US Dollar Baffled After Mixed Data and Fedspeak

2024.10.11 07:17

- Jobless claims contradict the stronger CPI report

- Fed’s Bostic talks about a November Fed pause

- Dollar trades sideways as the market still expects a November cut

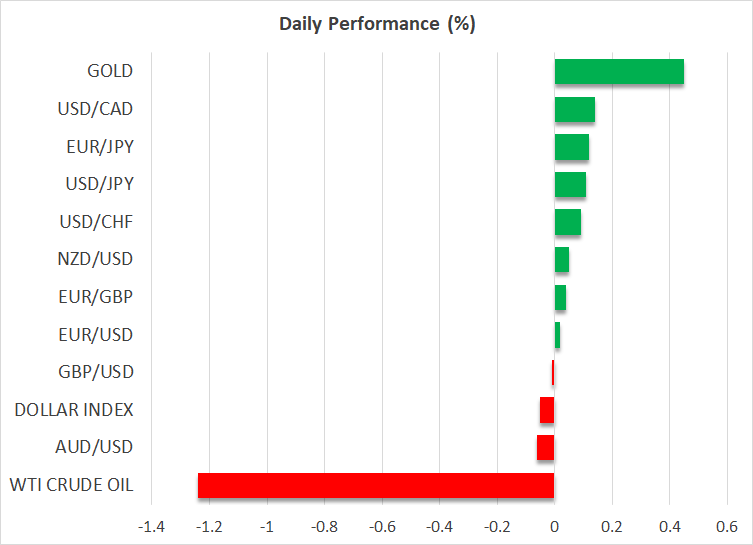

- Oil and gold in the green, pound doesn’t enjoy today’s data

CPI and Jobless Claims Jump, but Fed’s Bostic Makes the Headlines

The US inflation report managed to produce an upside surprise with both the headline and core indicators accelerating by an additional 0.1% on an annual basis compared to the economists’ forecasts.

On face value, these figures should have boosted the and caused a weakness in equities. However, the weekly claims figures also printed higher with the figure jumping to the highest level since May 2023, partly due to Hurricane Helene.

Since the US labor market is at the center of the Fed’s decision-making process, the post-CPI market movements proved short-lived with the market assuming that the stronger CPI report won’t stop the Fed from cutting rates at the November 7 meeting. Actually, the market-assigned probability for a pause at the next gathering dropped to just 7% after the claims’ release.

However, Atlanta Fed President Bostic decided to rock the boat by stating that “I am totally comfortable with skipping a meeting if the data suggests that’s appropriate”. This is the second consecutive day of hawkish commentary, as on Wednesday San Francisco President Mary Daly indirectly opened the door for a pause in November by stating that “one or two more rate cuts are likely this year”.

The dollar saw gains on the back of Bostic’s comments, but these quickly vanished as the market is relatively confident that the Fed won’t spoil the party and hence will announce a rate cut in November, even to the tune of 25bps.

