U.S. Recession Risk Remains Low, Defying Recent Forecasts

2023.07.11 08:18

New York Fed President John Williams says “I don’t have a recession in my forecast.” Neither does CapitalSpectator.com. That’s not blind adherence to a central banker’s prognostications. Rather, the view on these pages is based on the data. Not a single indicator but a broad sweep of the numbers.

The obvious caveat: everything could change tomorrow. That’s always true, which is why it is crucial to reassess every day as fresh numbers become available. But with the current set of figures in hand, the current profile looks persuasive in that US recession risk remains low in the here and now. Looking ahead into the near-term future suggests the same.

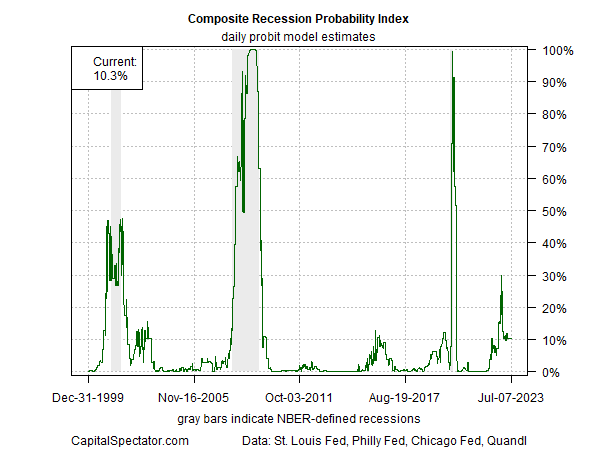

Here’s the reasoning supporting this view. The starting point is the low-recession-risk estimate, the primary indicator that’s featured in the weekly updates of The US Business Cycle Risk Report. The Composite Recession Probability Index (CRPI) currently estimates that an NBER-defined downturn in progress is just 10%.

Until CRPI, which aggregates signals from several multi-factor business-cycle indicators, reaches 50%-plus, a growth bias to some degree will likely prevail. (For details on CRPI, see page 9 in this recent sample of the newsletter.)

Composite Recession Probability Index

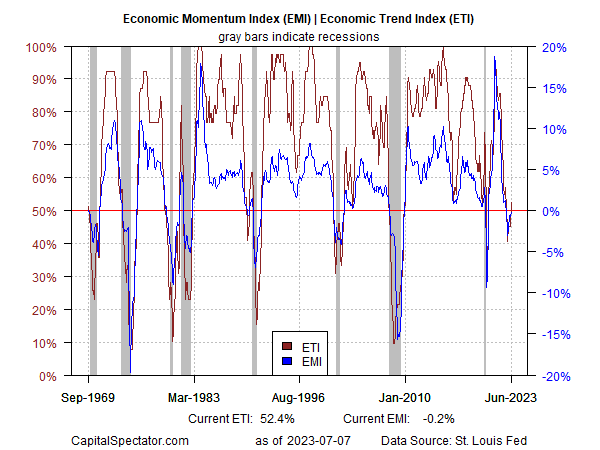

The near-term future also looks relatively upbeat, based on a pair of proprietary indicators featured in The US Business Cycle Risk Report. I use the Economic Trend Index (ETI) and Economic Momentum Index (EMI) as the basis for peering ahead by one to two months for the US macro trend. First, let’s look in the rearview mirror — here’s how the histories for ETI and EMI stack up through June, based on published data to date.

ETI – EMI Chart

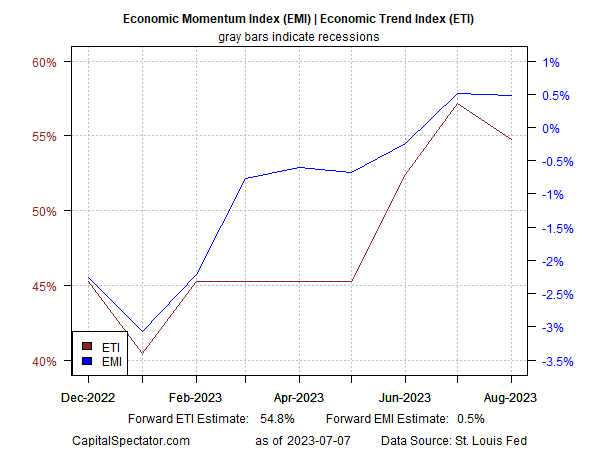

Using a statistical technique that estimates the forward values for each of the underlying 14 indicators used in the ETI and EMI and then aggregating the results suggests that both indicators will continue to signal expansion through August. It’s a relatively modest/weak expansion, but for the moment, it’s enough to keep the recession forces at bay.

