U.S. Dollar Stays Strong, Pound Plummets as UK Inflation Eases

2023.02.16 06:33

- US retail sales rebound strongly, adding to soft landing hopes

- Dollar climbs higher as investors maintain Fed hike bets

- Pound falls as slowing inflation alleviates pressure on BoE

- Equities gain, but gold extends decline

US retail sales rise most in two years, dollar extends gains

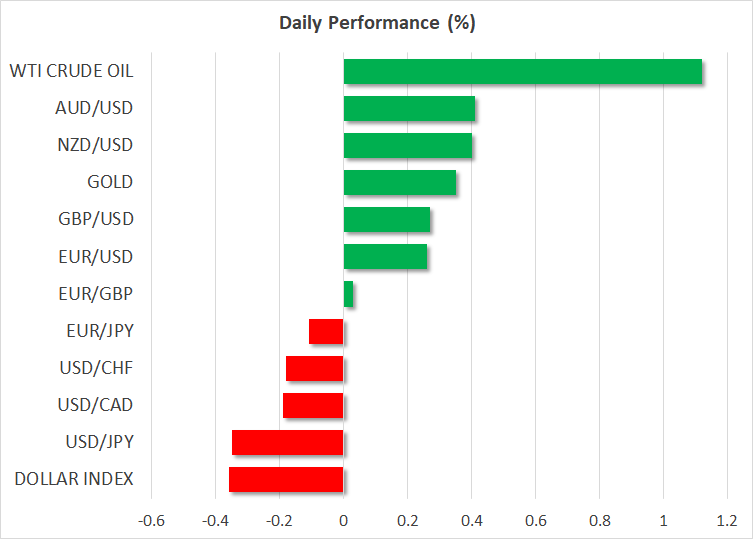

The US dollar continued to march north on Wednesday, outperforming all the other major currencies, although it pulled back somewhat today.

What added extra fuel to the dollar’s engines may have been the hotter-than-expected US retail sales data for January. Both headline and core sales rebounded strongly, exceeding analysts’ estimates by a large margin, after shrinking for two months in a row. It is worth noting that the surge in headline sales was the fastest in nearly two years and paired with the acceleration in the monthly CPI for the month, the stellar NFP gains, and the rebound in the ISM non-manufacturing PMI, it adds to hopes of a soft landing and thereby further justifies investors’ choice to raise their projections about the Fed’s future course of action.

