US Banks: The Good and the Bad

2023.03.28 08:44

Source: Macrobond, Federal Reserve, ING estimates

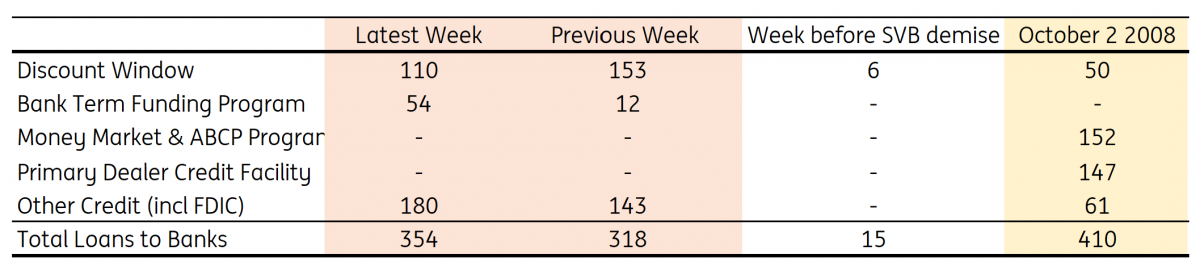

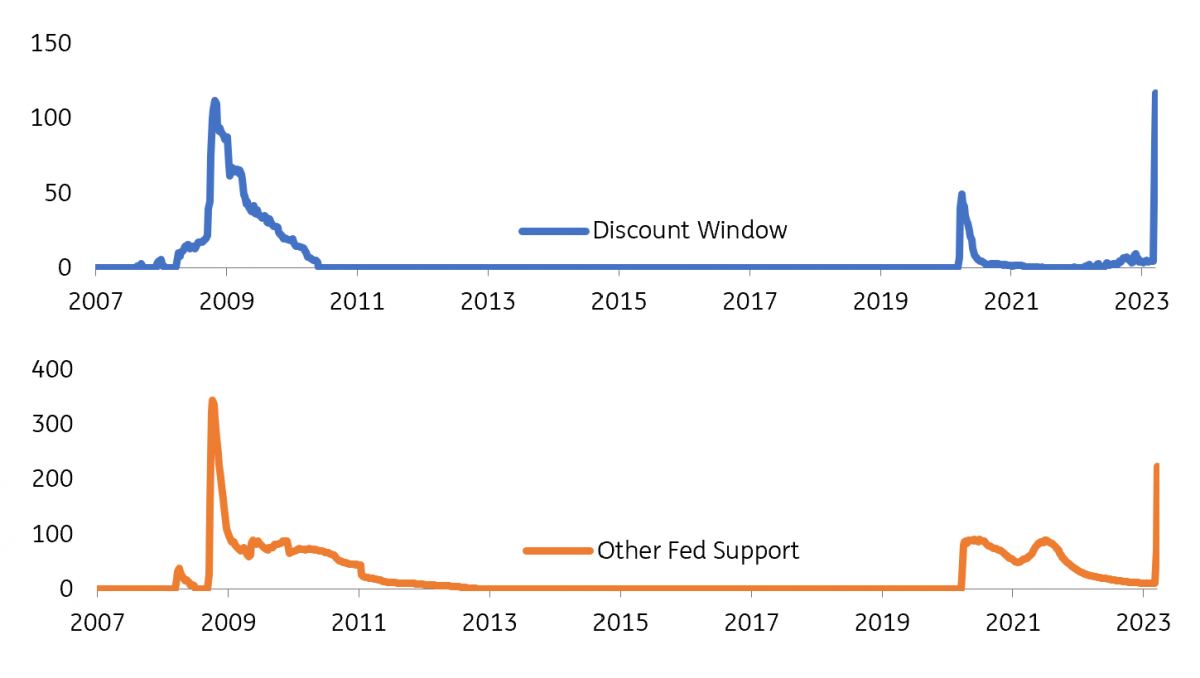

Fast forward to today, and the breakout of the US$354bn lent is very different. Some US$110bn has been provided through the discount window. This is the traditional means by which banks can access emergency liquidity. This had typically been provided at emergency terms too, but the Fed softened these and extended the available tenor.

