U.S. Dollar on the Backfoot, Wall Street Breaks Losing Streak

2022.12.09 18:23

[ad_1]

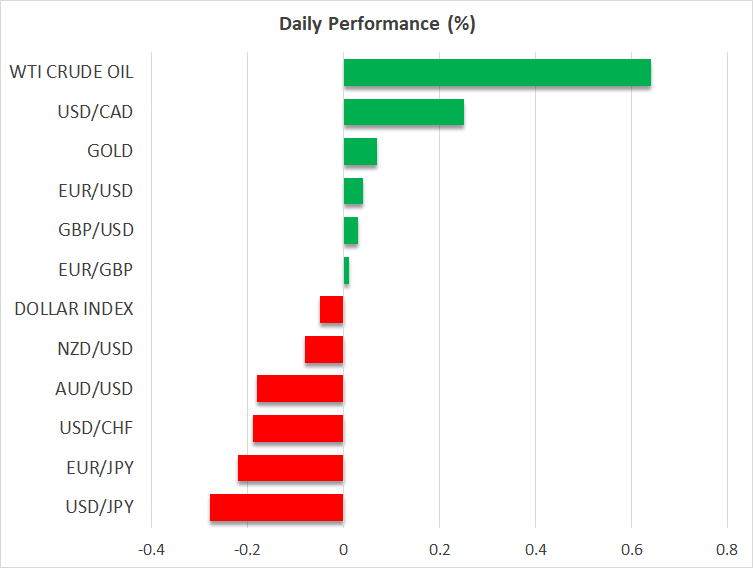

- Dollar trades south on rising jobless claims

- Wall Street rebounds as bad news is still good news

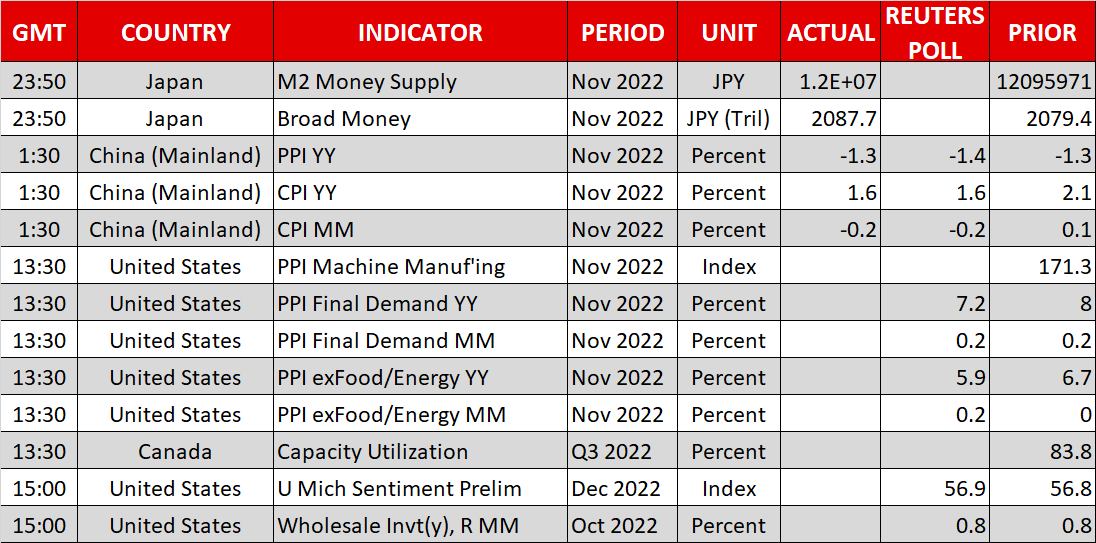

- PPI data eyed ahead of CPI numbers and Fed meeting

- Oil shrugs off Canada-US pipeline closure

Dollar slips as jobless claims rise; PPI numbers eyed

The US dollar continued trading lower on Thursday and during the Asian session Friday, underperforming all the other major currencies.

The incentive for more dollar selling was perhaps given by the US jobless claims data. Although the number of people filing new claims for benefits increased slightly, continuing claims rose to a 10-month high in late November, adding to speculation that the labor market may loosen further in the coming months, despite last week’s employment report suggesting that it is still faring well.

The next big tests for the US dollar may be next week’s CPI numbers for November on Tuesday and the FOMC decision on Wednesday, but today traders may pay some extra attention to the PPI data as they seem willing to grasp any piece of information that could help them solve the Fed policy puzzle. Expectations are for a decent slowdown which could allow investors to start an early party in hopes that next week’s consumer prices may follow suit.

Combined with another slide in the University of Michigan 1-year inflation expectations, this could add more credence to investors’ view of nearly two quarter-point rate cuts by the end of next year and thereby drive the US dollar even lower.

Although intensifying fears of a global recession at the turn of the year could result in some safe-haven inflows for the greenback, the further it moves away from its September peak, the slimmer the likelihood for an uptrend resumption becomes. And with market participants betting on lower rates towards the end of the year, the yielding dollar may pass the safe-haven torch back to the yen and gold. That’s why its outlook may be best described as neutral for now, given that any potential strength in coming weeks could just prove to be a short-lived rebound before a new leg south.

Wall Street rebounds but outlook remains gloomy

The snapped a five-day losing streak after the rise in the weekly jobless claims, suggesting that bad news is still good for stocks. Therefore, a decent slowdown in producer prices could extend that recovery today, as expectations of lower interest rates result in higher present values for firms that are valued by discounting expected cash flows for the months and years ahead.

That said, weak data cannot work in favor of equities forever. Further deterioration in the US outlook could break that inverse correlation as a damaged economy is far from a positive development for the stock market. Yes, more headlines pointing to a shift in China’s COVID policy could also be cheered, but it may take some time before that shift translates into improving economic activity. Therefore, Wall Street investors will not have to worry only about the performance of the US economy, but for the global one as well.

This adds to the narrative that any rebounds in stock indices are likely to stay limited, and with the S&P 500 staying below the downtrend line drawn from its record peak, that argument receives support from a technical-analysis perspective as well.

Oil slides on demand worries, despite pipeline closure

What adds more credence to the view that investors remain concerned over a global economic slowdown is the fact that oil shrugged off the closure of a major pipeline transferring the black liquid from Canada to the US. Despite China beginning to ease its COVID-related restrictions, investors seem convinced that demand may deteriorate further in coming months.

Having said that though, falling oil prices may not be a story for the whole of 2023. The easing of the restrictions may eventually translate into better economic numbers, which alongside a weaker dollar on Fed cut expectations could provide a helping hand for the black gold. It also remains to be seen what kind of impact the price cap on Russia’s exports will have on oil prices. If Russia responds by cutting supply to any country that adopts the cap, demand for oil from elsewhere may increase, which could also prove supportive for the overall market.

[ad_2]

Source link