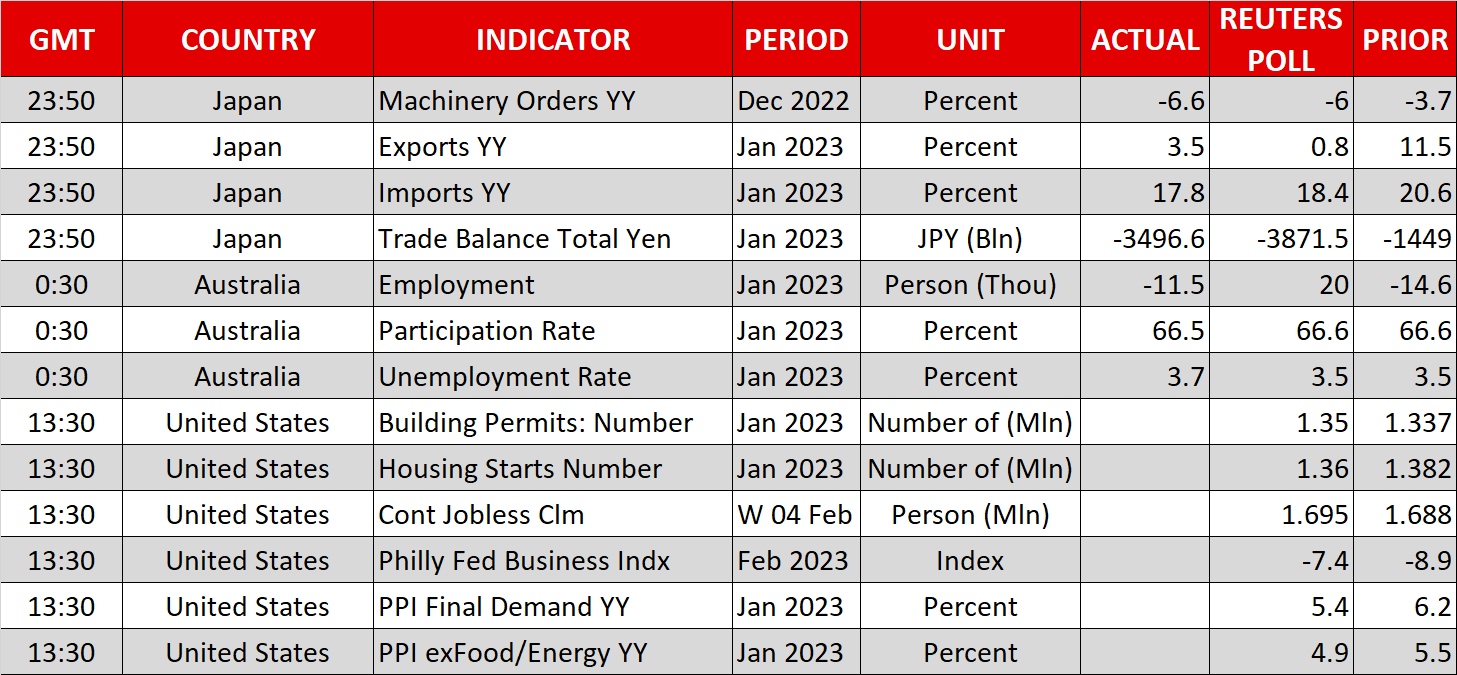

More data suggesting that the US economy might avert a recession could keep the dollar supported for a while longer. But, calling for a long-lasting recovery remains premature, as ahead of the next Fed meeting, which is scheduled for March 21-22, the economic agenda is packed with plenty of US data, including the employment and inflation reports for February. Today, the US PPI numbers are coming out and a decent slowdown could make investors have second thoughts and thereby lock some profits on their existing long positions.

Pound the main loser after UK inflation slows

The pound was the currency that lost the most ground against the greenback yesterday, feeling the heat of the bigger-than-expected slowdown in the UK CPI data. Both the headline and core rates fell to 10.1% y/y and 5.8% y/y from 10.5% and 6.3% respectively, and although the former is still in double digits, the slide in the latter may have bolstered expectations that the Bank of England is nearing the exit of this tightening crusade.

At its last meeting, the BoE changed its forward guidance, with Governor Bailey saying that the change reflects a turning of the corner in the fight against inflation. Previously, the Bank said that it would “respond forcefully, as necessary”, but they now mentioned that further tightening would be required if there is evidence of more persistent price pressures.

Although the risks of a sharp recession in the UK have lessened, with inflation for food and non-alcoholic drinks slowing to just 16.7% from a 45-year record of 16.8%, they are far from vanished, as it means households are still experiencing a severe cost-of-living squeeze. So, how fast or slow the Bank needs to move hereafter has no straightforward answer. Investors are currently assigning around a 65% probability for another 25bps hike at the upcoming meeting, with the remaining 35% pointing to no action. As for thereafter, they see only one more quarter-point increment before the Bank presses the stop button.

With the Fed now expected to proceed more aggressively and the ECB anticipated to keep delivering double hikes, the BoE is seen as the softest among the three, which leaves the pound vulnerable to more selling against the greenback and the euro.

Retail sales help stocks, but dent gold

The strong rebound in retail sales translated into gains on Wall Street as well, with the tech-heavy Nasdaq rising the most. Despite the rise in Treasury yields on increasing expectations that the Fed may eventually need to take interest rates higher and refrain from cutting them this year, as long as the data is pointing to a much better economic shape than previously estimated, investors seem willing to continue adding to their risk exposures.

Nonetheless, the bigger picture is far from changed after the retail sales release. The outlook for equity indices remains neutral. With interest rates now expected to finish the year above 5% and earnings estimates still being lowered, it is hard to envision equity indices heading towards their record highs. On the flip side, the optimism surrounding China’s reopening and the better than expected performance of several major economies are supporting forces.

Rising yields, a strong dollar, and improving risk appetite appear to be a deadly cocktail for gold. The precious metal extended its steep slide yesterday and may soon head towards the $1,825 support zone.