U.S. Real Interest Rates Could Plummet: What This Means for Gold Prices

2023.04.18 03:31

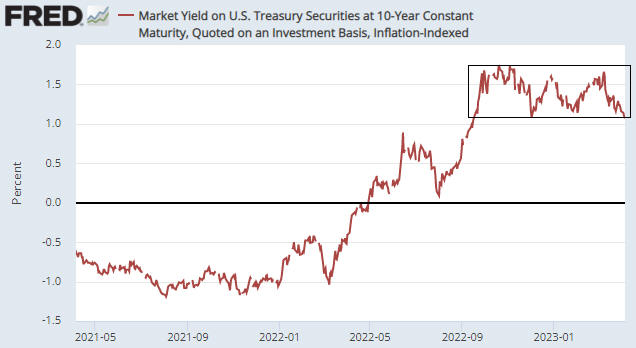

The following chart shows that the yield on the (Treasury Inflation-Protected Security), a proxy for the real long-term US interest rate, has oscillated within a horizontal range over the past seven months. These interest rate swings may not appear to be significant, but they have had significant effects on the financial markets in general and the market in particular.

TIPS Yield Chart

With regard to the effects on the gold market of the recent swings in the 10-year TIPS yield, we note that:

- The multi-year high recorded by the 10-year TIPS yield on 3rd November of last year coincided with the end of a multi-year downward correction in the US$ gold price.

- The short-term low in the 10-year TIPS yield on 1st February of this year coincided with a short-term peak in the US$ gold price.

- The short-term high in the 10-year TIPS yield on 8th March coincided with the end of a short-term correction in the US$ gold price.

- The US$ gold price rocketed upward from 8th March through to the end of last week as the 10-year TIPS yield moved back to the bottom of its range.

With the 10-year TIPS yield now at the bottom of its 7-month range, the most likely direction of the next multi-week move is upward. However, at some point there will be a sustained breakout from this range, with major consequences for the financial markets.

If the eventual breakout in the 10-year TIPS yield is to the upside, it will be bearish for everything except the US dollar. This is a low-probability scenario because it would require the Fed to either continue its monetary tightening in the face of severe economic weakness or take no action when presented with obvious evidence of deflation.

If the eventual breakout in the 10-year TIPS yield is to the downside, the consequences for asset and commodity prices will depend on whether the primary driver of the breakout is a falling nominal yield or rising inflation expectations (the real interest rate is the nominal interest rate minus the EXPECTED inflation rate).

A downside breakout in the real interest rate that was driven by a falling nominal yield would be bullish for gold. It probably also would be bullish for the relative to other major currencies while being bearish for most commodities and equities. This is because it likely would result from severe economic weakness. A downside breakout in the real interest rate that was driven by rising inflation expectations would be bullish for gold but more bullish for cyclical commodities (e.g., industrial metals) and equities. It would be bearish for the US dollar.

We expect that at some point within the next four months, the 10-year TIPS yield will make a sustained break below the bottom of its range, primarily due to falling nominal interest rates. It could happen as soon as this month, but July-August is a more likely timeframe. It mainly depends on how quickly the economy deteriorates.