US Dollar Awaits PCE Insights; Prepare for Adjustments Based on Fed Policy Signals

2024.11.27 10:24

- Dollar traders lock gaze on PCE inflation numbers

- Inflation stickiness could increase Fed pause chances

- S&P 500 and Dow Jones hit record highs, gold rebounds

Will PCE Inflation Data Increase Fed Pause Bets

Although Trump’s tariff threats triggered notable market moves early on Tuesday, some of the reaction was tempered later in the day, with the pulling back against all its peers on Wednesday.

Perhaps this may have been due to profit-taking ahead of today’s PCE inflation data, as fund futures are far from suggesting that investors have become less concerned about Trump’s tariff policies.

Anxious that aggressive tariffs and massive tax cuts could refuel inflation, market participants are still assigning a decent 37% chance for the Fed to take the sidelines in December, with the probability for that happening in January rising to 57%. Interestingly, there is a respectable 28% chance for the Committee to refrain from hitting the rate-cut button at both gatherings.

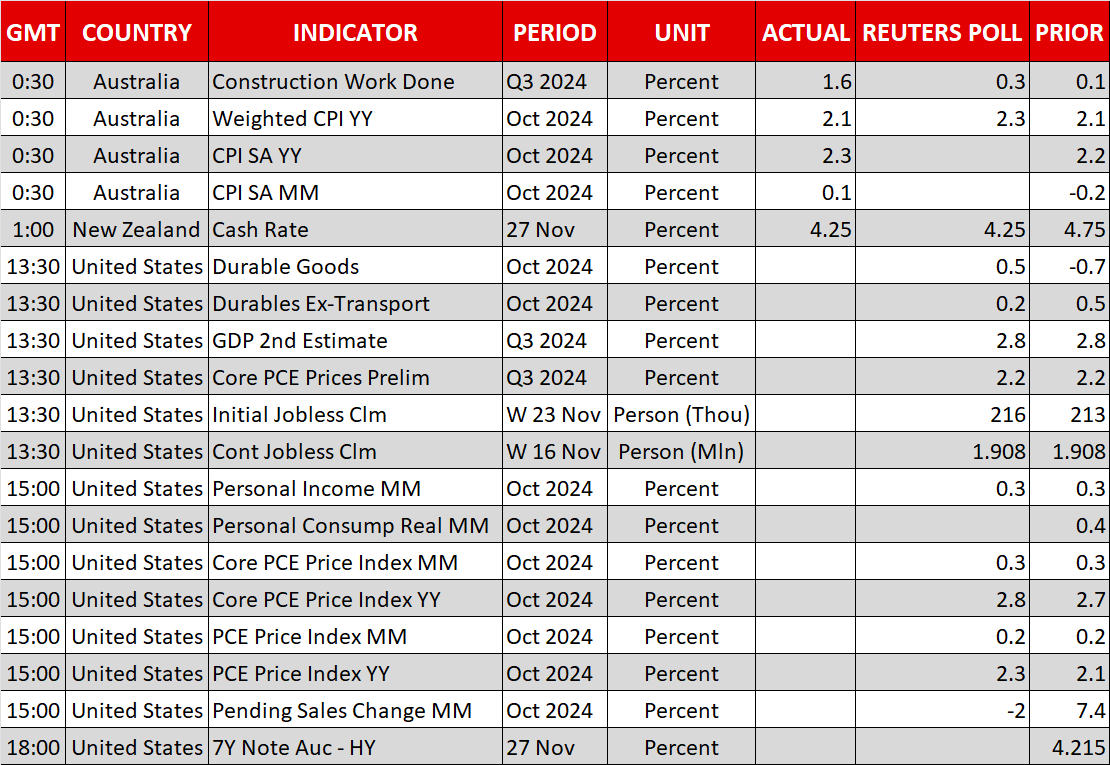

On Wednesday, the data is expected to show that US rebounded somewhat in October, with the index, the Fed’s favorite inflation gauge, seen accelerating to 2.8% y/y from 2.7%.

Should this be the case, the chances for the Fed stepping to the sidelines at the turn of the year could increase, thereby recharging the US dollar.

Kiwi Rallies on RBNZ, Yen Wears Safe-Haven Suit

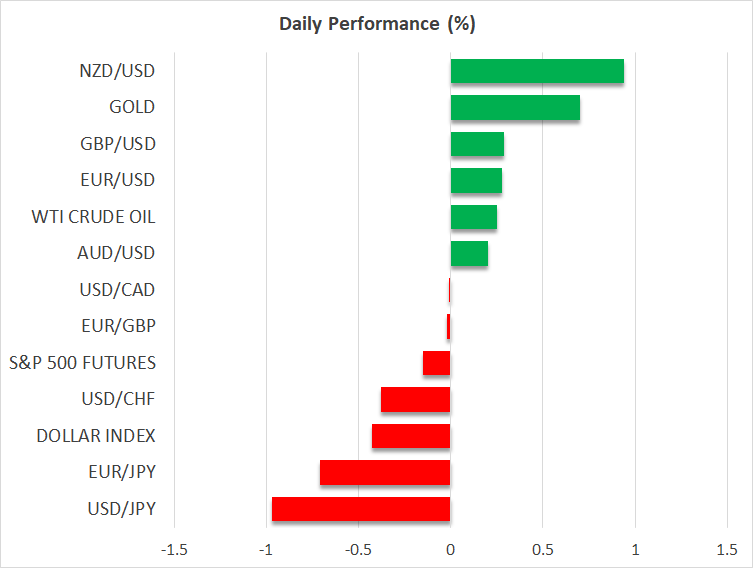

The and the are the main beneficiaries so far today, with the former spiking higher after the RBNZ cut interest rates by 50bps, disappointing those expecting a bolder 75bps reduction.

With no specific event to trigger the yen rally, it seems that the Japanese currency took its dusty safe haven suit out of the closet, and it may be attracting flows due to concerns regarding Trump’s tariff policies. On top of that, any turmoil between the US and China could strengthen Japan’s negotiating hand on trade in Asia.

In terms of monetary policy, the market is penciling in 15bps worth of rate hikes for December and 22bps by January. This could translate into two hikes, one worth of 15bps and one of 10bps, or one bigger quarter-point increase in January.

During the Asian session on Friday, Japan releases the numbers for November, which due to their strong correlation with the Nationwide prints, may be closely watched for signs on where Japanese inflation is headed. Thus, early evidence of sticky consumer prices may strengthen the case for the BoJ to press the hike button at both the December and January meetings.

Wall Street Defies Gravity, Gold Turns North

All three of Wall Street’s main indices edged north on Tuesday, turning a deaf ear to Trump’s tariff threats and ignoring the likelihood of a slower rate cut path by the Fed.

Both the and the entered uncharted territory, but with the gaining the most.

Perhaps this was due to the somewhat dovish Fed minutes, which weighed slightly on the probability for a December pause. But it could also be due to investors interpreting Trump’s determination to proceed with tariffs as strengthening the likelihood for implementing his promises on massive corporate tax cuts as well.

rebounded strongly, perhaps taking advantage of the weakness in the US dollar. Also, investors concerned about Trump’s tariff policies may have sought shelter in the precious metal, while the fact that a ceasefire between Israel and Hezbollah came into effect overnight may have allowed for some “buy the fact” response, given that gold tumbled significantly on the first headlines about a potential accord.