U.S. Dollar Slides as Inflation Cools, Fed Decision Next

2022.12.14 10:35

[ad_1]

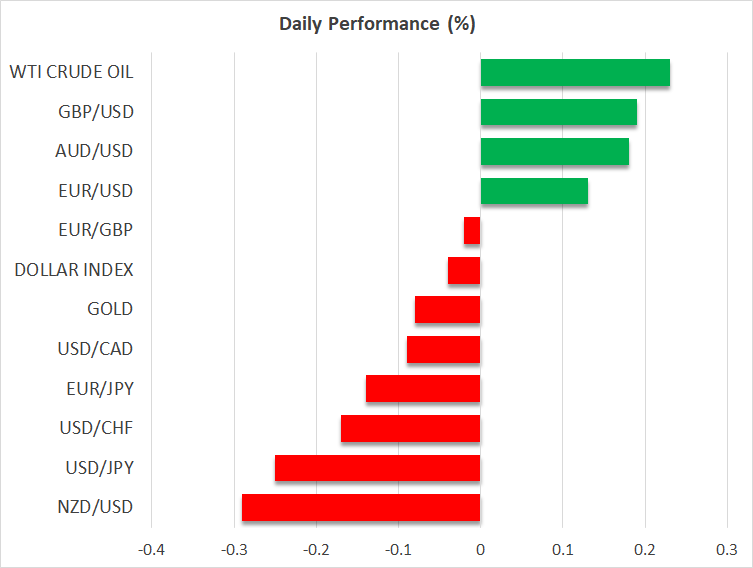

- Softer US inflation print sinks dollar, propels stock markets higher

- Fed decision today – focus on rate projections and Powell’s tone

- Decline in yields breathes new life into the yen and gold prices

Inflation relief

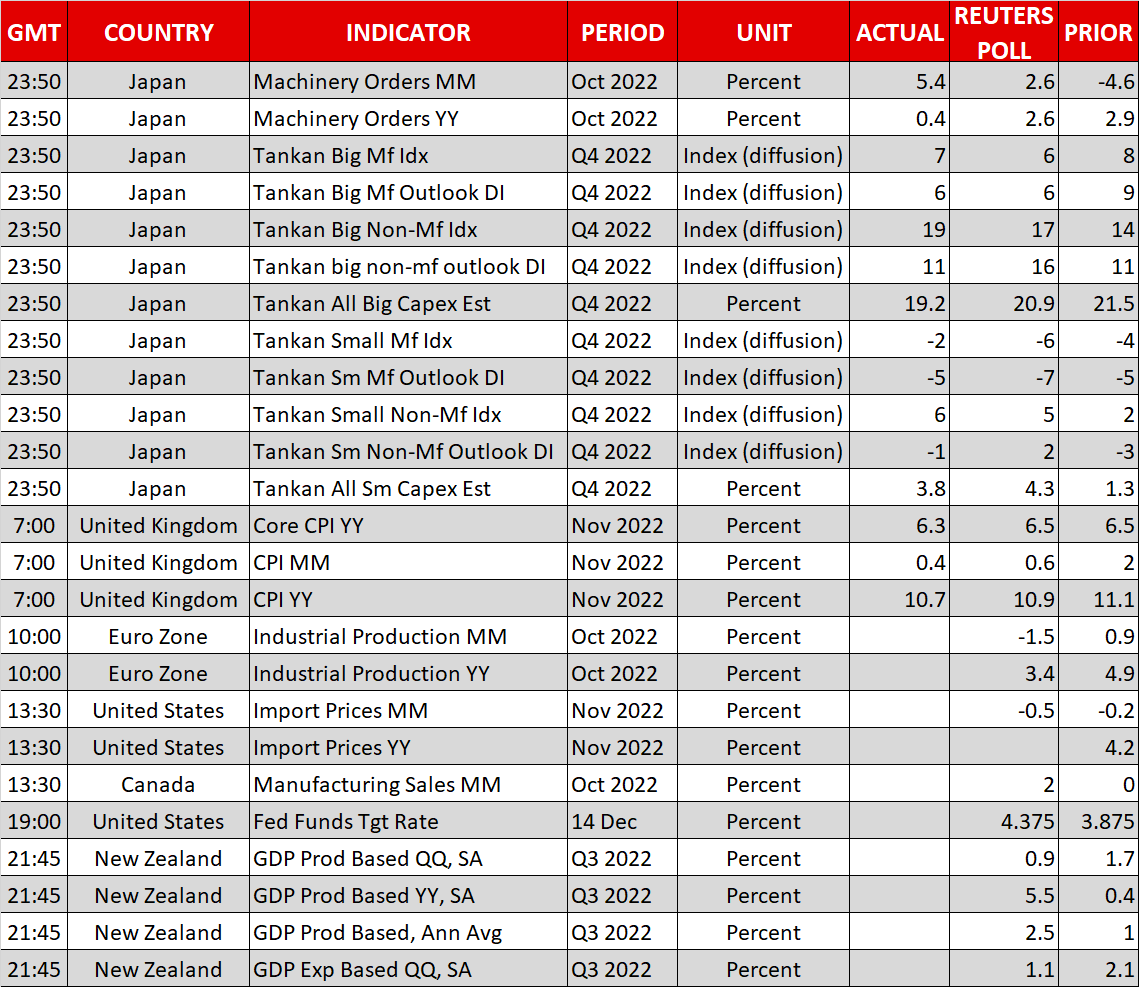

A downside surprise in US CPI yesterday fueled bets that the Federal Reserve won’t need to raise interest rates as high as previously feared to win the inflation war, setting off a chain reaction of relief moves across global markets.

Consumer prices rose by 7.1% in November from a year ago, below the forecast of 7.3%. Declines in energy items, airline fares, used cars, and medical care spearheaded the improvement in inflationary pressures, spelling some relief for consumers whose purchasing power is being eaten away.

Digging deeper into the CPI report, even rents and food prices decelerated, reinforcing the notion that a new disinflationary trend is in the making. How quickly inflation comes down to its 2% target is a different matter though, complicating life for Fed officials, who are wary of 1970s-style rolling flare-ups in inflation as the labor market remains historically tight.

Dollar slides, Fed decision next

In the FX complex, the US dollar was the main casualty as traders recalibrated the Fed’s interest rate trajectory lower, now wagering that rates won’t need to exceed 4.85% in this cycle. The dollar lost the most ground against the Japanese yen and Australian dollar, with the former benefiting from narrowing yield differentials and the latter from the euphoria in equity markets.

The next item on the menu is the FOMC decision later today. Market pricing suggests that the Fed remains on track for a 50bps rate increase, in which case the market reaction will be driven mostly by the updated rate projections in the new ‘dot plot’ and Chairman Powell’s commentary.

