US Dollar, Gold Gain as Geopolitical Risks and Eurozone Data Worsen

2024.11.22 09:27

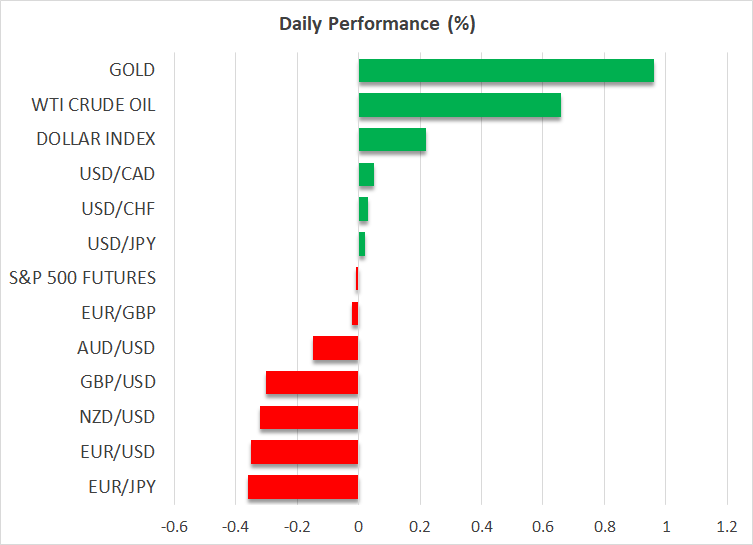

- Gold continues to gain, as geopolitics generates headlines

- Hawkish Fedspeak and strong US data support the dollar

- Euro suffers from another weak set of PMIs

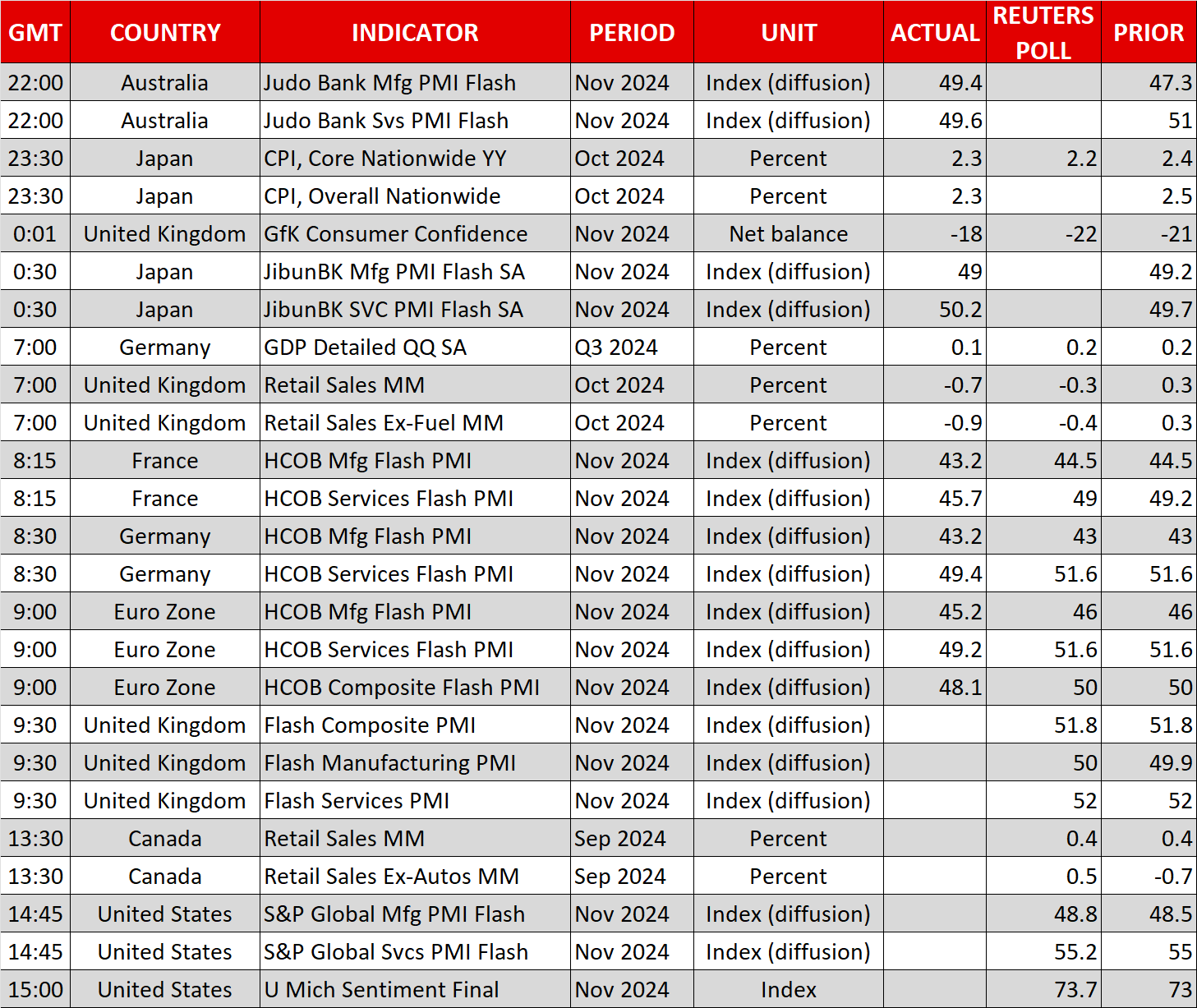

- Yen fails to benefit from stronger inflation

War Rhetoric Continues, Gold Takes Notice

The Ukraine-Russia conflict remains in the spotlight. The aggressive rhetoric from both sides continues, with US President Biden giving the green light for the use of anti-personnel mines, banned by more than 150 countries, and Russia responding by launching an intermediate-range ballistic missile.

These developments clearly constitute a severe escalation in a conflict that has been relatively frozen in the past few months. Interestingly, President-elect Trump has been quiet, not really commenting on the latest geopolitical events. He is busy assembling his cabinet but considering his pre-election statements about resolving this conflict, one would have expected more robust rhetoric from the next US president.

Gold Experiences Its Strongest Week of 2024

Most asset classes have not taken notice of these developments. On the other hand, has almost reached the $100,000 threshold, whereas gold continues to recover from its post-US election selloff. It is currently hovering below the $2,700 level, about 5% above its November 15 trough of $2,555. This is the strongest weekly rally for gold since the week of October 9, 2023.

It is quite interesting that this rally is taking place as the continues to strengthen. has dropped below 1.0500, for the first time since October 2023, as jobless claims fell to a seven-month low yesterday and Fedspeak keeps the door open to a pause at the December Fed meeting. While hawkish comments from Fed members like Michelle Bowman are not really surprising, Chicago Fed President Goolsbee really caught the market’s attention yesterday by stating that “it makes sense for the Fed to slow the pace of interest rate cuts”.

