US Dollar on Front Foot Against Peers But Awaits Key US Data

2024.12.04 09:40

- Fed officials support further interest rate reductions.

- Probability of a 25bps rate cut in December increases slightly.

- Euro traders keep their gaze locked on French politics.

Dollar Awaits More Key US Data

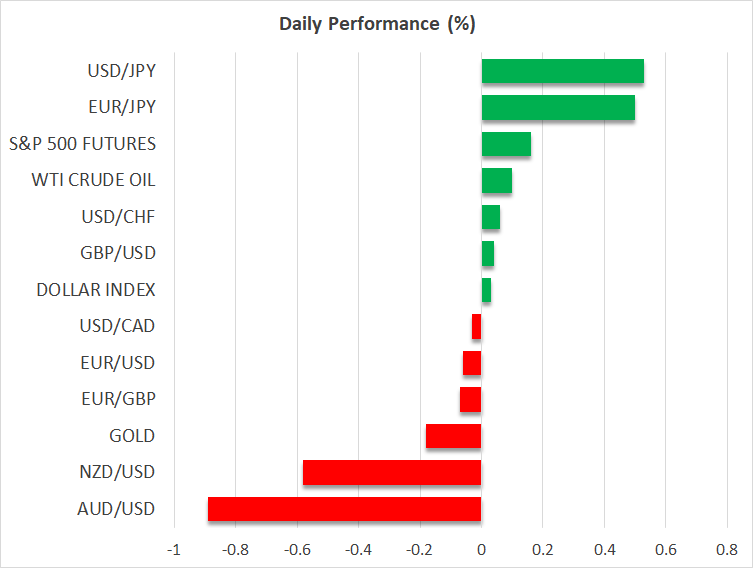

The traded mixed against its major peers on Tuesday, but it seems to be on the front foot against most of them on Wednesday.

Although the JOLTs job openings for October beat their forecast on Tuesday, the probability of the Fed pressing the rate cut button at its December 18 gathering increased to 73%.

Perhaps this was due to several policymakers stepping up to the rostrum and signaling support for further interest rate reductions. However, none of them pushed strongly to do so in December. San Francisco Fed President Mary Daly said that a cut at the upcoming meeting is absolutely not off the table, while Chicago Fed President Austan Goolsbee just said that next year, rates may come down a fair amount from where they are now.

Having said all that, even though the chances of the Fed taking the sidelines were reduced, the probability of a January pause remained elevated at 61%. Whether this percentage will go higher may depend on upcoming data and speeches from more Fed officials.

