US Dollar Falls on Reports About Trump Softening Tariff Plans

2025.01.07 07:42

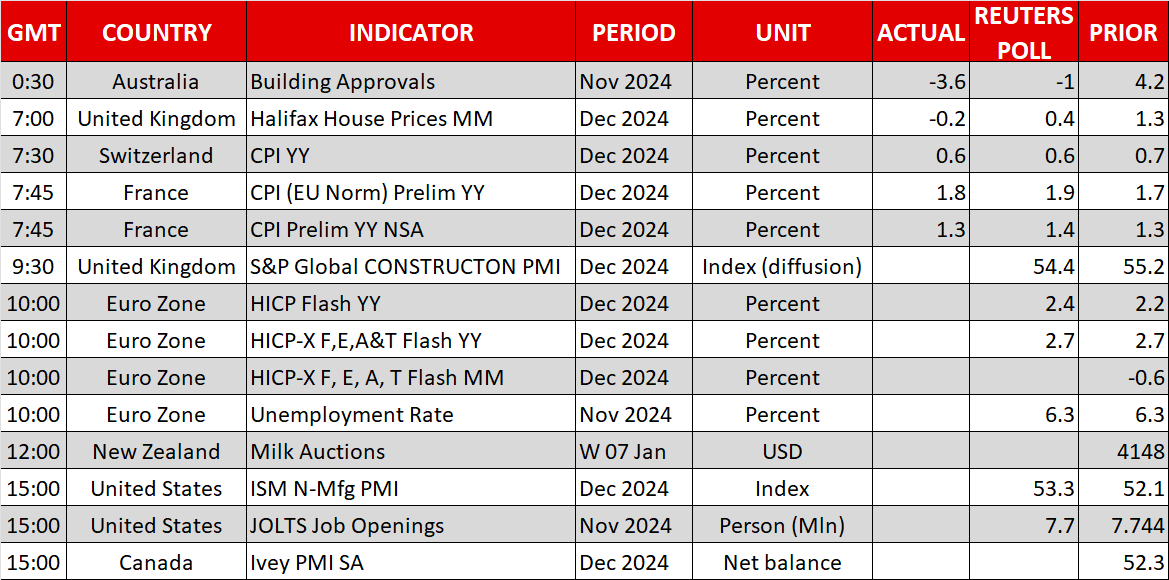

- Washington Post says Trump could scale back tariff plans.

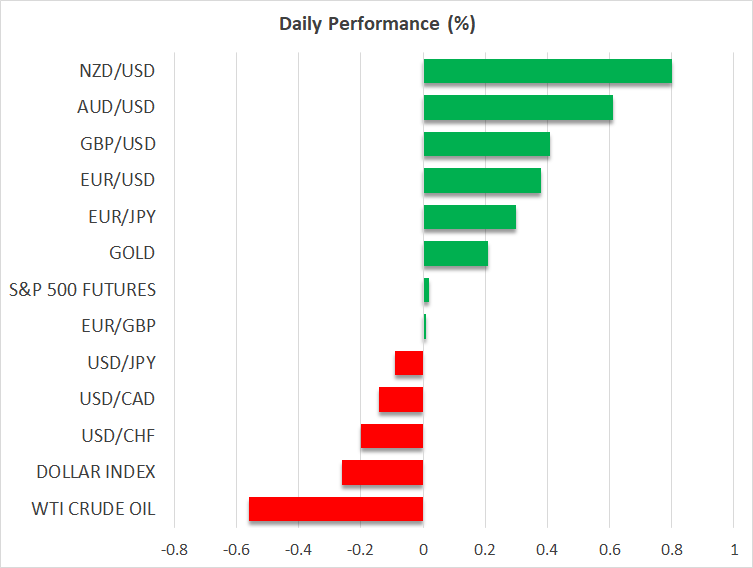

- Dollar drops; stays pressured even after Trump’s denial.

- Nasdaq and S&P 500 gain, driven by tech stocks.

Dollar Pulls Back on Tariff Reports

The slipped on Monday after the Washington Post reported that President-elect Donald Trump is planning to impose tariffs on every country, targeting only sectors deemed critical to US national and economic security. This eased concerns about tougher levies that could refuel inflation and that’s why the dollar pulled back after hitting a 25-month high on the first trading day of the year.

However, Trump denied the report, stating that the newspaper story was incorrect and that his tariff plans would not be pared back. The dollar bounced somewhat on Trump’s remarks, but surrendered to the bears soon afterwards, with the retreat continuing today.

Although Trump stuck to his guns, investors may have remained hopeful that his actions will not be as aggressive as his rhetoric, and anything corroborating that could allow further declines in the dollar and more gains in risk-linked assets.

Fed Rate Bets Not Shaken; Friday’s NFP Awaited

That said, Fed funds futures have not wavered, still pointing to nearly two quarter-point reductions by the this year.

Perhaps this was owed to remarks yesterday by Fed Governor Lisa Cook, who said that the Fed can afford to stay cautious about further rate cuts as the economy is faring very well and inflation has been stickier than expected. This means that what has been driving the dollar up and has prompted the Fed to reconsider its strategy were not only concerns about Trump’s policies but also having to factor in robust economic performance.

Taking that into account, investors may not be willing to continue selling dollars for much longer. More Fed policymakers are scheduled to speak this week, while on Friday, the all-important US jobs report will be released. Thus, should officials and the data enhance the notion that the Committee should remain patient, the dollar’s bleeding may stop, and the prevailing uptrend may resume.

German Inflation Data Lifts Euro Ahead of Eurozone’s Prints

The was yesterday’s main gainer, with the euro/dollar climbing and closing well above the 1.0340 key zone, driven not only by the Trump-related news but also by Germany’s higher-than-expected inflation numbers.

From around 110bps worth of rate reductions by the ECB this year, investors are now pencilling in 100bps.

Nonetheless, calling for a bullish trend reversal in the euro/dollar remains unwise as the divergence in policy expectations between the ECB and the Fed is still wide, while the political crises in France and Germany, as well as the uncertainty surrounding Trump’s tariff policy on European goods, constitute an extra headache for euro traders.

Tech Rally Boosts Wall Street

On Wall Street, both the and the eked out gains, with the former advancing more than 1% as the report on a less aggressive tariff policy by a Trump administration encouraged some risk buying.

On top of that, chipmakers like Nvidia (NASDAQ:) and Advanced Micro Devices (NASDAQ:) benefited from Microsoft’s (NASDAQ:) plan to invest $80bn to develop AI-enabled data centres. This development suggests that investors have yet to fully price in future growth opportunities related to AI, and therefore, any additional retreats due to bets that the Fed will proceed more cautiously with rate reductions are likely to prove limited and short-lived.

Combined with Trump’s pledges of massive corporate tax cuts, more headlines about AI-related plants by tech giants could allow Wall Street to resume exploring of uncharted territories.