U.S. Dollar Subdued, Euro Rebounds, Yen Retreats

2023.01.20 06:51

[ad_1]

- Dollar trades lower even as initial jobless claims beat estimates

- Euro rebounds after Lagarde appears hawkish

- Yen retreats, but stays in broader uptrend

- Wall Street records another day of losses

Dollar unimpressed by slide in jobless claims

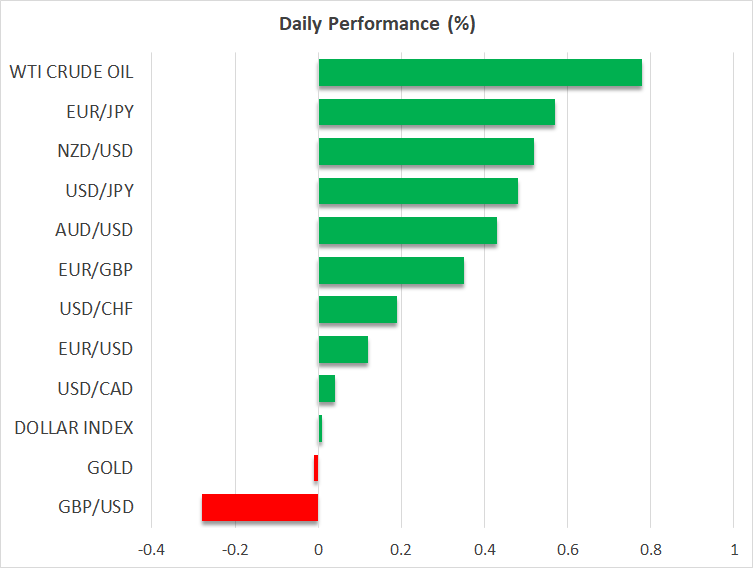

The US dollar finished Thursday lower against most of the other major currencies, gaining only versus the risk-linked and . Today, the greenback is losing against all except the yen and the pound.

It seems that investors are still trying to estimate the proper path for the US interest rates hereafter, despite Fed policymakers insisting that it is a clear case. Interest rates will rise beyond 5% and stay there for a prolonged period, they argue. Market participants took their implied terminal rate down to 4.85% following Wednesday’s bunch of disappointing data, but today they decided to lift it to 4.90%.

Maybe their decision was based on the better-than-expected initial jobless claims for last week. Instead of rising to 214k from 205k, the number of Americans filing new claims for unemployment benefits dropped to 190k from 205k, suggesting that the labor market remains solid and thereby, that interest rates could move a bit higher.

Yet, the US dollar did not stage a decent comeback. It actually finished the day lower against most of its peers; another proof that investors are more willing to sell when the data confirms their pivot hypothesis, rather than buy when the opposite is true. This is evident by the market pricing as well. Although they lifted somewhat their implied terminal rate, investors are still keeping it below the 5.125% level indicated by the Fed’s latest dot plot, while they are still anticipating nearly 50bps worth of interest rate cuts by the end of the year. And that’s even after two more Fed officials stressed that they would probably need to raise rates to slightly beyond 5%.

Lagarde pushes back on slowdown rumors, euro rebounds

The euro managed to rebound and return above $1.0800, perhaps aided by ECB President Lagarde’s remarks yesterday at the World Economic Forum in Davos. Specifically, the ECB chief said that inflation is way too high and that they will stay the course of rate hikes, pushing back on recent reports suggesting that ECB officials are considering slowing their rate increments at the March gathering. She also warned that ECB doubters should “revise their positions,” adding to the determination to continue with more 50bps rate hikes.

Compared to market expectations of about a 25bps hike by the Fed at its upcoming gathering, as well as rate reductions later this year, this is likely to keep euro/dollar supported. Traders’ stubbornness to keep the pair above $1.0800 suggests that, should new data allow it, they may be willing to take the price action all the way up to the $1.1175 territory, defined as a resistance by the high of March 31. That zone also acted as strong support between November 2021 and February 2022.

The yen is pulling back again today, even as Japanese inflation accelerated, with both the headline and core rates at double the BoJ’s 2% target. Despite the yen’s pullback, the data adds credence to investors’ view that the Bank may need to continue removing accommodation. Following the Bank’s decision earlier this week to stand pat, investors may have just pushed their expectations for more action to the April meeting, the first after Governor Kuroda steps down, and the next that will be accompanied by updated economic projections.

Wall Street slips for another day

All three of Wall Street’s main indices finished another day in the red, perhaps due to mounting recession fears after Wednesday’s disappointing US economic data, but also after the initial jobless claims encouraged some investors to drive their implied terminal rate slightly higher. That case is also supported by the small rebound in Treasury yields.

Having said all that though, with investors staying convinced that the Fed will eventually need to cut interest rates at some point this year, the main driver for equities may be fluctuations in investors’ mood regarding a potential recession in the US. Ergo, should economic data and earnings results continue to add to such fears, equities are likely to continue drifting south for a while longer.

Gold took full advantage of the dollar’s setback and the recession fears, and despite the small rebound in Treasury yields it posted another leg north. Expectations of rate cuts by the Fed and anxiety about a potential recession are a positive blend for the yellow metal, which seems to have regained its safe-haven status. With the next resistance being the round number of $2,000, it seems that bullion has ample room to continue drifting north.

[ad_2]