While Goolsbee was probably referring to the Fed’s 2025 rate strategy, it is becoming increasingly evident that the December Fed decision is not as clear-cut as most economists expect. At the most recent poll, almost 90% of economists penciled in a 25bps rate cut for the December 18 Fed meeting. However, the market is less convinced, as it is currently pricing in a 58% probability of such a rate move.

Euro Bulls Can’t Catch a Break

On the other side of the Atlantic, euro bulls appear powerless to stage a small recovery, particularly as the ECB prepares to further ease its monetary policy stance. With Germany remaining the “sick man of the euro area”, the preliminary PMI surveys failed once again to surprise on the upside, thus supporting expectations for a more forceful rate move on December 12.

Following today’s data, the market is pricing in a 43% probability of a 50bps rate cut in December. A significant slowdown in next week’s preliminary CPI report could go a long way towards cementing the 50bps rate cut, particularly as ECB members are mostly convinced that Trump’s return to the White House could almost automatically translate into new tariffs on the Eurozone’s exports to the US.

Yen Cannot Benefit From the CPI Report

The is on the back foot today, suffering small losses against the dollar, despite the stronger-than-expected inflation report. The upside surprise in the core inflation indicator is keeping the market’s hopes for a December meeting alive. Based on Governor Ueda’s recent rhetoric and the minority government’s plan for the supplementary budget, the market could be underestimating the BoJ’s determination to succeed in its current effort to push rates closer to normality, and hence potentially misjudging the yen’s strength going into December.