There are two schools of thought on how this meeting might play out. The dollar-negative, equity-positive scenario is that Powell acknowledges the progress in inflation and underlines the risks around economic growth, emphasizing that a lot of tightening is still in the pipeline and that overdelivering could inflict unnecessary damage on the economy.

On the flipside, financial conditions have loosened substantially lately with yields sliding and stocks rallying, amplifying the risk that inflation rears its ugly head again next year. Hence, Powell might prefer to push back by downplaying the progress in inflation and stressing that wage dynamics are too hot for comfort, so backing off too early could be a costly error.

Either way, the outlook for the dollar seems neutral at this stage. A softer Fed profile is bad news, but at the same time a total bearish reversal in the reserve currency is unlikely while recessionary risks are intensifying throughout the world. The dollar is down, but perhaps not out.

Stocks and gold jump

Stock markets stormed higher following the inflation report, drawing fuel from bets of a less aggressive Fed next year and renewed hopes that the US economy might achieve its elusive ‘soft landing’ after all. However, most of these gains evaporated as the session progressed, with equity traders locking in some profits to protect their books from any turbulence ahead of a litany of central bank meetings.

Gold prices shot up to reach their highest levels since June, taking advantage of the retreat in the dollar and US yields, both moves that help increase the allure of the yellow metal that is denominated in dollars and bears no interest to hold. Bullion is now down just 1% for the entire year, which is a very encouraging sign considering the dramatic spike in interest rates and the sharper losses in most other assets.

Looking ahead, the Fed meeting today will kick off a flurry of rate decisions, with central banks in the Eurozone, United Kingdom, and Switzerland announcing their own decisions tomorrow.

[ad_2]

Source link