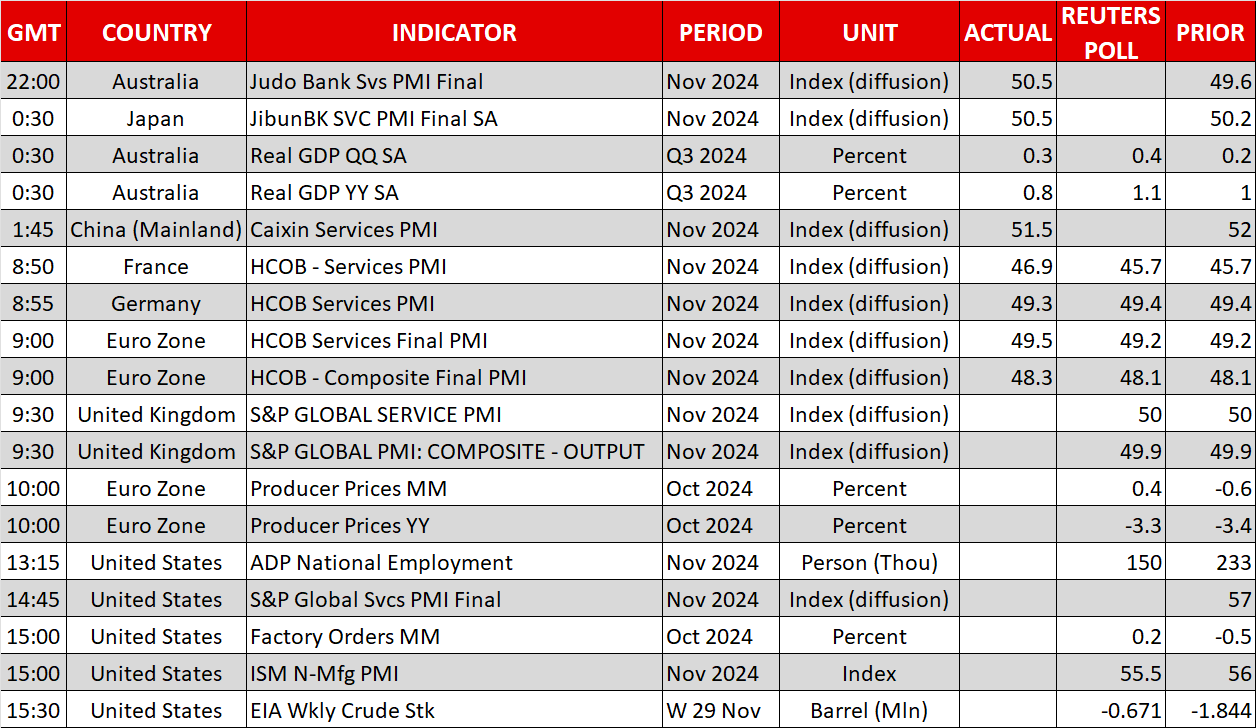

On Wednesday, ahead of Friday’s all-important NFP report, the agenda includes the ADP private jobs report, the final and , as well as the , all for the month of November. Fed Chair Powell will also give a speech.

Upbeat data followed by a reiteration of Powell’s view that the Fed is not in a rush to lower interest rates, could prompt market participants to increase their January pause bets, which could add more fuel to the dollar’s engines.

Euro Hostage to Politics, ECB’s Lagarde Speaks

bulls are eager to finally stage a sizable upleg against the dollar, but the newsflow remains bearish, especially on the political front. The French parliament is scheduled to hold a no-confidence vote on Wednesday against Barnier’s administration, and despite President Macron’s comments overnight, it would be extremely surprising if the vote fails. The largest parties in the French parliament have openly stated their distaste for Barnier’s 2025 budget, which includes bold tax increases and spending cuts.

A successful no-confidence vote means that France is back to square one. President Macron will be forced to find a new Prime Minister but considering the fact that his Ensemble alliance lacks a majority in parliament, the new administration is destined to fail again soon. At some stage, President Macron would have to consider calling new parliamentary elections or give the green light to other parties to form a government.

Coupled with the German general election in February, political developments in the Eurozone could continue to cast shadow over the euro, particularly as President-elect Trump takes over and starts implementing his agenda. This means that the ECB may once again be forced to pull the cart out of the mud. In this context, the market is anticipating a December rate cut, whose size is still being debated.

ECB President Lagarde will testify on Wednesday before the Committee on Economic and Monetary Affairs of the European Parliament. While this quarterly appearance does not tend to make headlines, Lagarde could use Wednesday’s testimony to signal her intentions ahead of next week’s ECB gathering.

Politics Heat Up in South Korea, Aussie Falls After GDP Data

Elsewhere, tumbled to its lowest level since November 2022 after South Korean President Yoon Suk-Yeol declared martial law saying that this was to counter “anti-state forces” within his political opponents.

Broader risk appetite was barely impacted by the news, with spiking higher very briefly, as the decision was revoked soon after it faced parliamentary rejection and public protests. The won pared a large portion of its initial losses. What’s more, the South Korean President is now facing impeachment calls.

The is suffering the most on Wednesday, coming under selling pressure after the softer-than-expected GDP data prompted market participants to bring forward their RBA rate cut bets. Ahead of the release, this Bank was expected to deliver its first quarter-point rate cut in May, but now it is seen doing so in April.