EMI – ETI Chart

Forecasts are always suspect, of course, but the technique I use to generate forward estimates of ETI and EMI is reliable and time-tested, and so I’m confident that these projections will prove to be fairly accurate approximations of the actual numbers once the data is published.

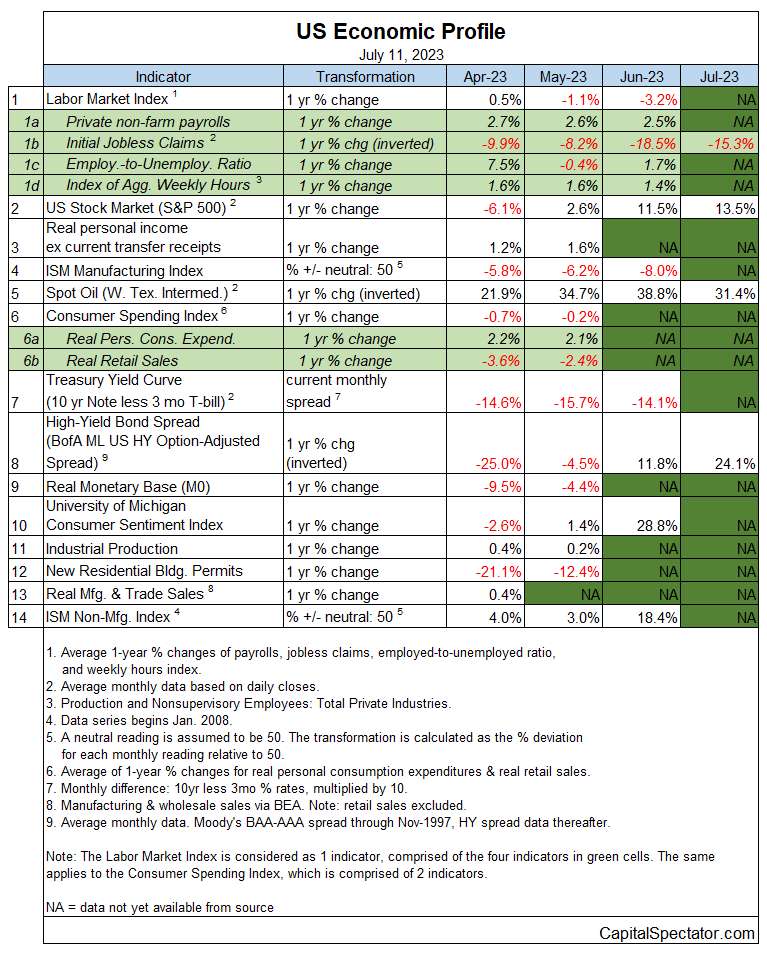

Finally, here’s a look at the underlying data sets that comprise ETI and EMI:

This is a framework for my canary in the coal mine. If the current optimism for the economic expansion starts to go south, the early warning will show up here. In theory, the earliest that a recession could start is in June, which is still a work in progress in terms of published data.

But the current degree of economic momentum is probably too strong to derail the high probability that the expansion will persist through June. My projections for July and August offer a similar, albeit somewhat less-confident, analysis. The further out we look, the lower the confidence that the analysis is accurate.

In short, recession risk remains low in real-time and in the near term. Presumably, that will be true tomorrow, but I’ll re-run the incoming numbers to check. Guesstimating if a US contraction has started, or is at high risk of starting, is a perpetually evolving estimate, one day at a time.