U.S. GDP Growth Nowcast Edges Higher for Upcoming Q2 Report

2023.04.11 10:19

Recession forecasts for the US continue to swirl, but the risk still looks low from the perspective of expectations for the first-quarter GDP report that’s scheduled for April 27, when the Bureau of Economic Analysis will publish it’s preliminary report.

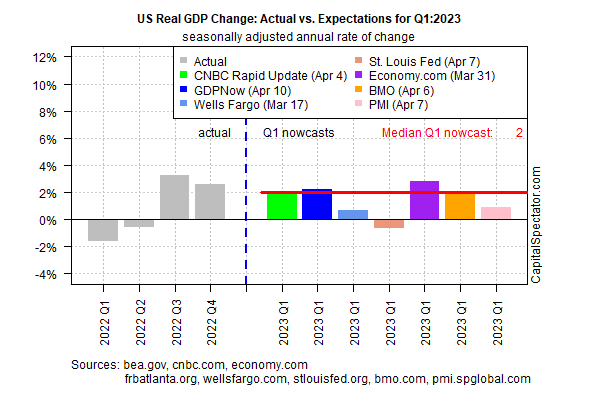

The median estimate for Q1 continued to rise, based on based on a set of nowcasts compiled by CapitalSpectator.com. Today’s update points to a 2.0% increase (seasonally adjusted annual rate). That marks a moderate downshift from the 2.6% increase for Q4, but today’s estimate also suggests the odds are still low that a new recession has started.

US Real GDP Actual vs Expectations

Note, too, that the current median nowcast increased modestly from the previous 1.7% for Q1, published on March 29. In turn, the previous nowcast marked an upturn from the March 10 update.

Despite the recent strengthening of median GDP nowcast, recession chatter remains on the boil. Business Insider notes this week:

“Fears of an imminent recession have reached a fever pitch this year, with everyone from Wall Street market strategists to company CEOs warnings of a slowdown in the US economy.”

That’s due in part to the deteriorating outlook for corporate earnings, which implies trouble ahead for the economy.

“Estimated earnings for the S&P 500 for the first quarter are lower today compared to expectations at the start of the quarter. The index is now expected to report its largest year-over-year decline in earnings since Q2 2020,” advises FactSet’s John Butters in a research note.

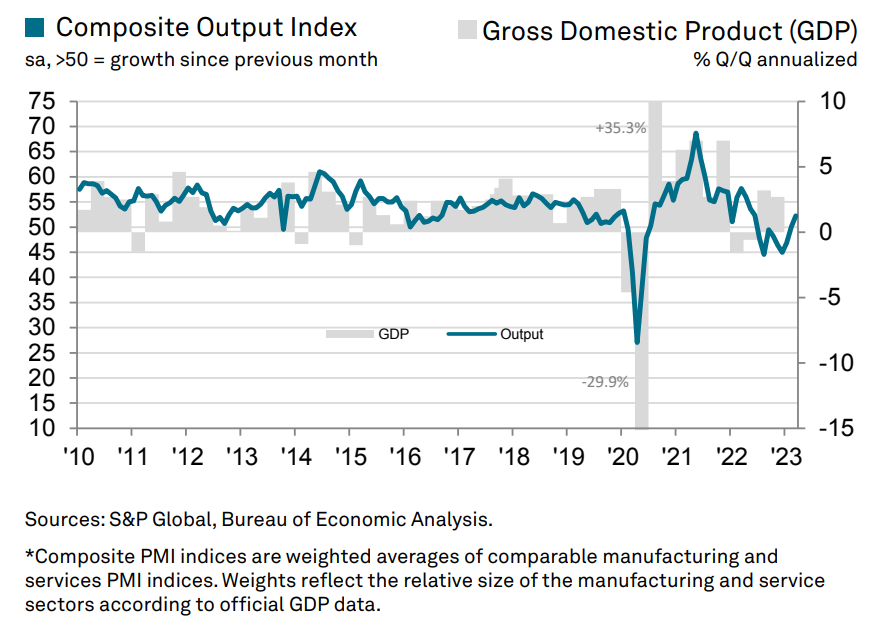

Yet the gloomy forecasts from various sources have pushed up the start date for trouble in the wake of firmer expectations for this month’s Q1 GDP report. One example of the revival in real-time evaluations of economic activity comes by way of the latest PMI survey data, which points to a stronger run of economic activity in recent months.

“Driving the upturn in activity was a renewed expansion in new business in March,” reports S&P Global in last week’s release of its Global US Composite PMI (a GDP proxy) for March. “The rate of growth was only marginal overall but brought to an end a five-month sequence of decline. The upturn was led by domestic demand as a broad-based contraction in new exports was recorded again.”

Composite Output Index – GDP Annualized

Composite Output Index – GDP Annualized

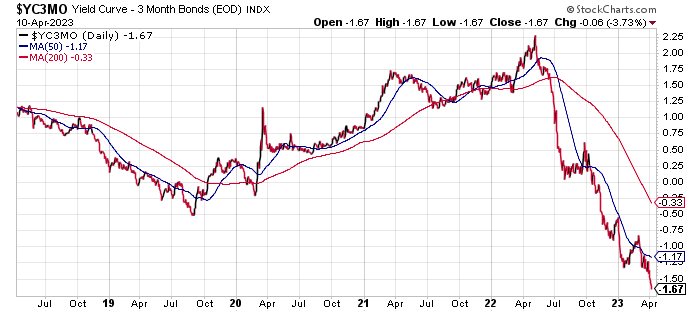

Nonetheless, some analysts say it’s just a matter of time before the rapid increase in interest rates over the past year tip the economy into recession. Among the signs that are widely cited: the deeply negative Treasury yield curve. The 3-month/10-year spread, for instance, is currently negative by 1.67 percentage points.

But some observers aren’t buying the dark outlook. “The bond market has gone berserk,” says Dominique Dwor-Frecaut, a senior market strategist at the research firm Macro Hive and a former analyst at the Fed. “For once, I’m on the side of equity markets. I don’t see a recession coming.”

The current GDP nowcast for Q1 agrees. What lies ahead for Q2 and beyond is another topic, but for the moment the search for a smoking gun in the hard data for real-time economic activity still skews positive.