U.S. Economy Set to Continue Growing in Q2

2023.06.06 08:24

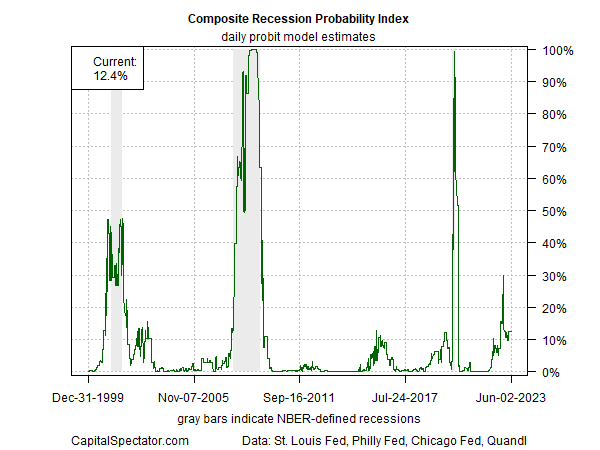

The odds remain low that the US will slip into a recession in the second quarter, based on current nowcasts compiled by CapitalSpectator.com. Although recession forecasts endure, the numbers suggest the economy will continue to expand in the near term.

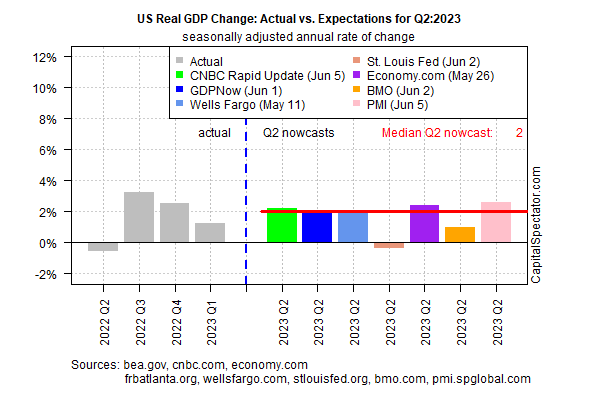

The median estimate for Q2 is a 2.0% rise in output (seasonally adjusted annual rate for GDP). The gain marks a moderately faster pace vs. the sluggish 1.3% gain reported for Q1.

The Bureau of Economic Analysis will publish its initial Q2 estimate for GDP on July 27. But with roughly half of the current quarter’s numbers in hand, the outlook is skewing positive for expecting that the US will continue to skirt an NBER-defined downturn in the current quarter.

Actual vs Expectations for Q2-2023

Today’s Q2 nowcast marks an uptick from the 1.9% median estimate in the previous (May 19). The key point: the persistence of moderate growth in the recent nowcasts suggests that the economy isn’t in immediate danger of contracting.

The strong gain in in May certainly supports the upbeat outlook for the near term. The economy added 339,000 jobs last month, the most since January.

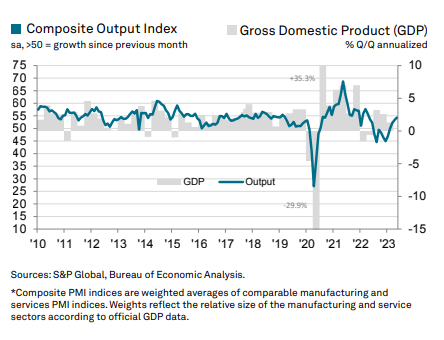

Bullish numbers for the economy are also conspicuous in yesterday’s survey-based estimate of GDP for May via US . The index’s 54.3 print last month reflects “the fastest expansion in business activity for just over a year,” S&P Global (NYSE:) reports.

“The survey data are indicative of GDP growing at an annualized rate of just over 2%, and an upturn in business expectations points to growth remaining robust as we head further into the summer,” says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

Composite Output Index

A similar view has been unfolding in recent months in the analytics of The US Business Cycle Risk Report (BCRR), which has been advising subscribers for much of this year that the weak economic data in late-2022 has been rebounding. As a result, the newsletter’s primary real-time recession indicator – an aggregate of various business-cycle indexes – currently estimates a modest 12% probability that the economy is in recession.

CRP Index Chart

There are several risk factors lurking that could tip the economy over the edge in the second half, and it would be naive to dismiss the possibility of trouble ahead. But such forecasts of recession are highly speculative at this stage. By contrast, BCRR’s forward estimates for economic activity through July strongly suggest that the US economy will continue to expand through the kickoff to Q3.