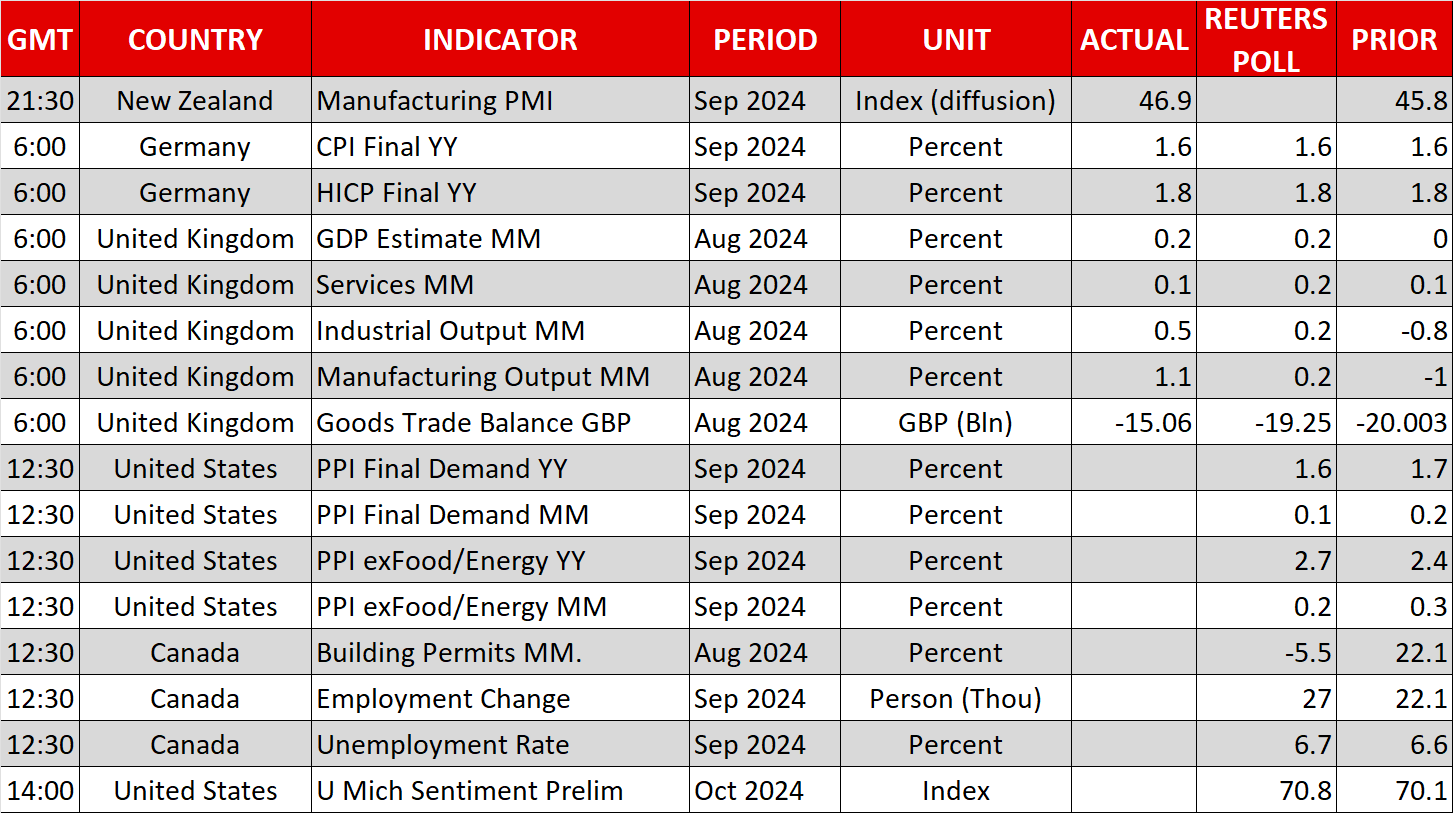

Fed rate cut expectations will remain in the spotlight again today as the September producer price index will be released and at least three Fed speakers will be on the wires, including Board member Bowman.

The sole dissenter at the September meeting, and a known hawk, might grasp the opportunity and advocate for a pause in November.

Oil, Gold Trade Higher in Parallel

remains in good spirits, hovering around the $75.50 area, as the barrage of attacks from both Israel and Iran’s proxies continue despite renewed efforts, mostly from France and the UK, for some sort of ceasefire.

Similarly, bounced aggressively higher after unsuccessfully trying to break below the $2,600 area.

China might have played a key role in gold’s performance, but, at the same time, it offers little assistance to the oil rally as the market remains very pessimistic about the impact of the new set of Chinese support measures. The index closed in the red again today as the new 500bn yuan SFISE facility (security, funds and insurance companies swap facility) has probably been deemed as insufficient.

Following Tuesday’s disastrous press conference, two more have been scheduled for Saturday and Monday, with some analysts joking that the Chinese administration will hold more press conferences than the actual number of measures announced. However, with the private firm IKEA calling for even more Chinese stimulus, the situation on the ground is probably worse than currently perceived.

Pound, Euro to Take the Front Seat Next Week

The countdown to next week’s ECB meeting has commenced with the recording its worst monthly performance against the dollar since January 2024. A dovish ECB cut on Thursday could extend the current weakness, particularly against the , which will be digesting the busy calendar of employment data to be published on Tuesday and Wednesday’s key CPI report. Despite the recent frailty, the pound remains one of the strongest currencies in 2024 with a 2.5% rally against the dollar.