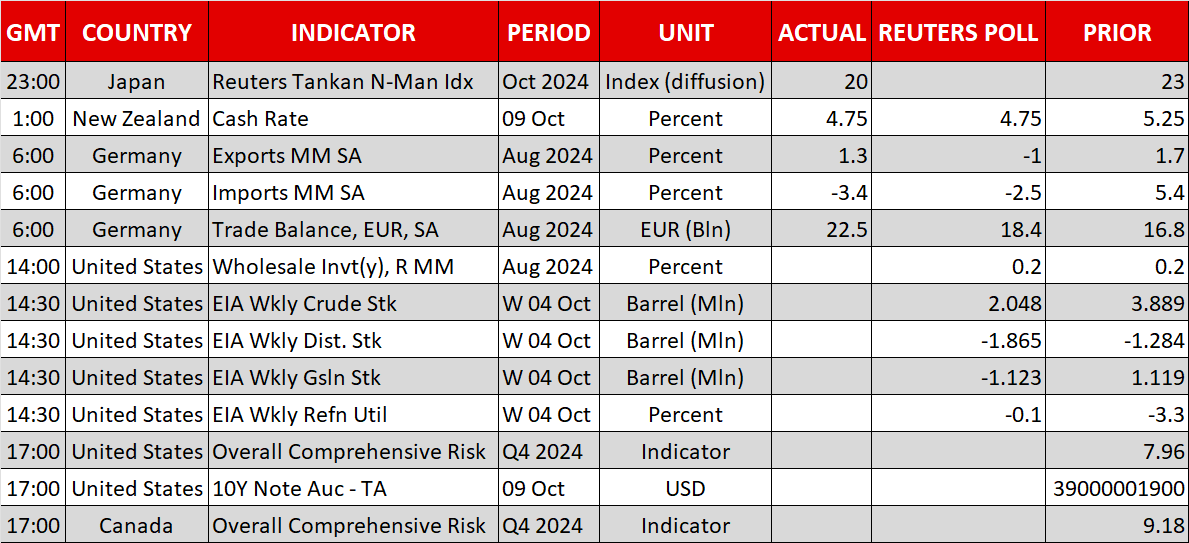

- Fed speakers and minutes in the spotlight today

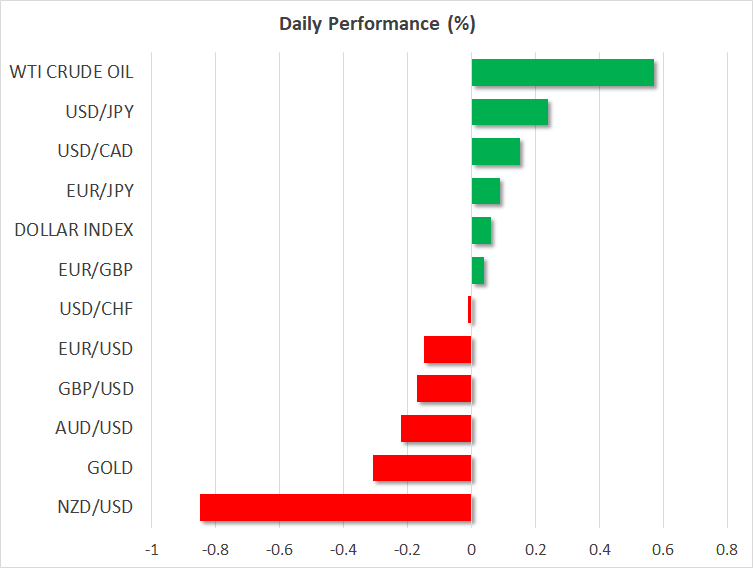

- Dollar’s rally pauses, but oil and gold suffer losses

- RBNZ cuts rates by 50bps, kiwi weakens

- China schedules another press conference as local stocks plunge

Fed Members Continue to Support a November Rate Cut

The public discussion regarding the Fed’s next steps continues, as a plethora of Fed members are on the wires almost on a daily basis. There is an unexpected unanimity among members that the Fed will keep on easing its monetary policy stance, despite last week’s strong . In fact, the dot plot published at the September gathering has two 25bps rate cuts penciled in until year-end.

Interestingly, the market seems to have run ahead of itself as it has quickly priced out the probability of a 50bps move, and it is now actually pricing in a 12% chance of no rate cut at the November 7 meeting. Such an outcome looks implausible at this stage as it could cause an acute market reaction, particularly in equities.

Having said that, today’s Fed minutes and Thursday’s could somewhat complicate the outlook. The September 50bps rate cut was almost unanimously approved, and most Fed members have since publicly expressed their support. However, it would be interesting to read any comments about how the Fed could react if the labor market remains tight, keeping wages growth elevated, and inflation fails to ease further.

Dollar to Benefit From Further Hawkish Headlines

Following a very strong performance last week, the is struggling to record further gains. The revised Fed rate cut expectations have been digested with the dollar bulls looking for a boost from other areas like geopolitics. In the Middle East, the back-and-forth between Israel and Iran’s proxies continues with the market still trying to guess Israel’s retaliatory strike.

Following pressure from US President Biden, it looks like Israel will avoid hitting Iran’s nuclear facilities. It could focus on Iran’s oil industry, although reports yesterday mentioned that Israel might at the end prefer to target only military installations. As a result, the commodities space is experiencing some rare losses this week.

is down almost 1.5% while futures are hovering around the $74 level.

RBNZ Cuts Rates, Ready for More

The Reserve Bank of New Zealand did not defy expectations and announced a 50bps rate cut earlier today. The overall rhetoric accompanying the decision was dovish with the committee now feeling slightly more confident about the inflation outlook. The market is currently pricing in an 80% probability for another 50bps rate move at the final meeting for 2024, held on November 27, but this move will most likely depend on the Fed’s decisions and developments in China.

As a result, the Kiwi is losing ground against both its neighboring and the dollar. Interestingly, the pair is trading at a critical level. A decisive drop below the 0.6060 area could lead to a more protracted correction.

China Announces Another Press Conference

Tuesday’s press conference from China’s National Development and Reform Commission created more questions than answers with Chinese stocks reacting negatively. The is deeply in the red again today, prompting a response from China’s administration. On Saturday, the Finance Ministry will detail its 2 trillion yuan fiscal stimulus package.

Failure from the Chinese officials to present a realistic but ambitious plan could open the door to another negative market reaction.