The volumes here are similar to the peaks seen during the Great Financial Crisis (peaked at US$117bn at end-October 2008). The good news is the latest number is, in fact, down from the US$153bn drawn in the previous week, which suggests a calming (even if that was a calming from the highest Discount window drawdown on record).

The silver lining is that in the past week there was no perceptible increase in the use of emergency funding facilities

At the same time, the use of the new Bank Term Funding Program rose to US$54bn, up from US$12bn in the previous week (the first week of its existence). This facility is an alternative to the Discount window, the major differences being a 12-month tenor and better pricing terms. It’s a means to liquify hold-to-maturity bond portfolios, and even sub-par priced bonds get liquidity back priced at par (the bond redemption value). Basically, the fall in the use of the Discount window was offset by a rise in the use of the Bank Term Funding facility.

The silver lining is that in the past week, there was no perceptible increase in the use of emergency funding facilities.

Recourse to Discount Window and other facilities (US$bn)

Source: Macrobond, Federal Reserve, ING estimates

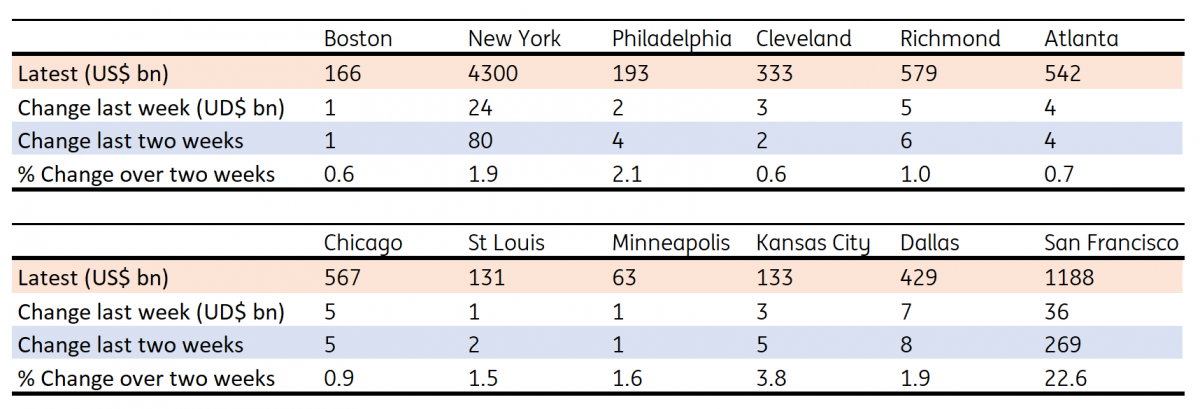

Also, we know from official commentary that a large chunk of the use of these facilities was for First Republic Bank, and if that’s the case, it’s likely that the rest of the banking system were not big takers. Also, if we look at the provision of liquidity and other interactions at Regional Fed Banks, there was no material evidence of a rise in angst at a regional level.

No material evidence of a rise in angst at a regional level

Most of the rise was at the New York Fed and the San Francisco Fed in the previous week, which most likely was a direct consequence of Signature Bank (NASDAQ:) in New York and Silicon Valley Bank and First Republic Bank on the West Coast.

Breakout of Regional Fed interactions with local banks (US$bn)

Source: Macrobond, Federal Reserve, ING estimates

A final important aspect to this is the loans provided as a corollary of the Federal Deposit Insurance Corporation provision of support. All deposits at Signature Bank and Silicon Valley Bank were made whole. That now sums to US$179bn, which includes the US$36bn increase for the latest week.

On the asset side of bank balance sheets, the sub-par pricing of hold-to-maturity bond portfolios is no longer an issue, as they can be liquified at the Fed, at 100%. Mortgages can also be liquefied through exchanges with Freddie Mac (OTC:) and Fannie Mae, but valuations at the point of exchange is more open to interpretation.

Liquidity is king right now, making things tough for the banks, as their job is to transform liquidity into ‘assets’ subject to illiquidity and / or price uncertainty. Right now, many small banks need that liquidity back, and there’s the rub.

It does not have to go wrong though, and looking at the hard evidence away from financial market vagaries, evidence over the past week suggests that things are at least not taking a deep dive here in the US. That of course can change, but the latest week has in fact seen some stabilisation.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user’s means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Original Post