U.S. Inflation Surprise Pummels Stocks, Boosts Dollar

2022.09.14 07:29

[ad_1]

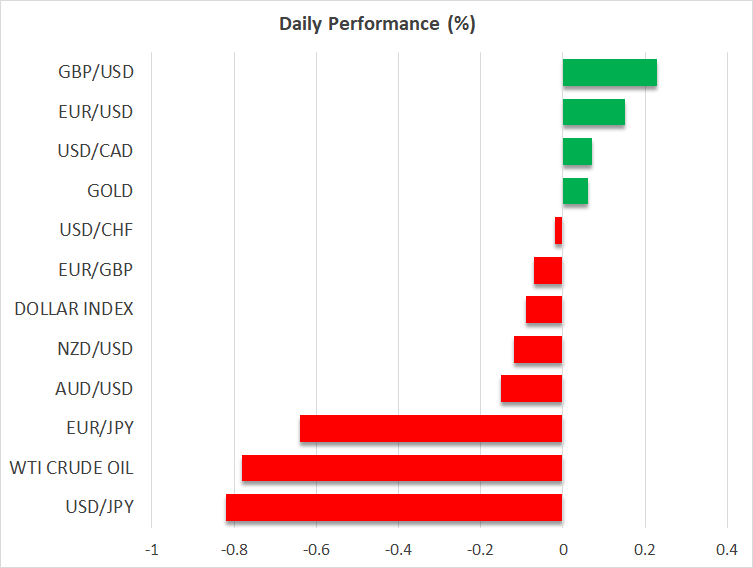

- US inflation comes in hot, fueling bets of a more forceful Fed

- Stock markets tank, dollar fires up as terminal rate increases

- Yen finds some support after Japan threatens FX intervention

Inflation shock

Hopes that the Federal Reserve is about to ease off the brakes got crushed yesterday under the boot of another shockingly hot US inflation report, sending shockwaves across global markets. Consumer prices defied forecasts for a monthly decline and instead rose in August, keeping the yearly rate running at an elevated 8.3% despite the continued decline in gasoline prices.

Most importantly, the core rate that strips out volatile items like energy and food rose sharply. Rising rents and healthcare costs were at the tip of the spear, which suggests that price pressures are broadening out into ‘stickier’ categories, making them harder to extinguish.

With underlying inflation going in the wrong direction and the labor market still near full employment, market participants concluded the Fed will have to roll out even bigger guns to cool the economy. A three-quarter point rate increase for next week is now locked in with a 65% probability, with the alternative being a full percentage point move that was not even on the table prior to the inflation release.

Equities sink

Apart from adding to bets around what the central bank will deliver next week, investors also raised the profile for the terminal Federal funds rate, which is now expected to peak at 4.3% in the first quarter of next year. This number was below 4% last week, so it has risen quite dramatically, putting tremendous pressure on every asset class.

Wall Street suffered some heavy damage, with the S&P 500 losing a stunning 4.3% as technology stocks were decimated. Tech shares and unprofitable names are especially sensitive to changes in interest rates since their valuations are based mostly on expectations of future growth. When discount rates move higher, the present value of their future earnings declines, leaving them vulnerable to valuation compressions.

Beyond the valuation angle, there is also a sense that the harder the Fed raises rates, the higher the risk of a recession that chips away at earnings. Bond traders have been screaming that the economy is in the danger zone for some time now and those warnings got louder yesterday as the yield curve inversion deepened, signaling a gloomier outlook for growth.

Dollar smiles, yen stabilizes

The undisputed winner was the US dollar, which enjoyed a double boost from rate differentials widening in its favor and safe haven flows as nervous investors sought shelter from the storm in equity markets. Hiding in the reserve currency has been the only winning trade this year and this dynamic is unlikely to change as long as the Fed keeps beating other central banks to the punch and the prospects for the global economy are deteriorating.

Over in Japan, the authorities have dialed up their rhetoric on FX intervention. The government escalated its warnings by characterizing the moves in the yen as reflecting speculation and not fundamentals, while the Bank of Japan called dealers at major banks to check yen prices, a practice that has preceded currency intervention in the past.

This is essentially an ultimatum, with Japanese authorities trying to flush speculators out of short yen bets without getting their hands dirty. While the jawboning was enough to stop the bleeding in the yen for now, the virtues of actual intervention to prop up the currency are questionable as it would be extremely costly, unlikely to succeed without global assistance, and could even backfire.

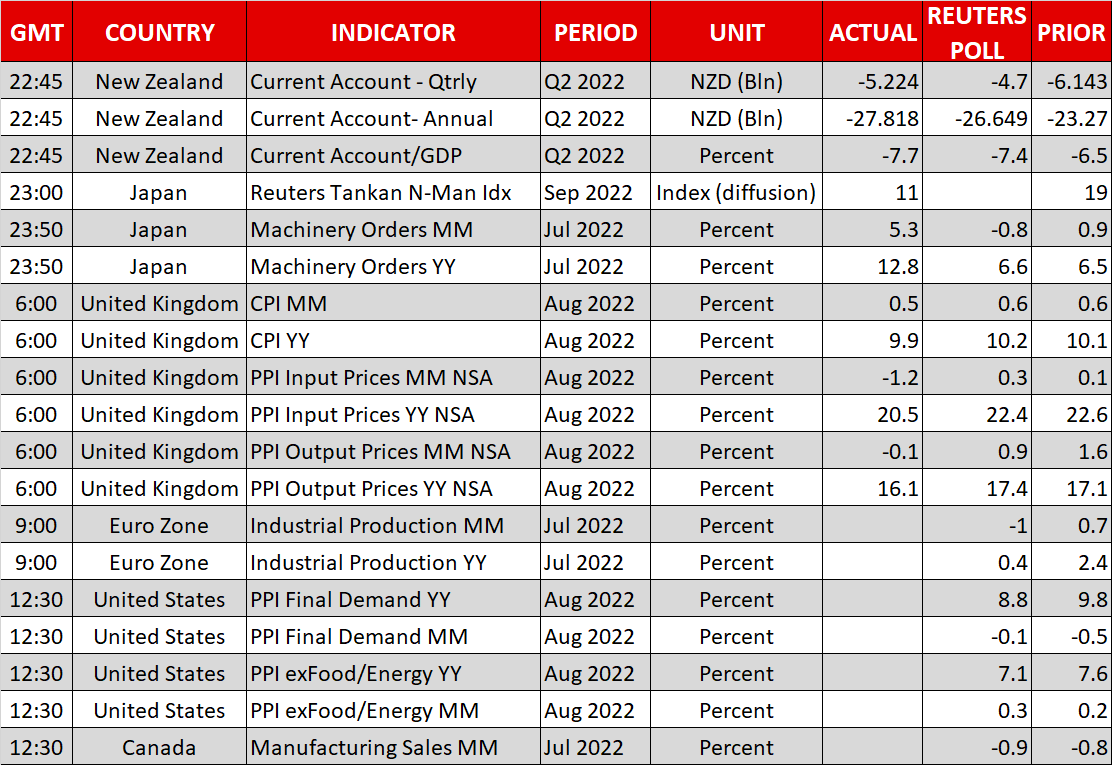

As for today, the latest batch of UK inflation data has already been released and was a mixed bag. The spotlight will now turn to producer prices out of the US.

[ad_2]

Source link